SPDR S&P 500 ETF Trust (SPY) Forecast: Massive week for equity bulls to hurdle

- SPY recovers to end a positive week for equities.

- Tech earnings week beckons: AAPL, META, AMZN, MSFT.

- SPY and QQQ bounce as Fed pivot talk once again bulls up equities.

Is this yet another failure at a buy-the-dip opportunity? The rallying call of 2020 and 2021 ("Buy the dip!") has so far not worked especially well this year. Transitory inflation has been replaced with a Fed pivot as the key phrase for bulls to cling to. We have had numerous failures as the Fed remains committed to a higher path for rates. Some signs of hope were circulating on Friday though when a late report from the Fed whisperer sent yields lower and thus equities higher.

"I think the time is now to start talking about stepping down. The time is now to start planning for stepping down," said San Francisco Fed President Mary Daly during a talk at the University of California, Berkeley on Friday. https://t.co/vPMSXDAKN8

— Nick Timiraos (@NickTimiraos) October 22, 2022

This led futures markets to pair a full 25bps from December 2023 rate predictions.

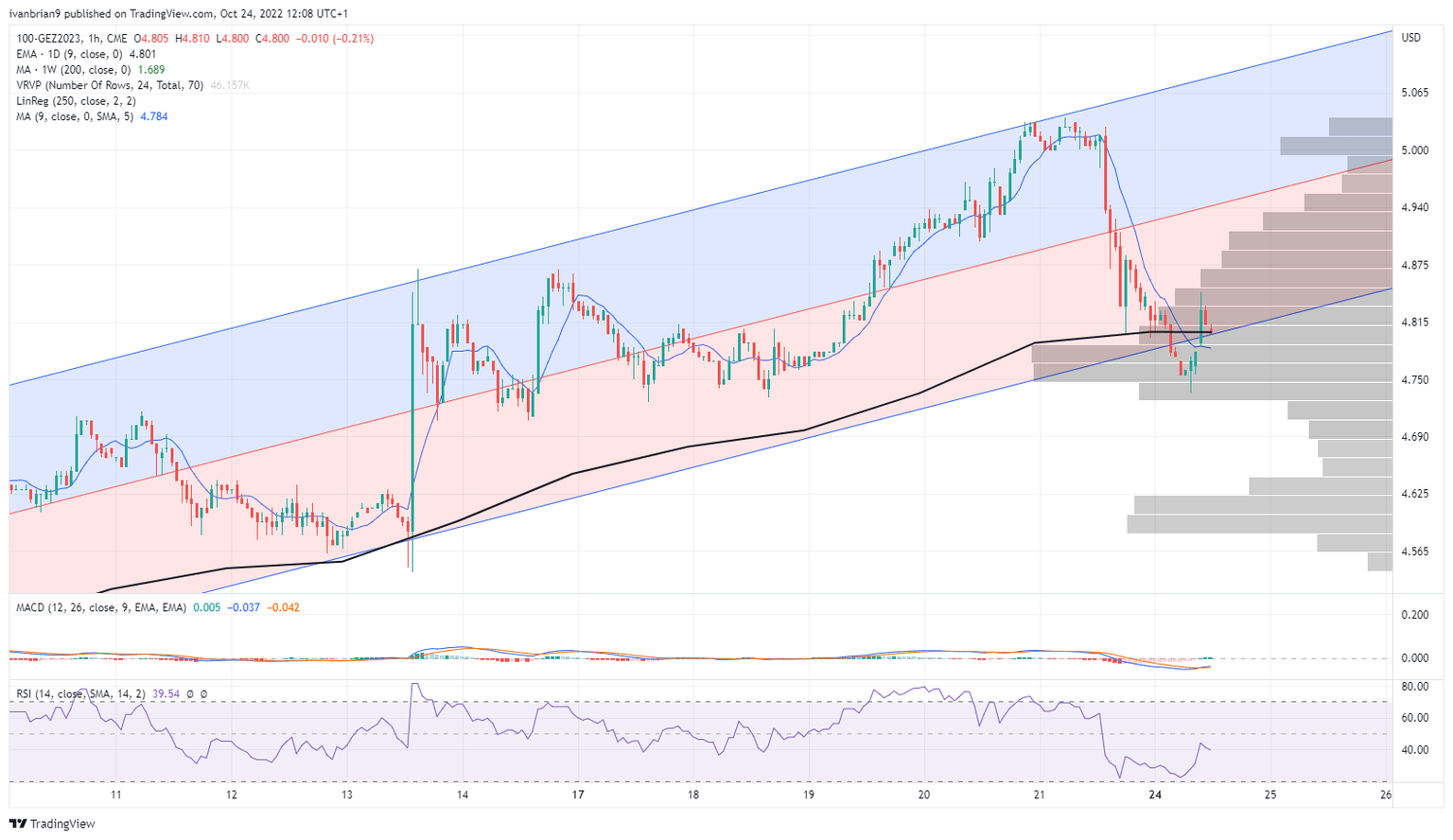

Eurodollar Dec2023 futures, hourly

SPY news

So far so good for earnings season, but now we enter the key week. This week we get reports from Apple (AAPL), Microsoft (MSFT), Meta Platforms (META), Alphabet (GOOGL) and Amazon (AMZN). This is make or break for the embers of this rally. Can it catch fire and really push on to the year's end?

