- NYSE: SPCE is on course to end the week on a higher note despite an early fall.

- Virgin Galactic Holdings Inc seems to shrug off the test flight cancellation in New Mexico.

- Markets are awash with cash that should bring rich customers to Virgin's space tourism venture.

There are no known cases of COVID--19 in outer space – but the virus has had an adverse impact on a tourism sector company aiming for the skies. Virgin Galactic Holdings Inc (NYSE: SPCE) has been forced to cancel a critical test flight. Authorities in New Mexico, where the module was set to launch from, canceled the trial due to the covid situation in the state.

Billionaire founder Richard Branson and his team were disappointed by calling off and even made it public via Twitter. Any delay means the company continues bleeding money. Shares reacted accordingly with a drop, but it turned around later on.

Shares bounced as bargain-seekers came in and probably as investors remembered the Branson has deep pockets. Moreover, it is essential to stress that the disappointment in New Mexico is only a delay – and unrelated to the company's performance.

Yet perhaps most importantly, the world is currently awash with cash – coming from monetary and fiscal stimulus. There may be new millionaires and billionaires making money in equity markets that could potentially sign up for Virgin space flights.

Moreover, while covid caused the recent cancelation, progress on vaccines is accelerating. Pfizer (NYSE: PFE) and BioNTech are set to submit an emergency application to use their vaccine as soon as Friday. Moderna (NASDAQ: MRNA) also reported outstanding results from its Phase 3 trial and other companies to have promising immunization schemes in the pipeline.

Once the pandemic is over, the money sloshing around the world is unlikely to be drained out and could reenergize tourism – including Virgin's orbital flights.

See Covid Vaccine: Pfizer's success promising for three other efforts, rally may have only just begun

SPCE stock forecast

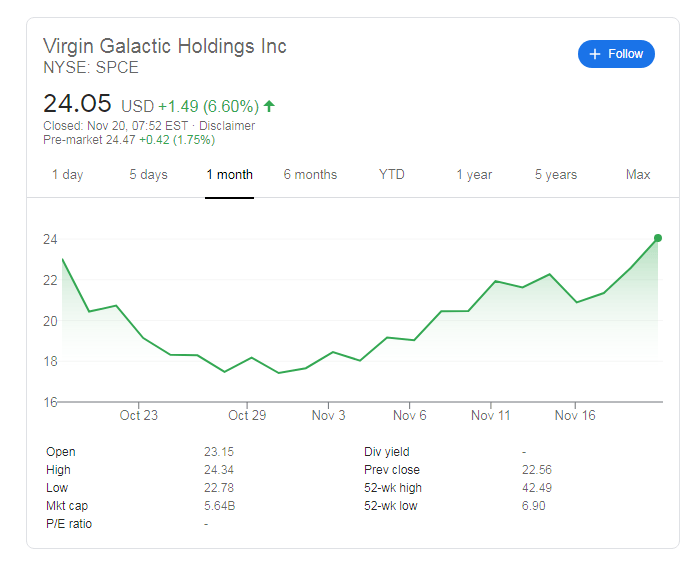

NYSE: SPCE is set to rise by 1.75% according to Friday's premarket data at the time of writing. That would complete an increase of nearly 20% from Monday's closing low of $20.89. Virgin Galactic's shares are now at the highest since early August. The next upside target is $25.54 seen in July. The 52-week high is $42.49. Support is at $20.89, followed by $18.

More When the market shivers, the Fed delivers? Where next for markets

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD breaks below 1.0400 due to renewed US-EU trade tensions

EUR/USD continues its decline for the third consecutive day, trading near 1.0390 during the early Friday. The pair weakens as the risk-sensitive Euro faces selling pressure amid heightened risk aversion following renewed US-EU trade tensions.

Bitcoin, Ethereum, and Ripple continue to sell off

Bitcoin price continues declining on Friday after falling more than 15% this week. Ethereum and Ripple followed BTC’s footsteps and declined by nearly 24% and 21%, respectively.

GBP/USD holds below 1.2600 as US PCE inflation data looms

The GBP/USD pair extends its downside to near 1.2580 during the early European session on Friday. Tariff uncertainty from US President Donald Trump undermines the Pound Sterling against the US Dollar.

Gold price remains depressed near two-week low amid modest USD strength

Gold price attracts sellers for the second straight day amid a broadly stronger USD. The risk-off mood and sliding US bond yields do little to support the precious metal. Traders now look forward to the US PCE Price Index for some meaningful impetus.

February inflation: Sharp drop expected in France, stability in the rest of the Eurozone

Inflation has probably eased in February, particularly in France due to the marked cut in the regulated electricity price. However, this overall movement masks divergent trends. Although disinflation is becoming more widespread, prices continue to rise rapidly in services, in France as well as elsewhere in the Eurozone.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.