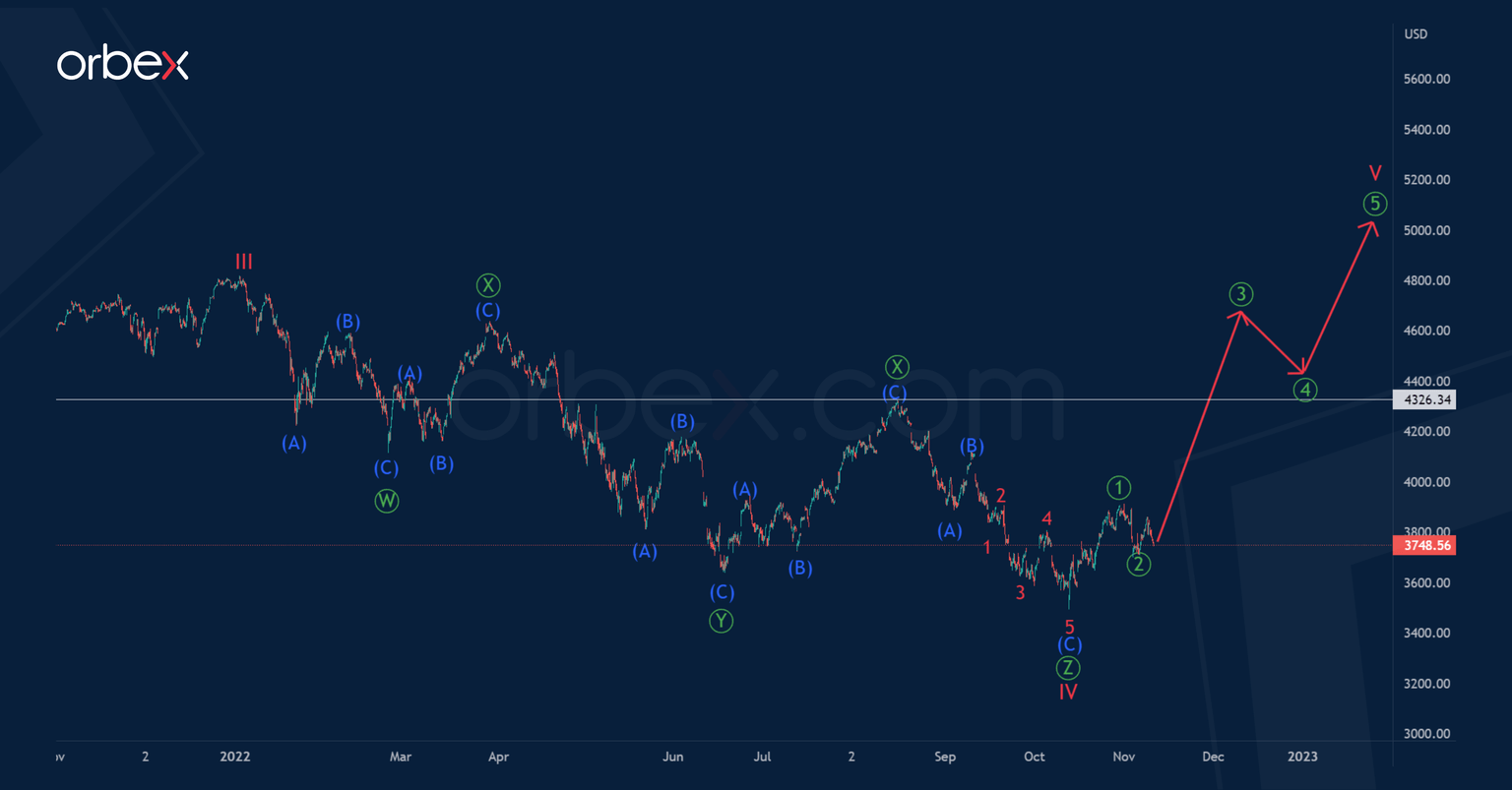

SPX500: The index may update the previous high of 4326.34

We continue to analyze the situation on the SPX500 index from the point of view of Elliott theory. It is assumed that a large impulse trend is being formed, which is marked by five sub-waves of the cycle degree I-II-III-IV-V.

Perhaps the first three parts of the impulse pattern are fully completed, and there is a possibility that the cycle correction wave IV has also come to an end. It looks like a triple zigzag of the primary degree Ⓦ-Ⓧ-Ⓨ-Ⓧ-Ⓩ.

Thus, in the near future, the price may start moving up towards a maximum of 4326.34 in the final cycle wave V, which will take the form of a primary degree impulse, as shown on the chart.

Let's also consider an alternative scenario in which the actionary wave Ⓩ will strive for equality with the wave Ⓨ.

Market participants may expect a drop in SPX500 to 3332.12. At that level, sub-waves Ⓩ and Ⓨ will be equal. Only after reaching the specified level, the price may turn around and start an upward movement. A bearish impulse wave (C) of the intermediate degree is required to complete the wave Ⓩ.

An approximate scheme of possible future movement is shown by trend lines on the chart.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.