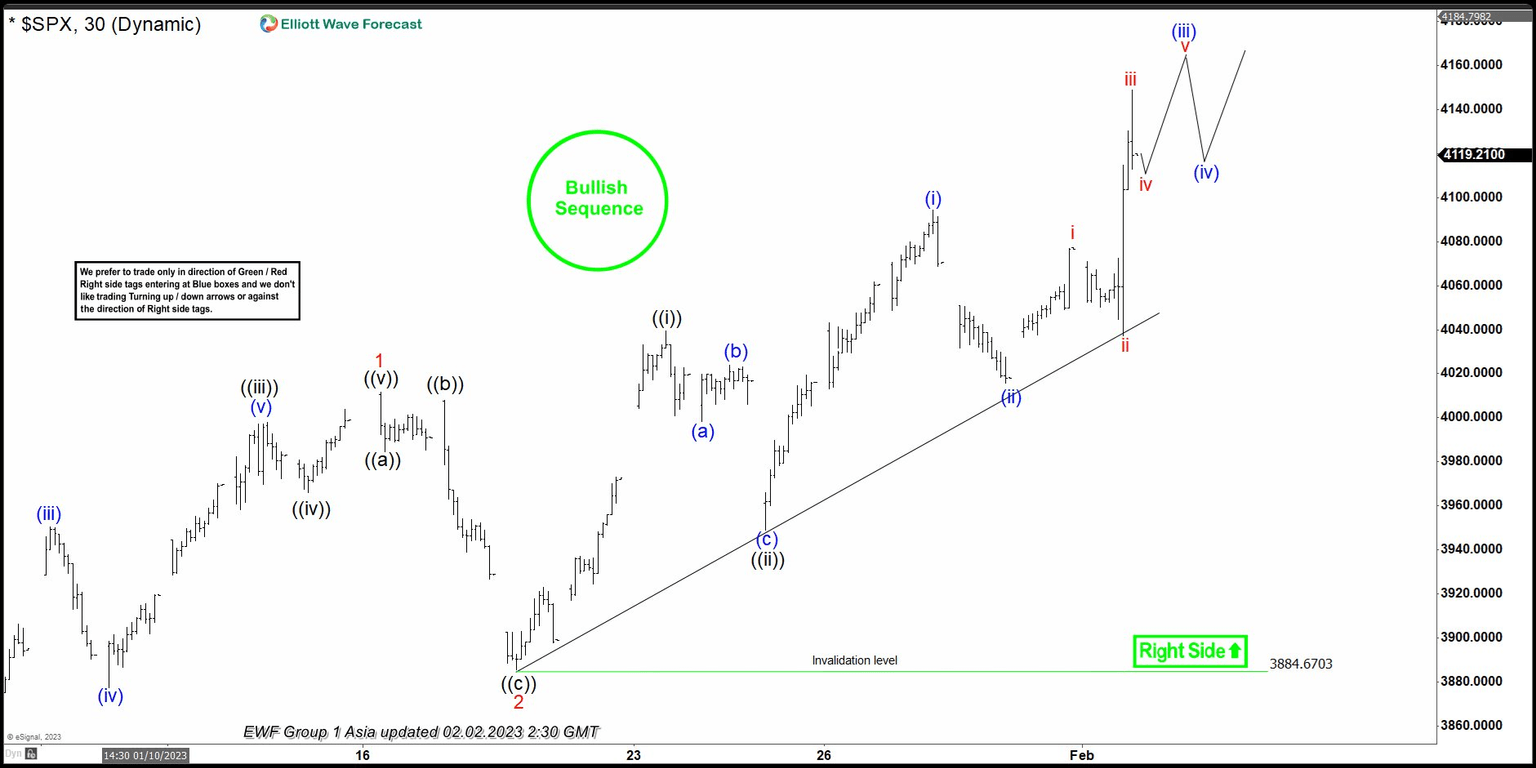

S&P 500 (SPX) bullish Elliott Wave sequence favors upside

S&P 500 (SPX) showing short term bullish Elliott wave sequence against October-2022 low. It proposed ended wave II correction at 10/13/2022 low of 3528.7 against daily sequence. Above there, it placed (1) at 4087.3 and (2) at 3764.5 low on 12/22/2022. It confirms higher high bullish sequence above (1) high, calling for further strength to continue. It placed wave 1 at 4011.54 high and 2 at 3885.54 low. Within wave 1, it favored ended ((i)) at 3846.65 high and ((ii)) at 3780.78 low. Above there, it placed ((iii)) at 3997.76 high as extended wave. It placed ((iv)) at 3965.95 low as shallow correction. Finally it ended ((v)) at 4011.54 high as wave 1 in (3) sequence and ended wave 2 as 0.5 Fibonacci retracement against wave 1 at 3885.54 low. Above wave 2 low, it confirms higher high sequence as the part of wave 3 of (3).

It placed ((i)) of wave 3 at 4039.31 high and ((ii)) at 3949.06 low as 0.618 Fibonacci retracement of wave ((i)). Currently, it favors higher in ((iii)) of 3. It favored ended (i) of ((iii)) at 4094.21 and (ii) at 4015.55 low as 0.5 Fibonacci retracement of wave (i). It is showing nest structure in wave 3 and expect to more strength to continue, while dips remain above (ii) low. In wave (iii) of ((iii)), it favors pullback in wave iv before final push higher to finish it. It placed wave i at 4077.16 high, ii at 4037.20 low and wave iii of (iii) at 4148.95 high. As long as price remains above (ii) low, it should see more upside as the part of nest within wave 3 and expect further strength. Alternatively, if it breaks below 4015.55 or 3949.06 low, it still can be either in ((ii)) or wave 2 correction and expect upside to continue later against 12/22/2022 low. It is showing bullish sequence and expect to remain supported in 3, 7 or 11 swings pullback to resume higher.

SPX 30-minute Elliott Wave chart

SPX Elliott Wave video

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com