If Apple is in line, then I feel the rally will accelerate. Snap (SNAP) earnings last week hit Alphabet and Meta Platforms on worries over digital advertising, so the bad news is already priced in there in my view. Apple is the main hurdle for bulls and will report on Thursday.

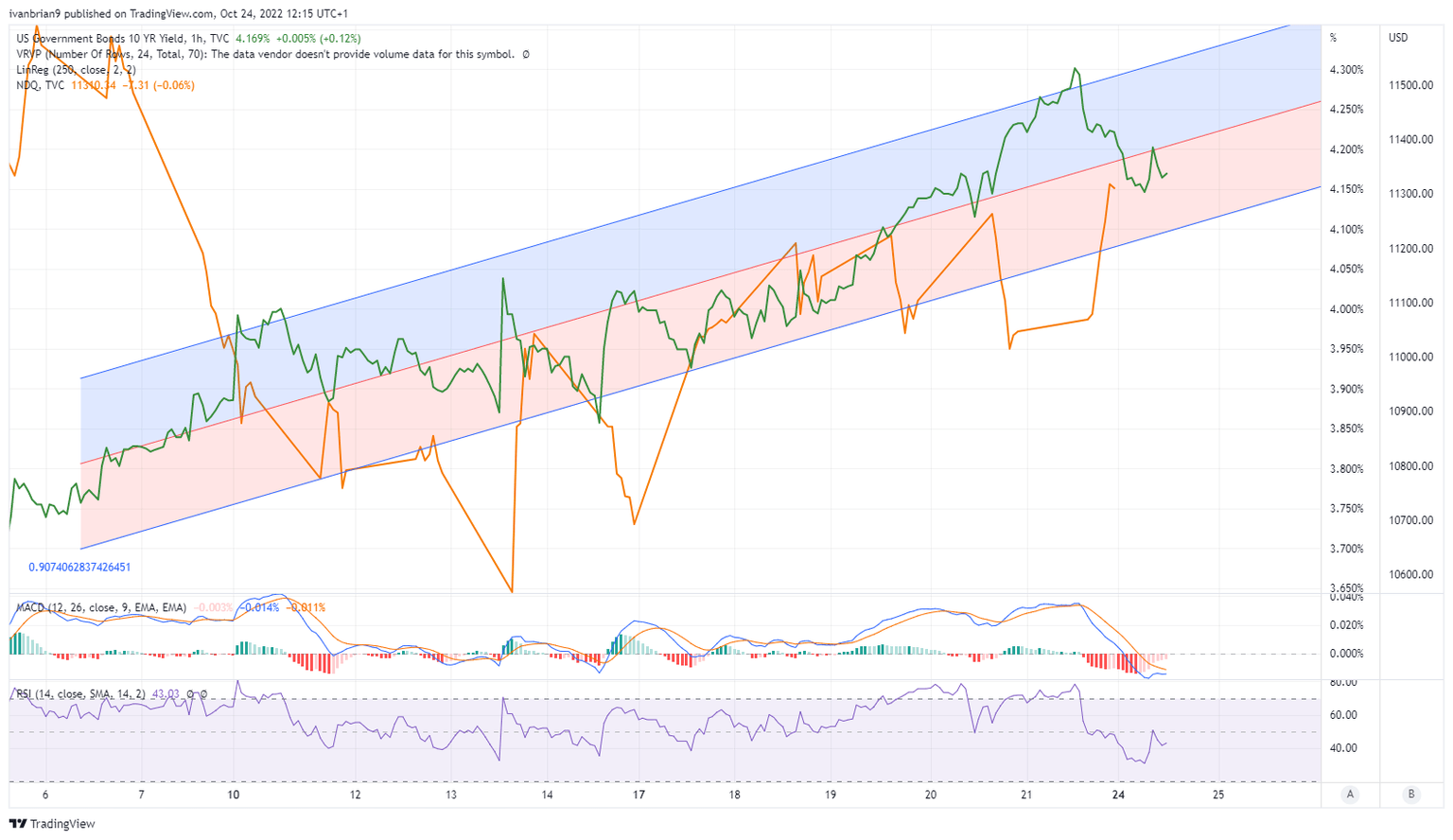

This week is also no slouch on the economic front. We get the Fed-favored PCE inflation data, US GDP and some key US auctions on the front end of the curve. The last few bond auctions have been poor, which has set a base for rates to move higher. A repeat performance could see more problems for risk assets, but at the moment it appears equities may be deleveraging from rates. Both can move higher together. Below we plot the US 10-year yield on the Nasdaq. For the past two weeks, rates have been going higher (green line) but the Nasdaq (orange line) has also moved higher.

