Spotify Technology Stock News and Forecast: Bank of America cuts price target

- Spotify shares fall nearly 4% on Tuesday as Joe Rogan spat stays in headlines.

- SPOT stock has been falling since earnings last week.

- Bank of America now adds to woes as it cuts price target to $262.

Spotify (SPOT) shares remain under pressure with another significant fall on Tuesday. The stock has not been producing much positive news for investors of late, and SPOT is down over 15% since reporting earnings last week. Now Bank of America has added to the negative news.

Spotify Stock News

The latest controversy over Joe Rogan was preceded by a disappointing earnings release. While Spotify did beat on the top and bottom lines (EPS and revenue), the company failed to provide future full-year earnings guidance. User growth guidance was short of expectations. This led to SPOT shares falling even before the headlines were filled with Joe Rogan.

Neil Young took down his music from Spotify in protest at the Joe Rogan Experience podcast. This is a hugely popular show for which Spotify is rumored to have paid over $100 million in a four-year deal. The podcast is accused of airing anti-vaccine views.

Now a Benzinga report says Bank of America has lowered their price target in view of the lack of guidance and uncertainty surrounding the stock. The target was cut from $352 to $262.

"We appreciate the company’s long term goals of 1bn users and 50mn creators and the necessity to invest to reach these targets, however, we believe additional clarity on the underlying leverage in the core business would go a long way in assuaging these business model concerns," Bank of America analyst Jessica Reif Ehrlich said.

Spotify Stock Forecast

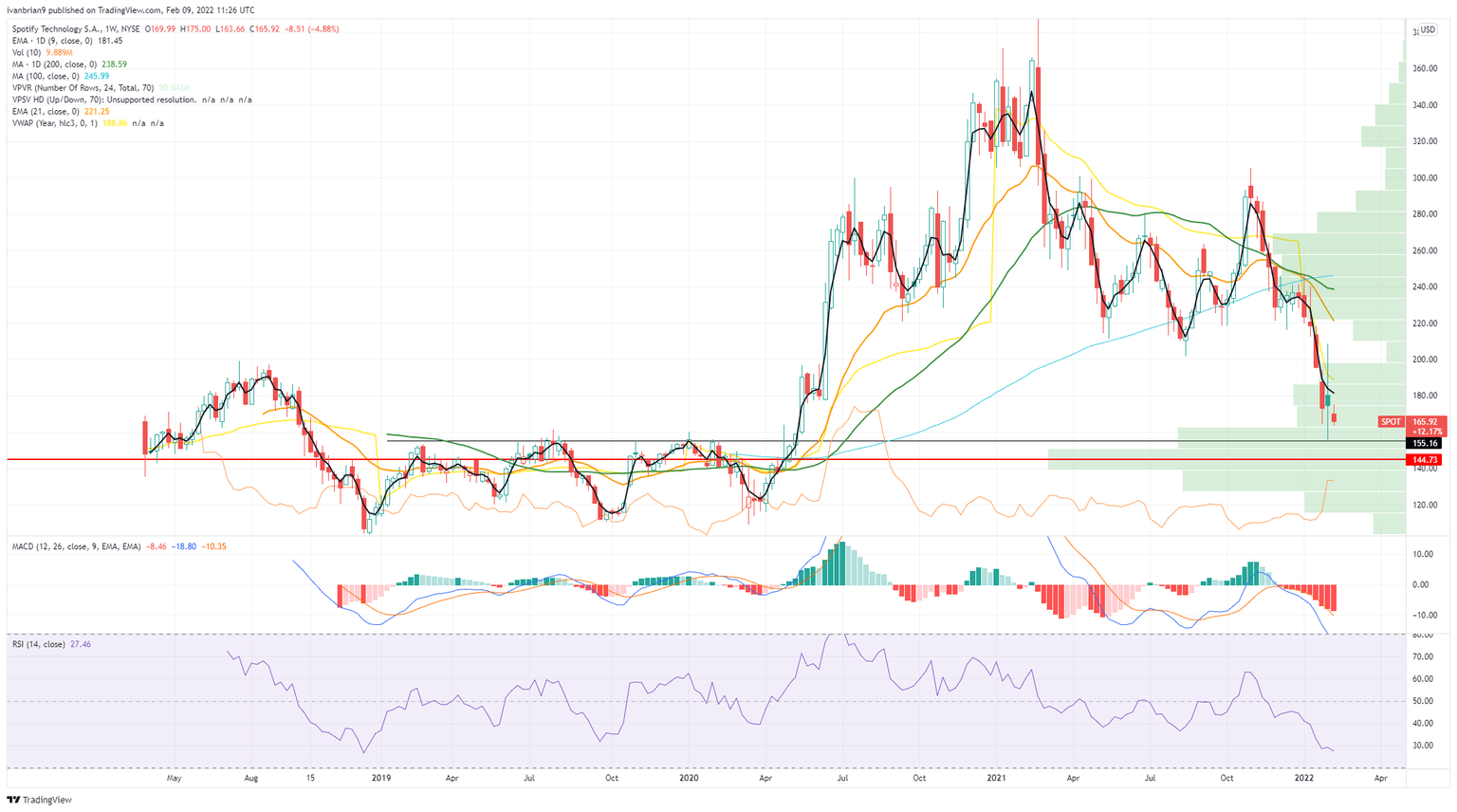

Spotify shares have retraced all the way back to 2020 levels – just another case of growth stocks going back to pre-pandemic levels. This is becoming an increasing theme in 2022. Now SPOT stock has retraced to a strong support level at $155. Volume is strong down here, which is adding to support. It may not be time to go long just yet, but this price support coupled with strong volume profile should at least stop the rot. The Relative Strength Index (RSI) is in traditional oversold levels under 30, and the Moving Average Convergence Divergence (MACD) is also at long-term lows. If $155 does give way, $144 is the next likely support.

Spotify (SPOT) chart, daily

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.