S&P 500 (SPX) still stuck on 4,000

- S&P 500 (SPX) fails to close above the 4,000 barrier.

- Options expiring on Friday have notable interest at the 4,000 strike.

- Earnings continue to look positive for consumer spending.

The equity market struggled on Tuesday but still managed to close in the green. The S&P 500 was up just under 1% but failed to close above the psychological 4,000 level. This is not just psychological – the Friday option expiry has notable interest at this strike, which should keep the market magnetized around it for the remainder of the week.

S&P 500 (SPX) news

Earnings so far have been sound for retailers. Walmart (WMT) was out before the open with good numbers and Lowe's (LOW) has added to this strength. However, Target (TGT) is the odd one out again. It has just warned for next quarter, and its shares are plummeting in the premarket, further adding to a shift in sentiment for the S&P 500 in my view. Lowe's is up 2%, but Target is down 14% at the time of writing. The boost from the PPI, which added to the CPI bullishness, will be challenged by this report from Target. Bond yields also look to have bottomed, so the risk-reward for this rally is becoming stretched.

S&P 500 (SPX) forecast

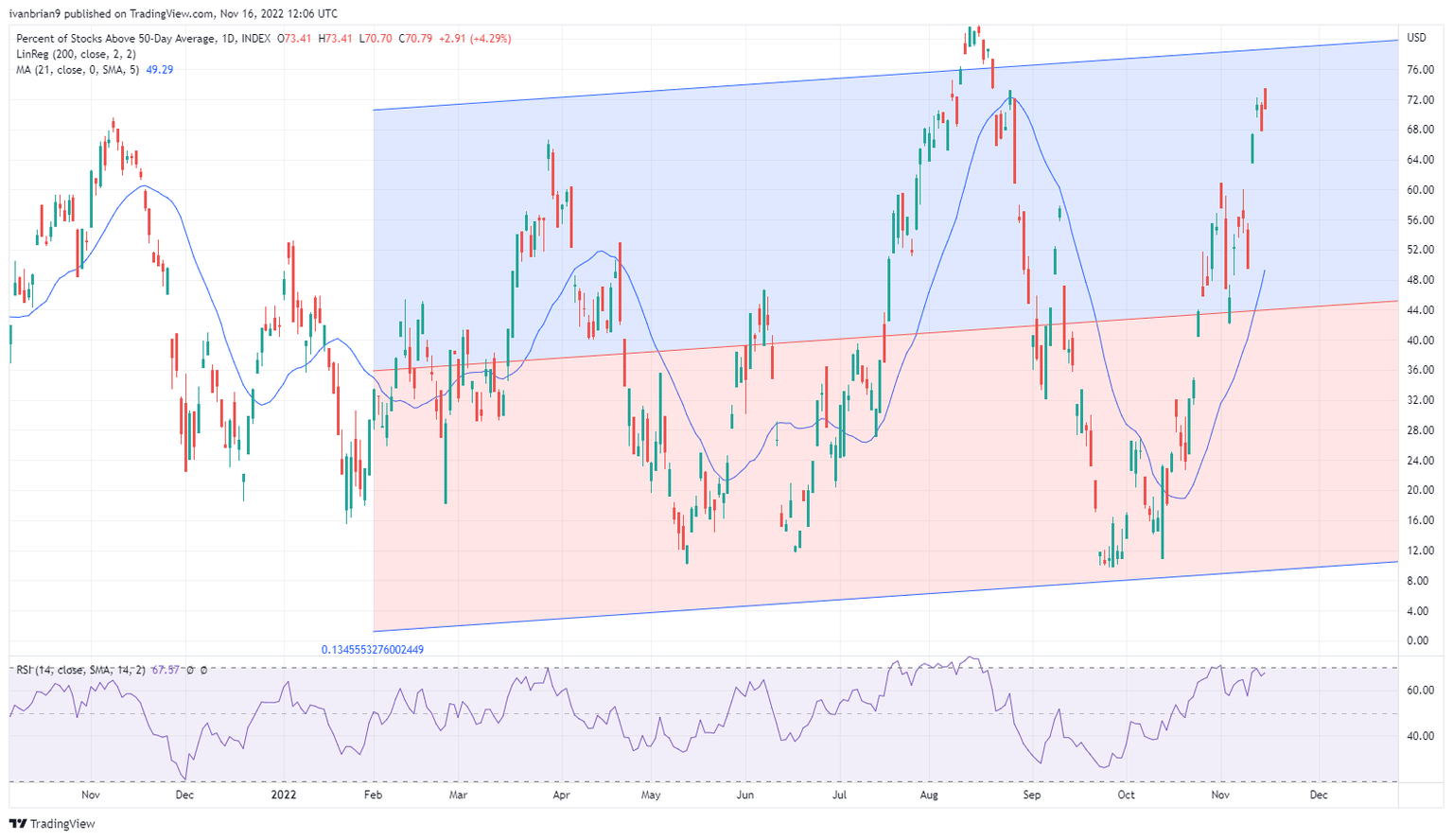

Historically, this is the best time of year for bulls, and the midterm adds to that thesis. The rally is now overbought in my view, but rather than a capitulation my base case remains a modest pullback and some period of consolidation. The year-end Santa rally is questionable. However, all will depend on the Fed's mood in its December meeting. Measures of market breadth are now corresponding with the August top. The number of stocks above the 200-day moving average is higher than in August, and the number above the 50-day moving average is also close to August highs.

The number of stocks above the 200-day moving average

The number of stocks above the 50-day moving average

Overall, resistance at 4,000 is strong with the 200-day moving average and channel resistance all close by. A small short-term pivot it at 3,946, while 3,859 is the strong pivot as there is a possibility for a gap to fill below.

SPX daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.