S&P 500 (SPX) Forecast 2023: A contrarian view on how stock markets will react to delayed recession

- Wall Street consensus view is a recession to hurt SPX and stocks in the first half of 2023.

- Consensus is usually wrong, looking back over stock market historic performance.

- Our S&P 500 forecast for 2023 is a contrarian one on the basis of a delayed US recession.

- Bank of Japan widening yield-curve control means higher interest rates for the United States as well.

Consensus is the most overused of terms in financial markets and a bastion of safety for fund managers and strategists alike. After all, if your benchmark is one of the major global indices, in this case the S&P 500 (SPX), then consensus is where you want to be. There is little incentive for mutual funds and money managers to take left-field bets as failure can cost your job or your fund.

2022 has not been a great year, with fund managers chasing stock markets on the way down and largely missing the two major rallies, one in the summer and another one again in November.

The long US Dollar position unwound spectacularly after the US Consumer Price Index (CPI) print in October and we witnessed a huge risk rally on the S&P 500 and other major equity indices. That has finally run out of steam as the Federal Reserve (Fed) once again dashed bull's hopes.

The Federal Reserve has been very consistent this year in saying they will raise rates to fight inflation and will not give up. However, the Fed does not have a lot of credibility on its side and the market has repeatedly tried to second guess them. We have had numerous Fed pivot rallies but each time these are dashed by hard data and from the Federal Reserve itself. The most recent example came just last week with a dot plot showing rates over 5% for all of 2023.

What are Fed funds futures telling us that the Federal Reserve is not?

