Here is what you need to know on Friday, April 9:

Up, up and away, as bulls push more record highs in equity markets. In the short term nothing, it appears, is clouding the picture. Or is it?

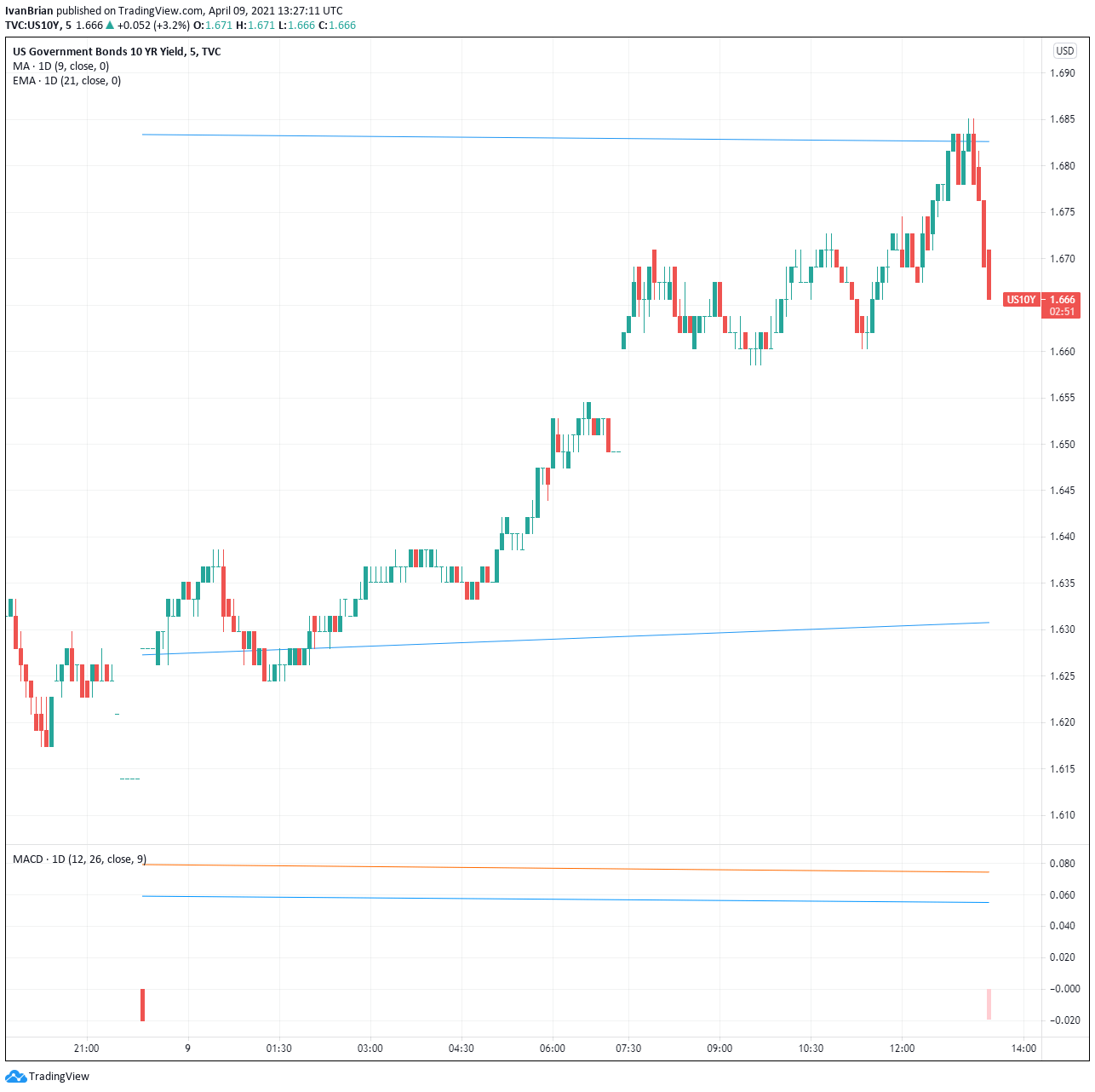

The 10-year yield reawakened with a fairly sharp rise back toward 1.7%. This may make the Nasdaq a bit hesitant on Friday with Nasdaq futures already slipping into the red. Inflation data will take its queue from the release of US PPI, if we ever get it, as the Labor Department says the data is delayed due to website problems.

