Watch the video extracted from the live session on 29 Aug 2023 below to find out the following:

- How to derive the tell-tale signs from last week’s price action

- What to look for after a stopping action

- What to expect during the most volatile month (September)

- The short-term trend development in the S&P 500

- And a lot more

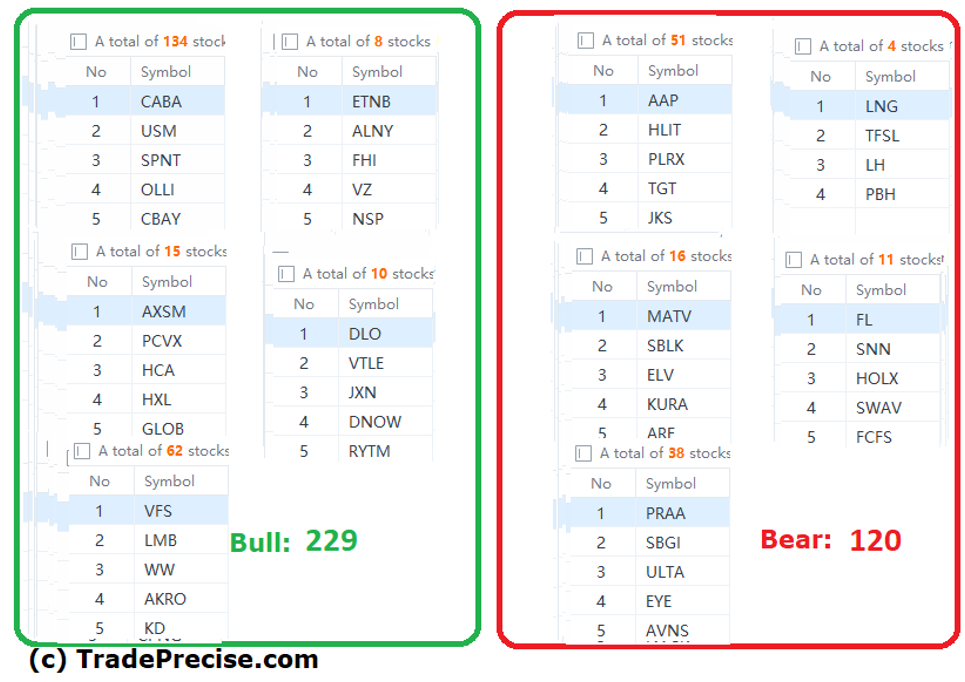

The bullish vs. bearish setup is 229 to 120 from the screenshot of my stock screener below pointing back to a positive market environment.

14 “low hanging fruits” (CLS, CELH, etc…) trade entries setup + 23 others (URNJ, SOFI, etc…) plus 8 “wait and hold” candidates have been discussed during the live session.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD falls toward 1.1400 after soft Eurozone inflation data

EUR/USD keeps the red near 1.1400 in European trading on Tuesday. The data from the Eurozone showed that the annual HICP inflation softened to 1.9% in May from 2.2% in April, weighing on the Euro. Meanwhile, the broad-based USD recovery ahead of key job openings data from the US drag the pair lower.

GBP/USD trades with negative bias below 1.3550 ahead of Bailey's testimony

GBP/USD stays pressured below 1.3550 in Tuesday's European session, eroding a part of the overnight strong move up to the 1.3560 area, or a multi-day peak. The price remains weighed down amid a modest US Dollar uptick, though the fundamental backdrop warrants some caution for bearish traders.

Gold price retains its negative bias as goodish USD rebound overshadows weaker risk tone

Gold price maintains its offered tone below a four-week top touched earlier this Tuesday though it has managed to rebound slightly from the daily low set during the first half of the European session. The intraday slide is sponsored by the emergence of some US Dollar buying, which tends to undermine demand for the commodity.

Crypto Gainers WIF, SPX, HYPE: Meme coins soar with Bitcoin’s recovery to $106K

Crypto market bounces back as Bitcoin (BTC) reclaims the $106,000 level at press time on Tuesday, resulting in a refreshed rally in top meme coins such as Dogwifhat (WIF) and SPX6900 (SPX), and Pepe (PEPE).

AUD/USD turns lower toward 0.6450 after RBA Minues, poor China's PMI

AUD/USD is meeting fresh supply toward 0.6450 in the Asian session on Tuesday as traders digest the RBA Minutes and the unexpected contraction in China's May Caixin Manufacturing PMI. Additionally, a modest US Dollar rebound keeps the pair undermined.