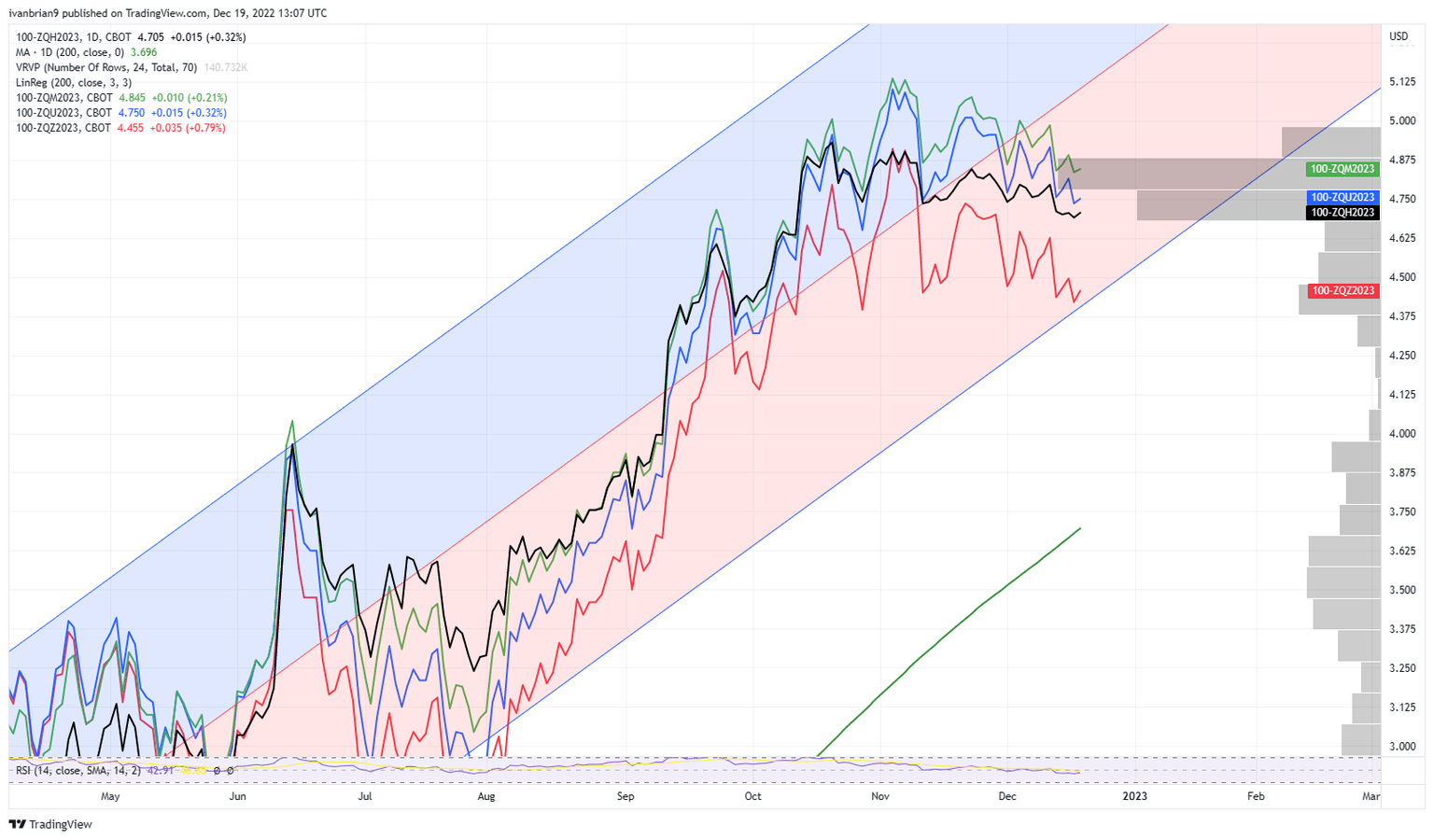

Fed funds futures (March 2023 black, June green, September blue, and Dec 2023 in red)

As we can see from the above chart of the standard Fed funds futures expiries, the market does not believe that the Federal Reserve will push rates above 5% and hold them there. From the above chart, we can see the market does expect a hike until June with Fed funds for June 2023 at 4.845%, below the dot plot of 5.1%. But in September, the Fed funds market is already pricing a move to 4.75%, and by December 2023 it is pricing a move to 4.45%.

The reason is the bond market is betting on a recession to force the Fed to pivot.

Who do we believe: the market or the Fed?

The Most Anticipated U.S. #Recession In Modern History pic.twitter.com/SYjOFpQxjZ

— Christophe Barraud (@C_Barraud) December 19, 2022

The consensus is for a recession but not for a severe one. We can determine this from analysts' earnings estimates for the S&P 500. Forecasts have been coming down gradually, but not enough to price in a deep recession. They are expecting rather a shallow one, with a swift recovery due to the Fed cutting interest rates. The latest forecasts are for flat EPS in 2023 and modest EPS growth in 2024.

Looking at the earnings estimates for next year, it's clear that none of the major firms are forecasting an earnings recession. That's why there is still significant downside risk in equities. pic.twitter.com/vCCzEf2vNN

— PassedPawn.eth (@passedpawn) December 7, 2022

That said, Wall Street strategists remain very confused (when aren't they!)

Strategists haven't been this divided when it comes to the S&P 500 outlook since 2009. pic.twitter.com/jnJ1qVsHlU

— Growth & Value (@Growth_Value_) December 7, 2022

Whatever type of recession we get, if we do get one, the news is not good. The average S&P 500 decline in a recession since 1960 is a sharp 33.6%, yikes!

Recession is always bad for stocks but the depth of the GDP decline is meaningless as a predictor of the depth of the market decline. The average recession-related decline for the S&P 500 since 1960 is 33.6%, from 13.9% in 1960-61 to 56.8% during the great financial crisis. pic.twitter.com/Gx8SFHxJ3Y

— Gina Martin Adams (@GinaMartinAdams) December 7, 2022

The critical question therefore remains, will we get a recession?

