Spotify Technology Stock News and Forecast: SPOT, Joe Rogan spat rumbles on

Spotify shares finished Monday down 1.67%. - The argument over Joe Rogan podcast rumbles on as Spotify CEO speaks out.

- SPOT CEO says silencing Joe is not the answer.

Spotify (SPOT) shares have been rumbling (see what I did there) all over the place lately as tech and growth names take a hit and investor enthusiasm diminishes toward the sector. Tech names were highly volatile last week as Facebook bombed and then Amazon rocketed. Spotify had enough volatility then without the increasing furor over the Joe Rogan Experience. This is a hugely popular podcast that Spotify reportedly paid circa $100 million for.

Spotify Stock News

Spotify CEO Daniel Ek was on the wires on Monday saying sorry to Spotify workers for the public drama over the Joe Rogan podcast. To recap Neil Young removed his music from Spotify after some content on the Joe Rogan Experience was described as controversial and perhaps could be viewed as an anti-covid vaccine stance.

“While I strongly condemn what Joe has said, and I agree with his decision to remove past episodes from our platform, I realise some will want more,” Mr. Ek said in the note.

The fight took a fresh twist late last week when Grammy-winning artist India Arie posted a video compilation on Instagram apparently showing Joe Rogan using racial slurs. (We have not seen the video). She captioned the video #deletespotify. Joe Rogan apologized, saying it was a “most regretful and shameful thing.”

Now a fresh twist has arisen in the ongoing rumble with news that Rumble has offered Joe Rogan $100 million to move his podcast to their platform. Rumble is a YouTube-esque video sharing platform that exploded in popularity during the pandemic. So much so that Rumble is due to go public via a SPAC deal with CF Acquisition Corp VI (CFVI). CFVI stock closed up over 18% on news of the offer on Monday.

Spotify Stock Forecast

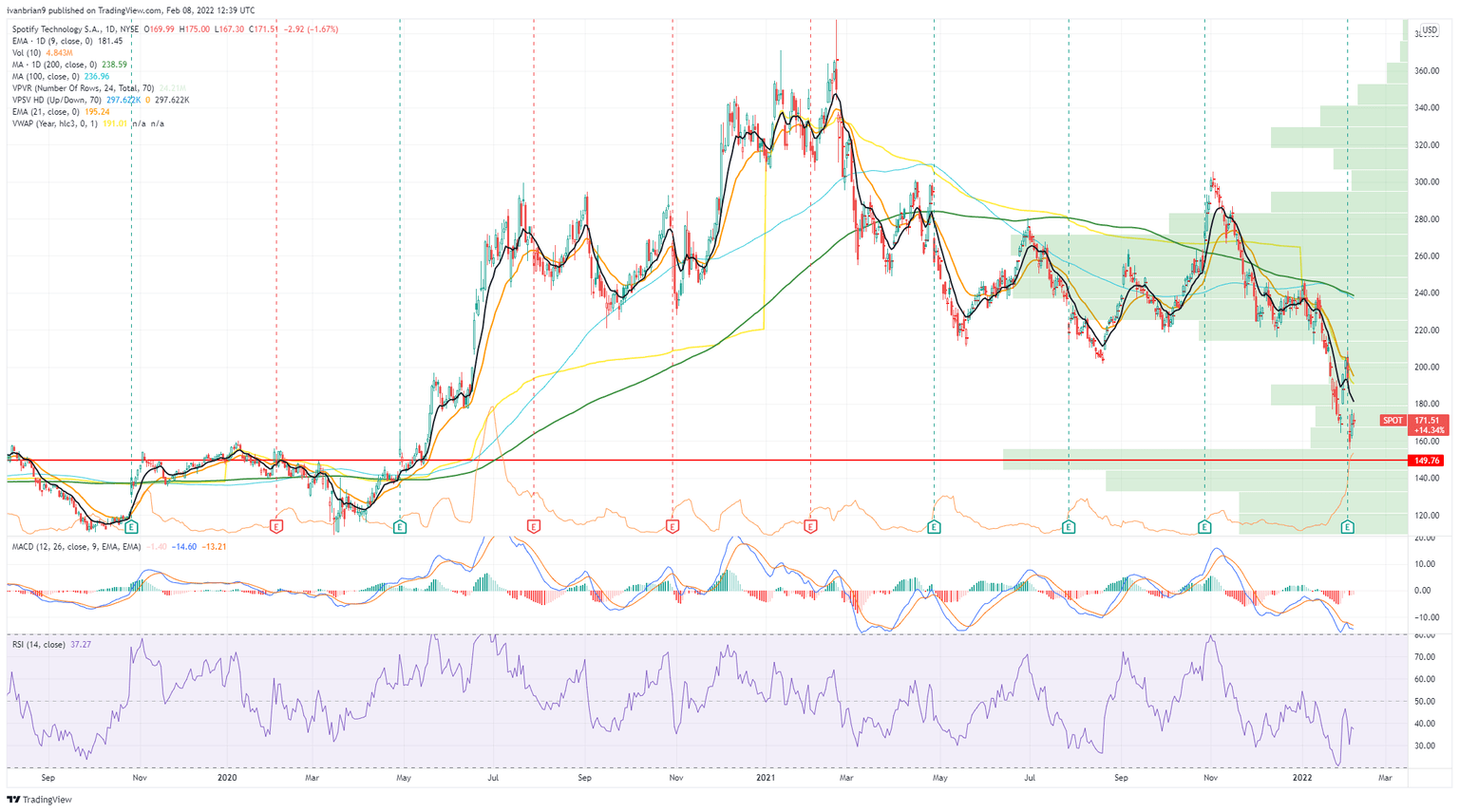

We are not sure how this one is going to play out. We feel Rumble is unlikely to succeed given that Spotify has an exclusive deal with Joe Rogan. Technically, the chart is strongly bearish. The recent earnings from SPOT compounded this, but we can see some sign of hope. SPOT has given back most of the pandemic gains. This is happening to many high growth tech names. Basically, the pandemic was the loosest monetary policy in history and stocks surged accordingly. Now that times have changed it is time for a much-needed correction. $150 is the point of control and so a strong support. We also note the strong bearish divergence from the Relative Strength Index (RSI).

SPOT chart, daily

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.