- SPY closes nearly 3% lower on Tuesday.

- Nasdaq (QQQ) is the worst performer with a near 4% loss.

- All sectors bar energy finish lower on Tuesday.

The recent nervousness in equity markets spilled over on Tuesday with equity markets in the US moving sharply lower after European markets had finished for the day. The S&P 500 (SPY) finished 2.8% lower, the Dow Jones Index was down 2.4% but it was the tech sector that again fared the worst with the Nasdaq (QQQ) down 3.87% on the day. The small-cap Russell 2000 (IWM) also lost over 3%. Tech (XLK), Financials (XLF), and Communications (XLC) were the worst sectors with Energy (XLE) just about closing in the green +0.14%.

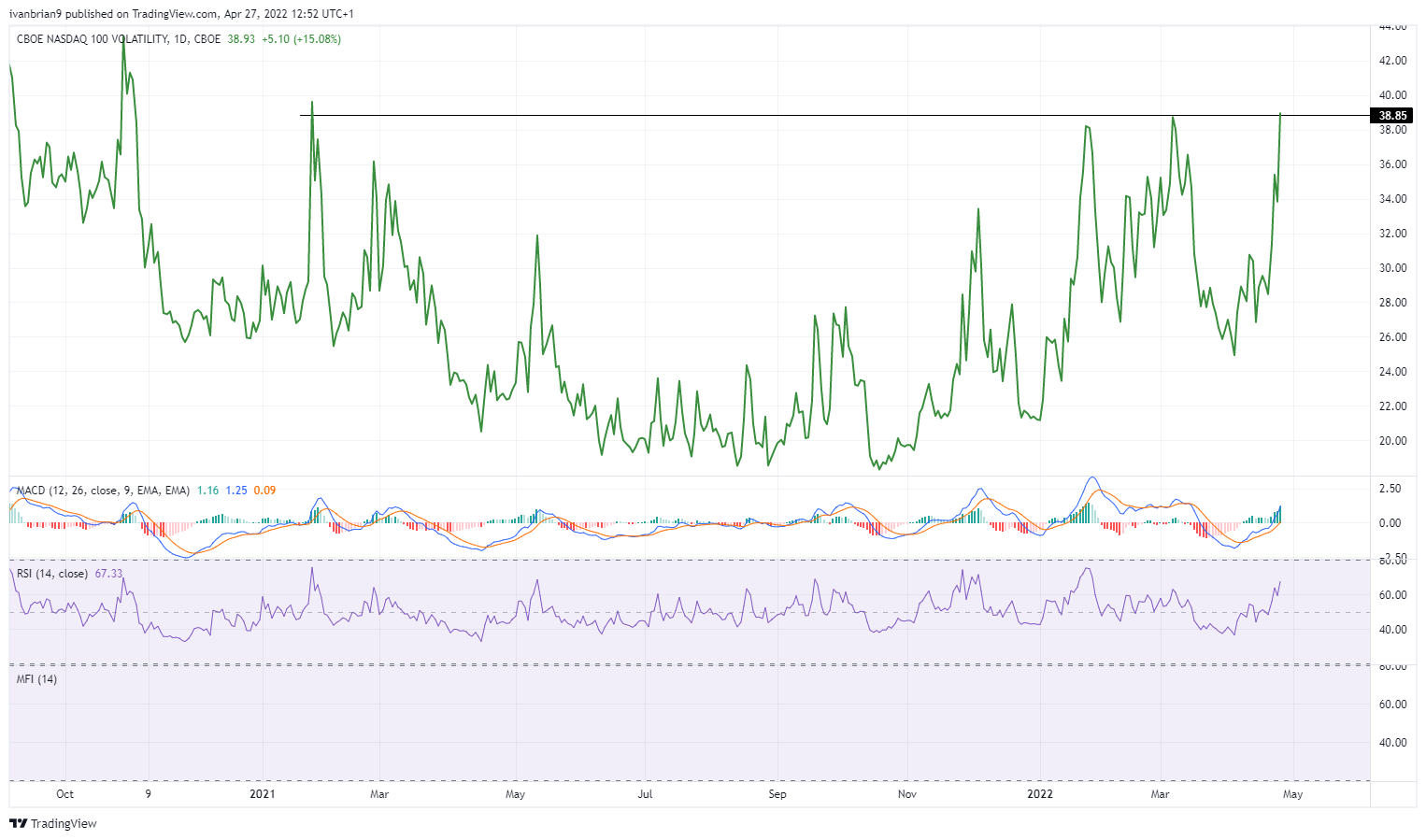

Volatility spiked again with the well followed VIX up above 30 and the less well know Nasdaq volatility index (VXN) spiking to a year high.

VXN Nasdaq Volatility Index, daily

S&P 500 (SPY) stock news

Things were holding up before Tuesday really got going with Pepsi (PEP) adding to strong earnings from rival Coke (KO). But geopolitical events took over as news of a conflict in Moldova stoked fears the Russia Ukraine crisis could spread. News later in the day that Russia was suspending gas supplies to Poland and Bulgaria also dented investor confidence. The final nail in the coffin came from Tesla (TSLA) which slumped 14% as concerns grew over the impact Elon Musks Twitter (TWTR) takeover would have on Tesla (TSLA). Elon Musk has reportedly pledged Tesla stock as collateral for loans to finance his acquisition of Twitter. After hours earnings from Microsoft (MSFT) and Google (GOOGL) painted conflicting pictures. Microsoft saw strong growth in its Azure cloud revenue while Google posted more somber earnings as advertising revenue fell. This has read across for Amazon (AMZN) the number 2 cloud provider behind Azure and Facebook (FB), also reliant on advertising. Facebook Meta Platforms reports earnings after the close tonight, Wednesday.

S&P 500 (SPY) stock forecast

This is where things get really interesting. $415 is key support, the last time we set a powerful double bottom down here which st up the rally. Now can it hold again? If not the Ukraine low at $410 is the obvious target. If that goes it gives further confirmation that we are in a bear market with a lower low matching the lower highs. Earnings season this week is key.

SPY chart, daily

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD retreats below 1.1350 after mixed EU data

EUR/USD remains on the back foot and trades below 1.1350 in the European session on Tuesday. The data from the Eurozone showed that Industrial Production expanded by 1.1% in February. On a negative note, ZEW Survey - Economic Sentiment slumped to -18.5 in April from 39.8.

GBP/USD clings to gains above 1.3200 after UK jobs data

GBP/USD is defending minor bids above 1.3200 heading into the American session on Tuesday. The latest data from the UK showed that the Unemployment Rate steadied at 4% in the quarter to February, while Average Earnings disappointed, limiting Pound Sterling's gains.

Gold stays in consolidation phase above $3,200

Gold holds steady and fluctuates above $3,200 after posting modest losses on Monday. Easing fears over a deepening global trade conflict and the improving risk mood caps XAU/USD's upside as markets keep a close eye on tariff headlines.

Canada CPI expected to hold steady in March ahead of BoC policy decision

Statistics Canada will release the March Consumer Price Index report on Tuesday. Annualised inflation is expected to have held steady at 2.6%, matching the February reading. Market players anticipate a monthly advance of 0.7%, easing from the previous 1.1%.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.