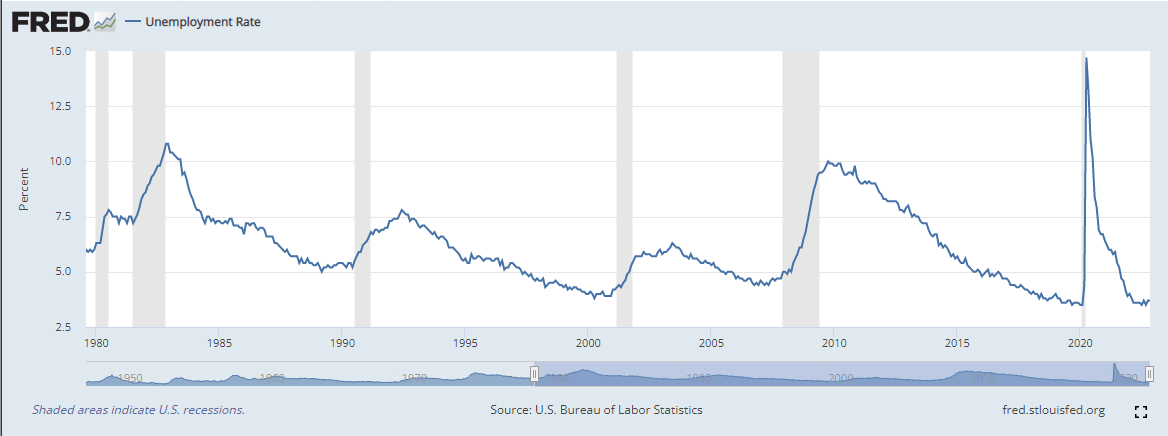

As we showed above, it seems inevitable, but it may be delayed. Employment remains tight in the United States and also in much of the rest of the G7 countries.

Unemployment Rate in the United States (Source: fred.stlouisfed.org)

