SPDR Consumer Discretionary ETF ($XLY) Elliott Wave analysis: The rally and what’s next

In today’s article, we’ll examine the recent performance of the SPDR Consumer Discretionary ETF ($XLY) through the lens of Elliott Wave Theory. We’ll review how the rally from the October 23, 2024, low unfolded as a 5-wave impulse and discuss our forecast for the next move. Let’s dive into the structure and expectations for this ETF.

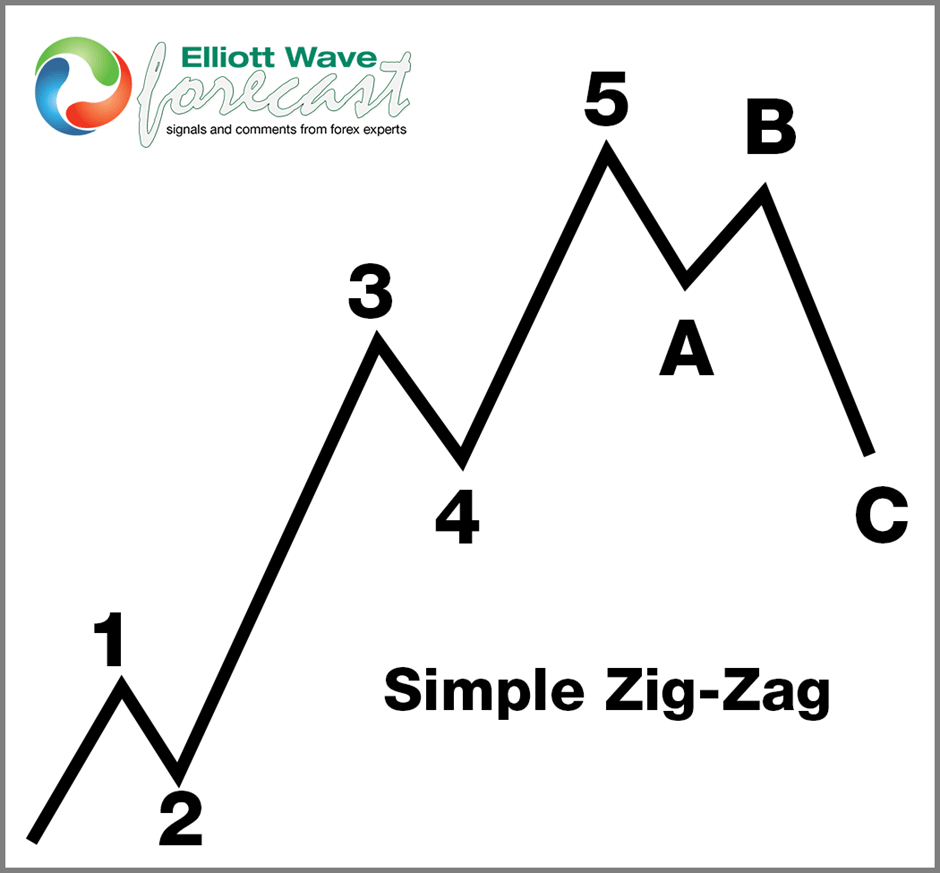

5 Wave Impulse Structure + ABC correction.

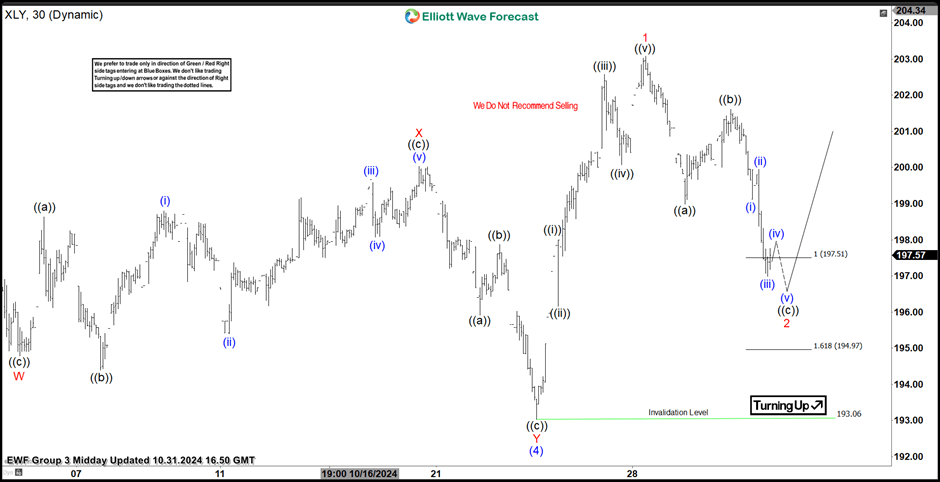

$XLY 1H Elliott Wave Chart 10.31.2024:

In the 1-hour Elliott Wave count from October 31, 2024, we see that $XLY completed a 5-wave impulsive cycle beginning on October 23, 2024, and ending on October 28, 2024, at the red 1. As expected, this initial wave prompted a pullback. We anticipated this pullback to unfold in 3 swings, likely finding buyers in the equal legs area between $197.51 and $194.97.

This setup aligns with a typical Elliott Wave correction pattern (ABC), where the market pauses briefly before resuming the main trend.

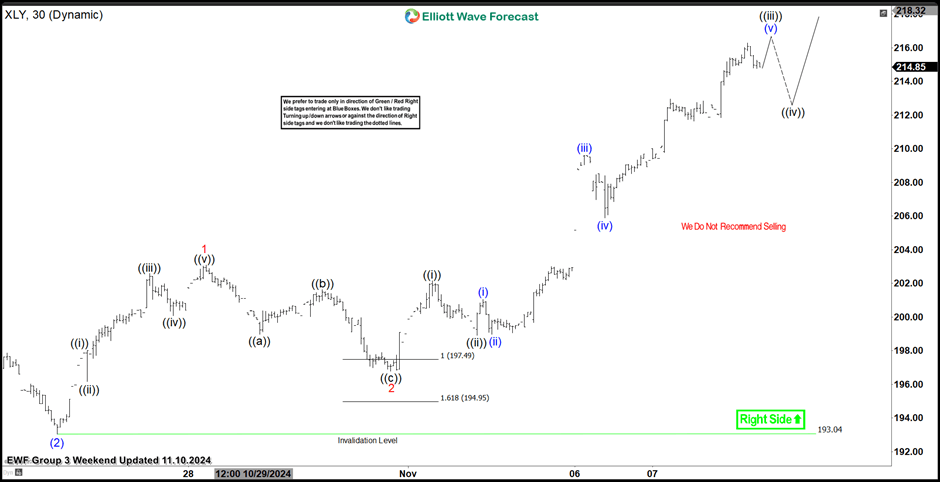

$XLY 1H Elliott Wave Chart 10.15.2024:

The most recent update, from November 10, 2024, shows that $XLY reacted as predicted. After the decline from the red 1 peak, the ETF found support in the equal legs area, leading to a renewed rally. As a result, traders could adjust to go risk-free, which confirmed that the bullish trend remains intact.

What’s next for $XLY?

With the current rally breaking into new all-time highs, $XLY appears well-supported. Based on the Elliott Wave structure, we expect the ETF to continue its upward trajectory, targeting the $235–$278 range before another potential pullback. Therefore, it is essential to keep monitoring this zone as we approach it.

Conclusion

In conclusion, our Elliott Wave analysis of the SPDR Consumer Discretionary ETF ($XLY) suggests that it could continue its bullish run, with significant upside potential in the short term. Therefore, traders should monitor the $235–$278 zone as the next target, keeping an eye out for any corrective pullbacks. By using Elliott Wave Theory, we can identify potential buying areas and enhance risk management in volatile markets.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com