Spotify Technology S.A. (SPOT) Elliott Wave technical analysis [Video]

![Spotify Technology S.A. (SPOT) Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/TechnicalAnalysis/ChartPatterns/Chartism/mobile-phone-with-stock-chart-62799468_XtraLarge.jpg)

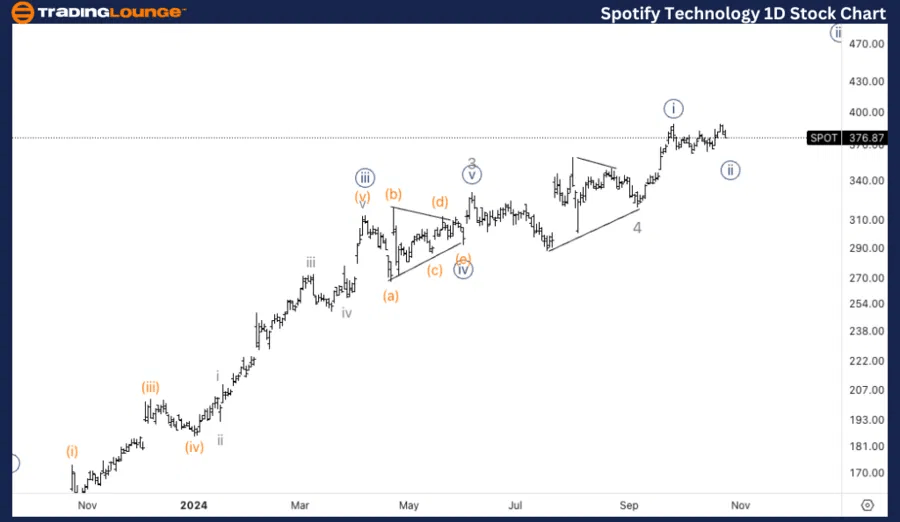

SPOT Elliott Wave technical analysis

-

Function: Trend.

-

Mode: Impulsive.

-

Structure: Motive.

-

Position: Wave 5 of (1).

-

Direction: Upside within wave 5.

- Details: With ongoing pullbacks occurring in three-wave patterns, the outlook remains bullish for further upside within Minor wave 5, potentially targeting the $500 level.

Spotify Technology S.A. (SPOT) – Daily chart

SPOT Elliott Wave technical analysis

-

Function: Trend.

-

Mode: Impulsive.

-

Structure: Motive.

-

Position: Wave {ii} of 5.

-

Direction: Seeking a bottom in wave {ii}.

-

Details: Evidence suggests wave {ii} may still be unfolding, as the latest upward movement aligns with a three-wave structure. This could imply a final leg lower before the upward trend resumes in wave {iii} of 5.

Spotify Technology S.A. (SPOT) – One-hour chart

This analysis examines Spotify Technology S.A. (SPOT) on both daily and 1-hour charts, applying Elliott Wave Theory to analyze current trends and anticipate future price direction.

-

Daily Chart: SPOT is advancing within Minor wave 5 of (1) on the daily timeframe, maintaining a three-wave pullback formation. This suggests the upward trajectory in wave 5 remains valid, with a potential target around $500.

-

1H Chart: The 1-hour chart indicates that wave {ii} may still be developing, with an additional minor pullback expected before continuing upward in wave {iii} of 5.

Spotify Technology S.A. (SPOT) Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.