Maybe the Fed has just decided to freeze prices permanently! Powell certainly did not think rising prices will lead to "worriesome inflation" in a speech on Thursday.

10-year yield over last 18 hours

The dollar is a touch stronger back below 1.19 against the euro. Gold is 1% lower at $1,726, Oil similarily down 1% at $59.28, and Bitcoin recovers some ground to $58,500.

European markets are mixed. The Dax is +0.1%, FTSE -0.4%, and the EuroStoxx is flat.

US futures are led by the Dow +0.2% while the S&P 500 is flat, and the Nasdaq is down 0.4%.

Stay up to speed with hot stocks' news!

S&P 500 SPX top news

The US decides to release PPI after all, and it is higher than expected! PPI monthly +1% versus 0.5% expected.

Florida sues Centre for Disease Control to allow cruises from the US. Royal Caribbean says it would like to be treated like the airlines, who are allowed to fly.

President Biden is to release his first budget proposal to Congress later on Friday.

Federal Reserve Clarida says inflation should revert back by the end of the year.

Uber and Lyft are giving drivers access to vaccines and providing free or discounted rides to vaccination centres for certain communities.

LEVI beats estimates on EPS and revenue, stock up in pre-market.

FuboTV wins rights to Qatar 2022 World Cup qualifying matches for South American teams.

Amazon: Alabama unionisation ballot ongoing amid challenges to some 500 ballots according to Reuters. CNBC reports 2-to-1 so far reject unionisation.

Mcdonalds is to hire up to 25,000 across Texas in April.

MSFT: says some public LinkedIn data has been extracted and made available for sale.

Nike: says Satan Shoes released by a Brooklyn company will be recalled as part of a legal settlement. Nike had filed a trademark infringement lawsuit against the Brooklyn company.

Pfizer: Australia has doubled its order of Pfizer's COVID-19 vaccine.

Southwest Airlines is recalling over 2,700 flight attendants from leave.

Boeing asks some customers to look at potential electrical problems in some 737 Max planes.

Chipotle upgraded by Wedbush on Thursday has seen six days of price gains.

Ups and Downs

Charles Schwab: JPMorgan raises price target.

Honeywell: Deutsche Bank upgrades.

Philip Morris: JPMorgan upgrades.

GE: UBS increases price target. see more

DraftKings: Jefferies names as top pick.

Carnival: Credit Suisse upgrades.

Economic data due

At the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds above 1.0400 in quiet trading

EUR/USD trades in positive territory above 1.0400 in the American session on Friday. The absence of fundamental drivers and thin trading conditions on the holiday-shortened week make it difficult for the pair to gather directional momentum.

GBP/USD recovers above 1.2550 following earlier decline

GBP/USD regains its traction and trades above 1.2550 after declining toward 1.2500 earlier in the day. Nevertheless, the cautious market mood limits the pair's upside as trading volumes remain low following the Christmas break.

Gold declines below $2,620, erases weekly gains

Gold edges lower in the second half of the day and trades below $2,620, looking to end the week marginally lower. Although the cautious market mood helps XAU/USD hold its ground, growing expectations for a less-dovish Fed policy outlook caps the pair's upside.

Bitcoin misses Santa rally even as on-chain metrics show signs of price recovery

Bitcoin (BTC) price hovers around $97,000 on Friday, erasing most of the gains from earlier this week, as the largest cryptocurrency missed the so-called Santa Claus rally, the increase in prices prior to and immediately following Christmas Day.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

.png)

.png)