- SPY closes higher on Tuesday as main indices advance cautiously.

- Nasdaq, Dow also higher but close up less than 1%.

- Small Cap Russell 2000 (IWM) is the strongest performer, gaining 1.6% on Tuesday.

Equity markets continued to squeeze early adopters of the bear market rally theory as the main indices continued their steady march higher on Tuesday. Equity markets are exhibiting slowing volatility as the week revolves around Friday's US CPI report with Thursday's ECB rate decision a mere speed bump along the way. Tuesday witnessed the VIX remaining stable at around 24 with large-cap stocks moving slowly. There was some interest in the retail and meme stock space with two strong performances from GameStop (GME) (+14%) and AMC Entertainment (AMC) (+9%). Both stocks saw renewed interest due to a Reuters report highlighting growing short interest in the stocks. This appeared to embolden retail traders in another short squeeze effort. They may have some success with GME, which now is nearly flat on the year. AMC though is a different case as it is down over 50% year to date, meaning shorts are likely to have much higher entry prices and will be difficult to smoke out.

SPY news

The energy sector continues to be the big outperformer as oil prices once again push on. As we write this morning, oil is above $120 again. At some stage, this shock will make equity investors risk-averse and see yet more switching from all sectors to the energy names. Before Friday we are unlikely to see any significant portfolio adjustments. Friday is also notable for a significant option expiry, so it should make for a volatile day. Until then we may see some choppy rangebound sessions.

SPY forecast

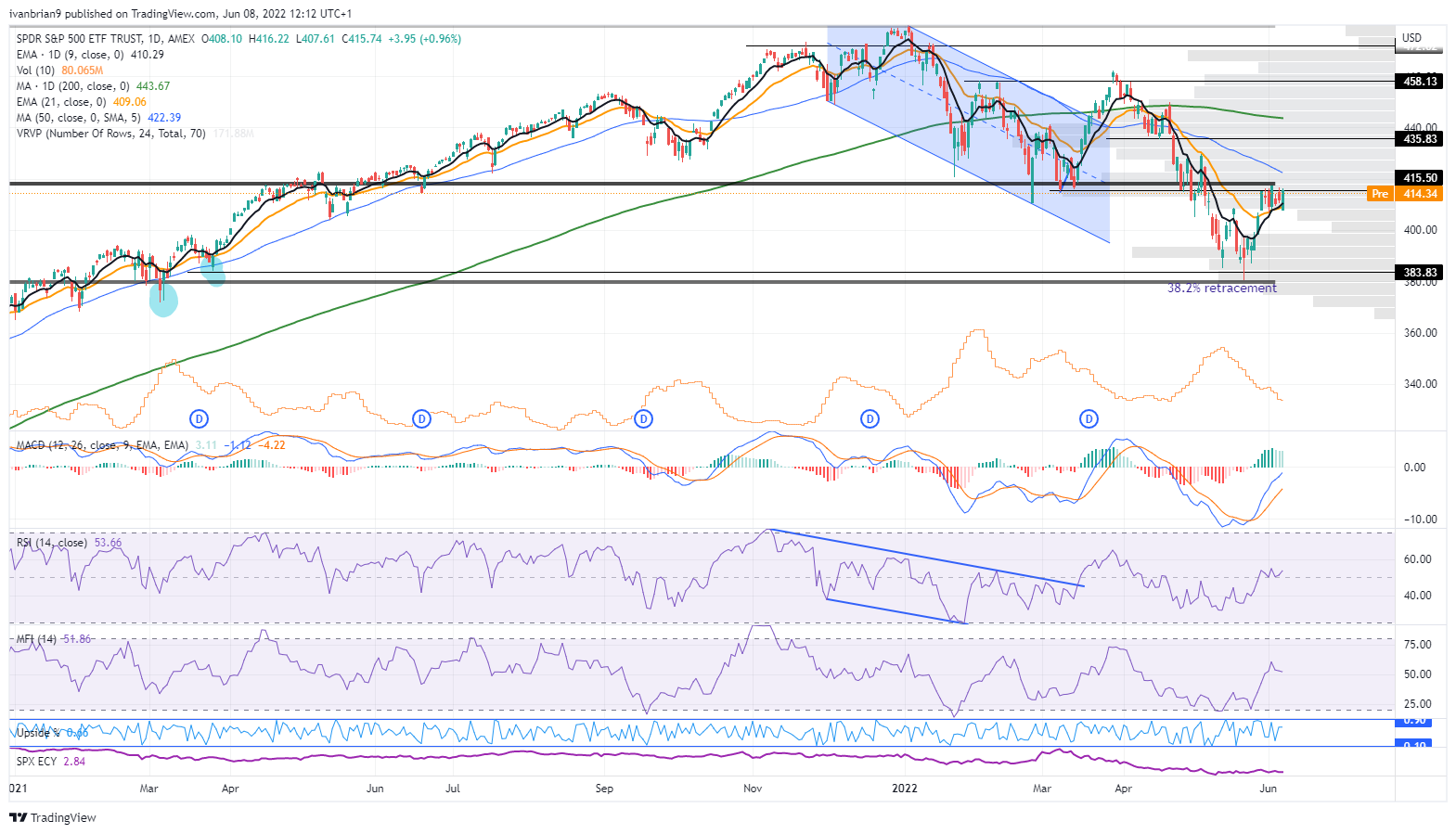

This $415 level has been well flagged by us, and so it is no surprise to see choppy trading with a lack of direction at current levels. We still feel too many are waiting to short this rally and hence favor a break to stop out early shorts. This move could and should extend to $435. At that stage, it may present a better shooting opportunity. Failure to break this $415 level, and we move to the Fibonacci retracement support at $380.

SPY chart, daily

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD holds the bounce toward 0.6500 amid mixed markets

AUD/USD remains on the front foot, looking to 0.6500 in Asian session on Monday. A broadly subdued US Dollar supports the Aussie but the further upside appears elusive as sentiment remains tepid ahead of Fedspeak and Tuesday's RBA Minutes release.

USD/JPY regains 154.00 and beyond amid BoJ's Ueda-led volatility

USD/JPY has recaptured 154.00 in Asian trading on Monday after BoJ Governor Kazuo Ueda's comments injected volatility around the Japanese Yen. Ueda offered no clues on a likely December interest rate hike, weigihing heavily on the Yen while triggering a big USD/JPY jump.

Gold extends recovery to test $2,600 amid renewed Russia-Ukraine tensions

Gold price (XAU/USD) extends its rebound to test $2,600 early Monday, snapping a six-day losing streak. The latest uptick in Gold price could be attributed to rsurfacing Russia-Ukraine geopolitical tensions after US authorizes Ukraine to use long-range US weapons to strike inside Russia.

Dollar rally 2024: Epic bull run or dangerous bubble?

Dear, The US dollar is surging—how high can it go? Is this unstoppable growth or a bubble about to burst? Discover the 5 key factors fueling this rally Watch, learn, and get ready for what’s next! .

Week ahead: Preliminary November PMIs to catch the market’s attention

With the dust from the US elections slowly settling down, the week is about to reach its end and we have a look at what next week’s calendar has in store for the markets. On the monetary front, a number of policymakers from various central banks are scheduled to speak.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.