- SPY finished the week in negative territory but only just.

- The S&P 500 ETF witnessed wild swings but closed less than 1% lower last week.

- Sentiment readings are showing huge fear but bulls are taking of this being a buy signal.

The SPY finished Friday lower after an early attempt to rally was knocked back. The US employment report was about as good as hoped for by equity bulls. The wages component rose less than expected while job creation remains strong. The economy and labor market according to the Fed are red hot and can handle multiple rate rises. This employment report appeared to confirm that.

Equity futures rallied on the report, the US dollar weakened and bond yields fell. However, this attempt at a rally proved shorty lived and the equity market was looking at more steep losses before a small recovery toward the close on Friday.

SPY stock news: Companies pass price hikes to consumers

After the volatility caused by the Fed interest rate decision, the Bank of England, and Friday's jobs report, one might hope for some stability this week. Earnings season is now past and it has largely been a strong one, despite feeling otherwise. Over 70% of S&P 500 companies have beaten analyst's estimates and we are more or less through earnings season.

This week we will renew our focus on inflation when US CPI is released on Wednesday. This will once again let yields dictate equity market performance. While earnings season has been positive it has largely been down to companies passing on price hikes to consumers. This means inflation may last longer than forecast. It also means however that demand will begin to taper off so the consumer will be the recession gauge.

Sentiment gauges are massively skewed to fear. The CNN Fear and Greed Index is close to peak fear while the AAII survey was one of the lowest in years. The AAII did bounce a bit in the survey on Friday so perhaps it is time to start thinking about that dip.

SPY stock forecast: Wait a bit more before buying the dip

We too are tempted by this dip as earnings season has held up, but from purely gut instinct think it may be necessary for the market to inflict some more pain on participants just yet. After all the market runs at about 80% of participants losing money so it exists to frustrate most of us (Deemer's Law!). We have been noticing over the weekend many blogs and commentaries saying it is time to buy this dip but if we all buy it then it is likely we will see further frustration. We made our sub $400 call for SPY last week and we will stick by it.

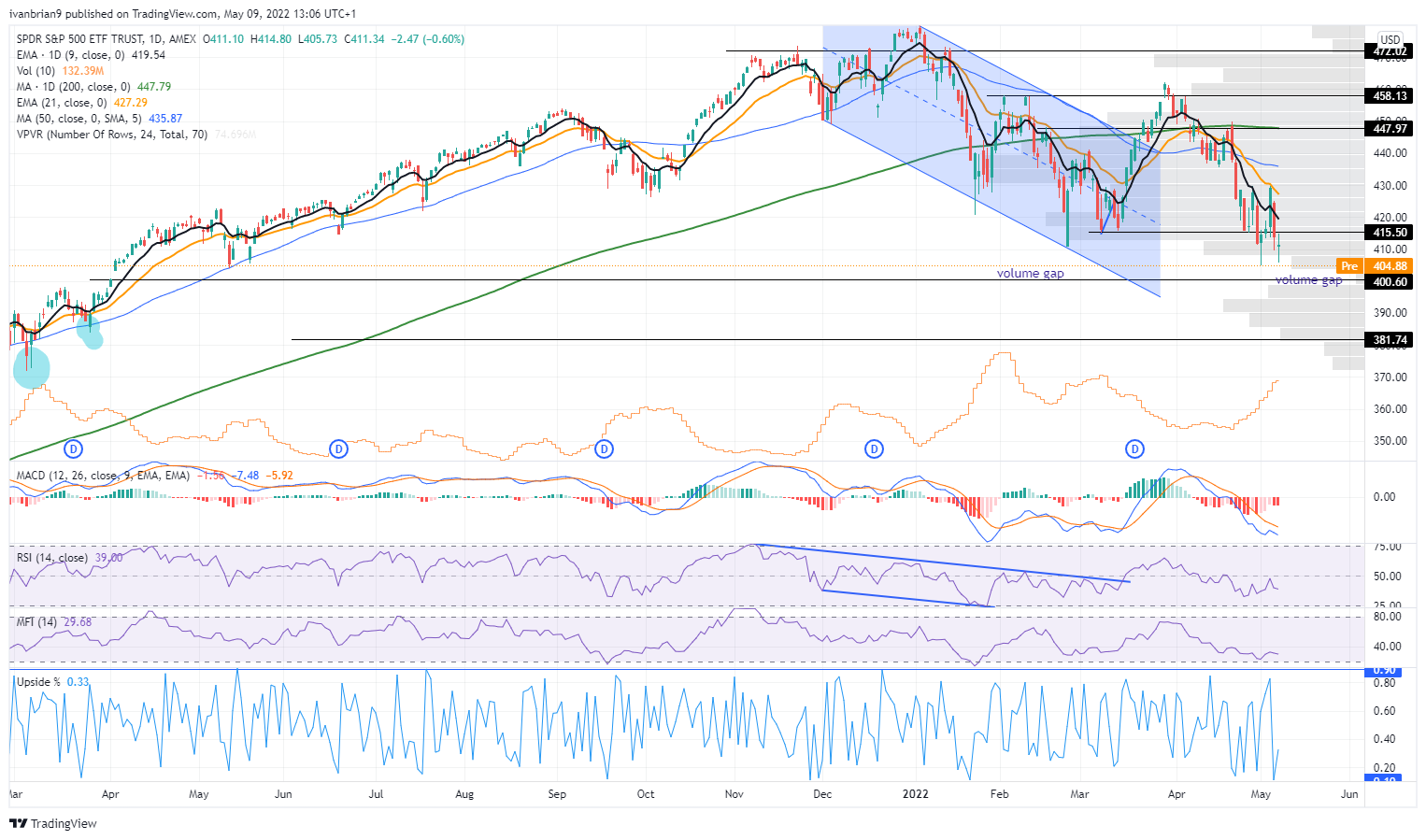

Notice also the volume gap just below $400 until $390. This is reflected in the futures markets also and in general, liquidity has been poor across many asset classes. A sharp move below $400 should accelerate to $390. This would then results in peak fear, and perhaps that is the dip to wait for.

RSI and MFI remain negative and the market breadth is also still weak. Last Thursday was a 90% down day, as in 90% of total NYSE stocks closed lower. This is a capitulation sign but we have no cause for a rally just yet.

SPY chart, daily

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stabilizes near 1.0400 after upbeat US data

EUR/USD consolidates daily recovery gains near 1.0400 following the release of upbeat United States data. Q3 GDP was upwardly revised to 3.1% from 2.8% previously, while weekly unemployment claims improved to 220K in the week ending December 13.

GBP/USD extends slide approaches 1.2500 after BoE rate decision

GBP/USD stays on the back foot and break lower, nearing 1.2500 after the Bank of England (BoE) monetary policy decisions. The BoE maintained the bank rate at 4.75% as expected, but the accompanying statement leaned to dovish, while three out of nine MPC members opted for a cut.

Gold approaches recent lows around $2,580

Gold resumes its decline after the early advance and trades below $2,600 early in the American session. Stronger than anticipated US data and recent central banks' outcomes fuel demand for the US Dollar. XAU/USD nears its weekly low at $2,582.93.

Bitcoin slightly recovers after sharp sell-off following Fed rate cut decision

Bitcoin (BTC) recovers slightly, trading around $102,000 on Thursday after dropping 5.5% the previous day. Whales, corporations, and institutional investors saw an opportunity to take advantage of the recent dips and added more BTC to their holdings.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.