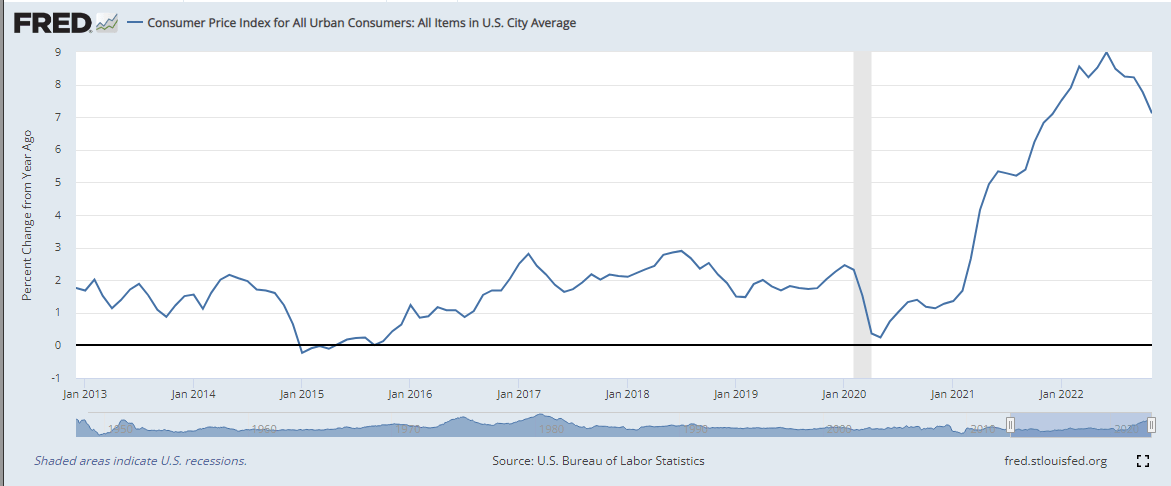

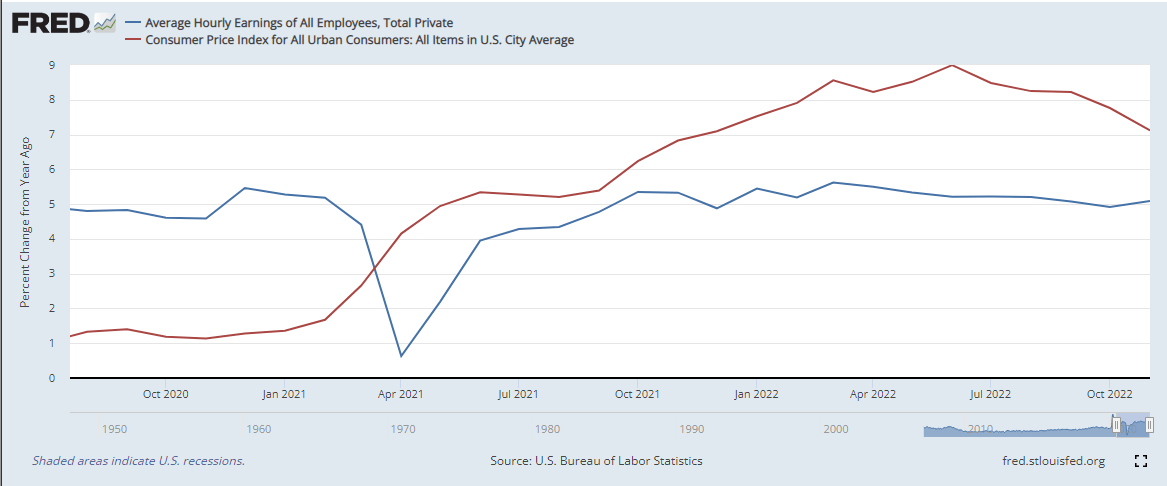

Added to tight employment are decelerating inflation and rising wages, so real wages are rising. Yes, my base case is that inflation is high and will remain so, but it is definitely declining.

Source: fred.stlouisfed.org

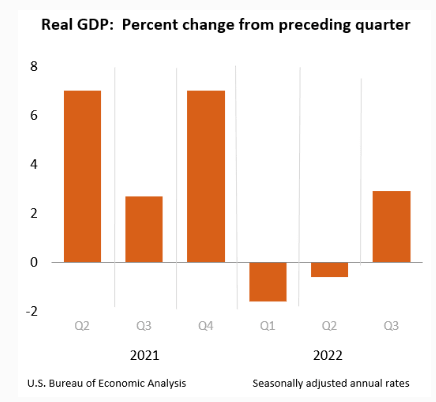

The last US Gross Domestic Product (GDP) print was positive and if you glance at the latest chart from the US Bureau of Economic Analysis (BEA) it looks like GDP growth is moving in the right direction and accelerating.

Source: BEA.gov

The latest from the Atlanta Fed's GDPNOW forecast shows Q4 US GDP growth at a still healthy 2.8%. With consensus for a recession, what if it does not happen? What if this is a longer-term project, akin to the 1970s. Are we in an inflationary growth phase, and 2024 is when the real recession will start? That would be the contrarian view, or at least one of them. There is rarely money to be made in sticking with the crowd.

Real incomes are rising due to the lagged effect of wage negotiations and the faster effect of falling inflation. Rising real incomes should support consumer spending and so ensure the US recession is delayed by up to a year.

Going back to interest rates, I am writing this article just after the Bank of Japan (BoJ) announced its shock decision to effectively abandon zero rates – or widen its yield curve control (YCC). This is not good news for risk assets. To put it simply, Japan is the biggest buyer of US Treasury bonds in the world. Remember, if buyers step away, prices will usually fall. This action by the BoJ makes the attractiveness of US Treasury bonds slightly fall, and means capital will more likely flow back to Japan.

That should also mean bond prices remain challenged and so yields and inflation are to remain sticky in my view. The Federal Reserve pivot theory just got a little harder for 2023 after this latest BoJ shift.

S&P 500 (SPX) forecast for 2023: A contrarian one

After all this hypothesizing, we now move on to the good stuff, predictions. In trading, it is important to note that making predictions is a fool's game. You should not have a bias and let the price and market guide you when trading. However, everyone loves a prediction, so with that caveat out of the way, here we go.

I should state that I am attempting to go for the contrarian view here, as that is my nature. My baseline is for economic growth to remain strong for at least the first half of 2023. The second half may see signs of a recession, but I do not think the US will enter one.