US 10-year yield

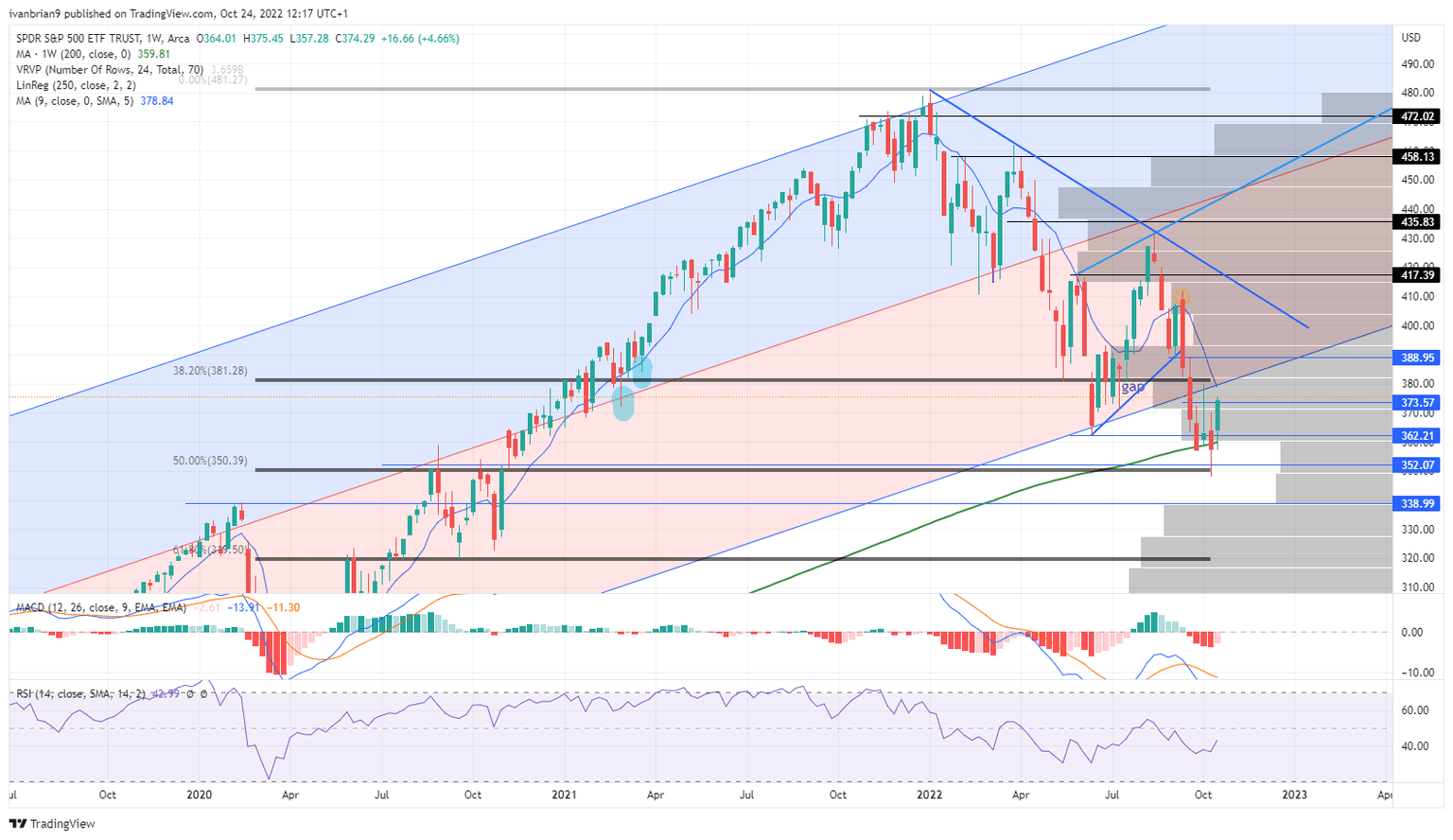

SPY forecast

Apple is basically my pivot! $352 remains a massive support, and $373 is my actual pivot. If we can stabilize above $373, a move to $388 should be easy to attack and then $410. Seasonality is on the side of bulls, so too I believe is positioning and sentiment. Buybacks are about to restart, and the Fed is in a blackout period with dovish speak the last in traders' ears. If Apple is in line, then expect the rally to accelerate.

SPY daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.