S&P/TSX 60 Index Elliott Wave technical analysis [Video]

![S&P/TSX 60 Index Elliott Wave technical analysis [Video]](https://editorial.fxsstatic.com/images/i/Equity-Index_S&P500-2_XtraLarge.jpg)

S&P/TSX 60 Elliott Wave technical analysis

Technical overview

-

Function: Trend.

-

Mode: Impulsive.

-

Structure: Orange Wave 5.

-

Position: Navy Blue Wave 3.

-

Direction next lower degrees: Navy Blue Wave 4.

-

Details:

-

Orange Wave 4 appears completed.

-

Orange Wave 5 is currently developing.

-

Wave cancellation invalid level: 1,463.86.

-

S&P/TSX 60 Elliott Wave analysis overview

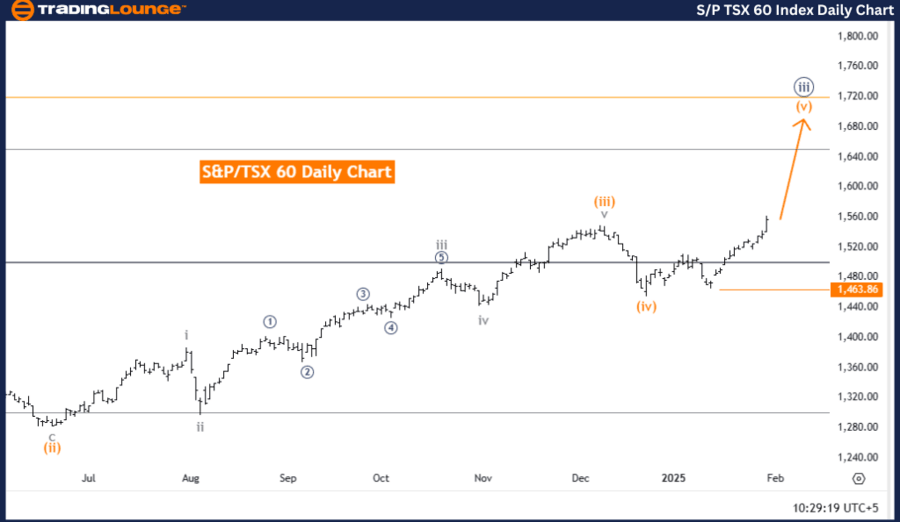

The S&P/TSX 60 Elliott Wave Analysis on the daily chart presents a detailed technical perspective on the index’s current trend.

Market trend and structure

-

The analysis identifies the market as being in an impulsive mode, indicating a strong and sustained directional movement.

-

The current structure is labeled as Orange Wave 5, which is a sub-wave within Navy Blue Wave 3, part of a larger Elliott Wave cycle.

Key observations

-

Orange Wave 4 appears to have completed, and Orange Wave 5 is now in progress, signaling continued upward momentum.

-

The next anticipated move at a lower degree is Navy Blue Wave 4, typically a corrective phase following the completion of an impulsive wave.

-

Traders should closely monitor Orange Wave 5, as its completion may trigger the start of Navy Blue Wave 4.

-

The wave cancellation invalid level is set at 1,463.86, meaning if the price falls below this level, the current wave count becomes invalid, requiring a revised analysis.

Conclusion

The S&P/TSX 60 is currently in an impulsive phase, labeled as Orange Wave 5, within a larger trend inside Navy Blue Wave 3. The completion of Orange Wave 4 has set the stage for a continuation of the current trend.

Traders should monitor the progression of this wave and observe the invalidation level at 1,463.86 to confirm the wave structure’s validity. This analysis provides a structured framework to understand the market’s current position and anticipate future price movements within the ongoing trend.

S&P/TSX 60 Elliott Wave Analysis – Day Chart

S&P/TSX 60 Elliott Wave technical analysis

Technical overview

-

Function: Trend.

-

Mode: Impulsive.

-

Structure: Orange Wave 5.

-

Position: Navy Blue Wave 3.

-

Direction next lower degrees: Navy Blue Wave 4.

-

Details:

-

Orange Wave 4 appears completed.

-

Orange Wave 5 is currently developing.

-

Wave cancellation invalid level: 1,463.86.

-

S&P/TSX 60 Elliott Wave analysis overview

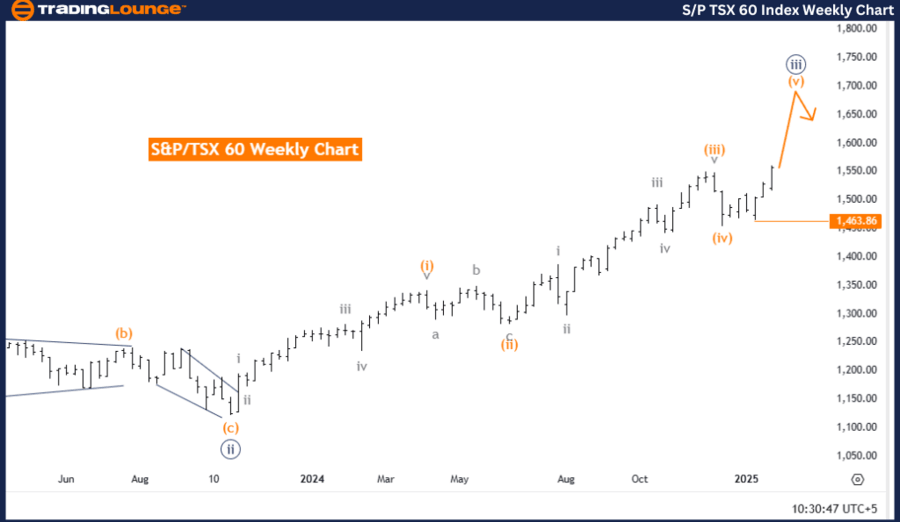

The S&P/TSX 60 Elliott Wave Analysis on the weekly chart provides a comprehensive technical perspective on the index’s current trend.

Market trend and structure

-

The analysis identifies the market as being in an impulsive mode, indicating a strong and sustained directional movement.

-

The current structure is labeled as Orange Wave 5, which is a sub-wave within Navy Blue Wave 3, part of a larger Elliott Wave cycle.

Key observations

-

Orange Wave 4 appears to have completed, and Orange Wave 5 is now in progress, signaling continued upward momentum.

-

The next anticipated move at a lower degree is Navy Blue Wave 4, typically a corrective phase following the completion of an impulsive wave.

-

Traders should closely monitor Orange Wave 5, as its completion may trigger the start of Navy Blue Wave 4.

-

The wave cancellation invalid level is set at 1,463.86, meaning if the price falls below this level, the current wave count becomes invalid, requiring a revised analysis.

Conclusion

The S&P/TSX 60 is currently in an impulsive phase, labeled as Orange Wave 5, within a larger trend inside Navy Blue Wave 3. The completion of Orange Wave 4 has set the stage for a continuation of the current trend.

Traders should monitor the progression of this wave and observe the invalidation level at 1,463.86 to confirm the wave structure’s validity. This analysis provides a structured framework to understand the market’s current position and anticipate future price movements within the ongoing trend.

S&P/TSX 60 Elliott Wave analysis – Weekly chart

S&P/TSX 60 Index Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.