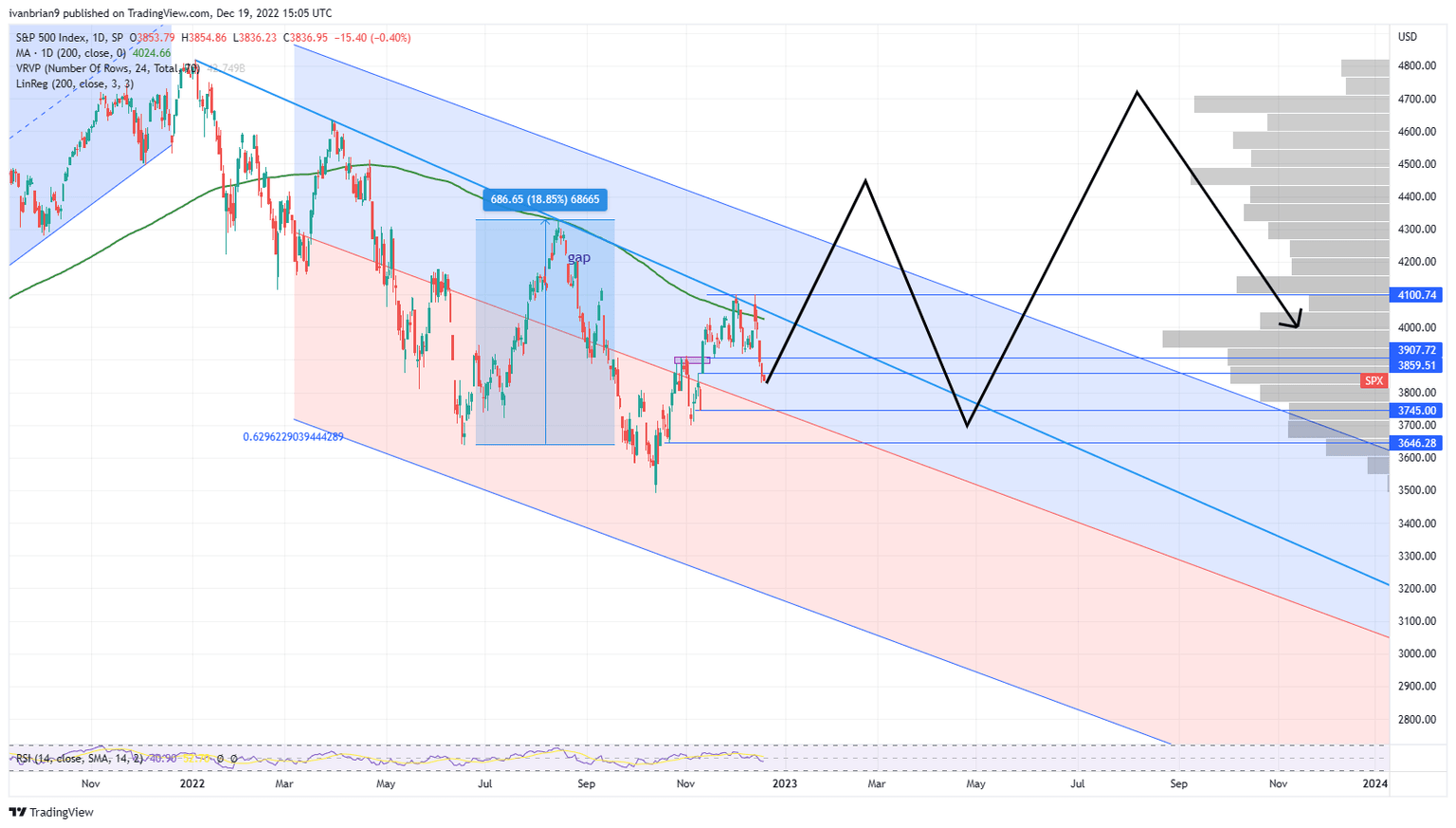

I believe the S&P 500 will peak in January and then slide as panic sets in that indeed we are not getting a Federal Reserve pivot. But again, just like in 2022, we will see a strong summer rally as earnings, employment and GDP remain strong. This will take the S&P 500 to perhaps as high as 4,700. However, as 2024 looms, the second half of 2023 will be challenging. Remember that markets are always forward-looking and will eventually foresee a 2024 recession with accompanying high interest rates, making for a toxic combination for those holding risk assets like stocks.

Overall, I expect a sharp decline in H2 2023, leading the S&P 500 to finish the year modestly lower at 3,600.

SPX daily

Whatever way we look at it, the options market is not pricing in any significant left-field events. Such as either a melt-up or down. The other view that is definitely not contrarian is a crash. Option protection and SKEW are not pricing in any tail risk. But then they rarely do! Let's hope my first contrarian view is the more likely one!

There you have it. Remember to trade what's in front of you, not what you want to be in front of you!

CBOE Skew index ( 200-day MA advanced forward) as a contrarian indicator that correlates with

— Ricardo V. Lago (@ricardovlago) December 20, 2022

S&P 500..Skew measures to what extent market

expects extreme outcomes ( black swans ).. It market does not ( a dropping index - See red line) it

means that they are too complacent

6/6 pic.twitter.com/qThGz5wrqS

Best of luck for 2023 to all our readers.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.