- The S&P 500, the Nasdaq 100, and the Dow Jones remain positive.

- Softer than expected, US CPI data augmented speculations that the Fed will be less aggressive.

- Traders expect the Federal Reserve to hike to 5% and cut rates ahead of Q4 2023.

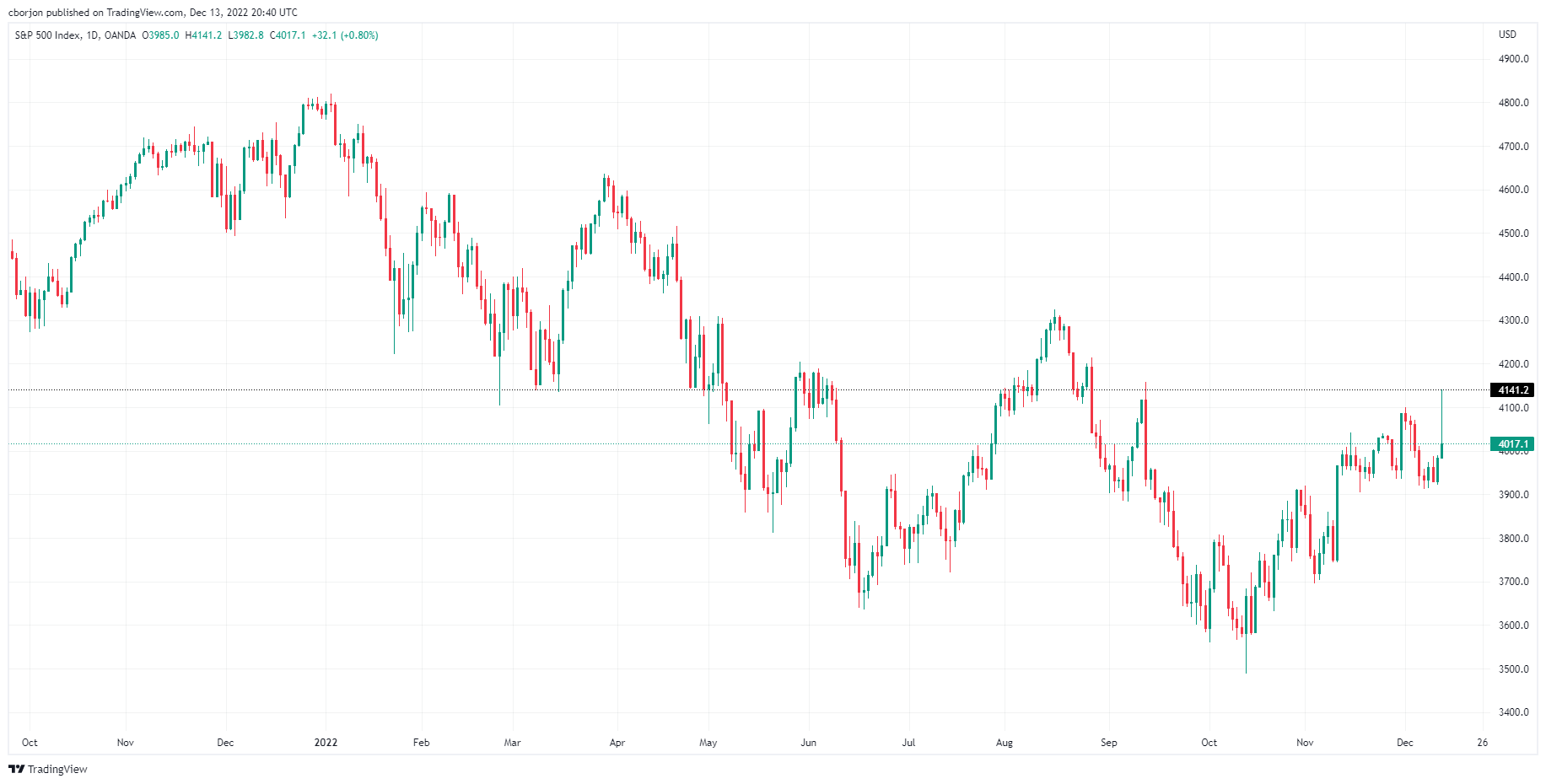

US stocks remained volatile after the release of inflation data in the United States (US) and remain positive off the day's highs, with the S&P 500, the Nasdaq 100, and the Dow Joines Industrial Average, each gaining 0.98%, 1.33%, and 0.47%. At the time of writing, the S&P 500 sits around 4,026.90.

It should be said that the indices, albeit remaining positive, are trading well below the day’s highs, as shown by Tuesday’s price action, forming a vast “inverted hammer” candlestick. Some traders speculate that is the reflection of profit-taking ahead of Wednesday’s Federal Reserve monetary policy meeting.

Before Wall Street opened, the US Department of Labor revealed that November’s Consumer Price Index (CPI) rose less than the 7.3% YoY expected to 7.1%. The so-called core CPI for the same period, which excludes volatile items like food and energy, printed 6.0% vs. 6.3% estimates. The reaction on the data sent the S&P 500 rallying to fresh three-month highs.

Money market futures seem to indicate an upcoming rise in the Federal Funds rate, making it peak at 5%. Eurodollar futures portrayed traders speculating that the Federal Reserve would make its first rate cut of around 20 bps by September 2023. Meanwhile, the US Dollar Index appeared volatile as it fell to six-month lows near 103.586, although recovering shortly afterward and now resting comfortably at 103.987.

Elsewhere, US Treasury bond yields, namely the 10-year benchmark note rate, plunged 15 bps, from around 3.630% to 3.459%, though of late, recovered some ground, sitting around 3.514%.

Analysts at TD Securities said, “the November CPI report does not affect the expectation of a 50bp rate increase at tomorrow’s FOMC meeting. Additionally, given the strength in core services inflation, it is clear the Fed will need to remain in a tightening mode beyond the December meeting. We will be looking for any Fed communication tomorrow regarding a further downshift in the hiking pace for the February meeting.”

What to watch

Ahead of the week, the US economic docket will feature the Federal Reserve Open Market Committee (FOMC), where the Fed is expected to hike rates by 50 bps the Federal Funds rate (FFR). Additionally, the Summary of Economic Projections (SEP) would be released, and the dot-plot would portray the Fed officials’ expectations for interest rates.

S&P 500 Daily Chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD weakens below 1.0900 on trade tensions

The EUR/USD pair loses ground to around 1.0880 during the Asian trading hours on Thursday. The escalating trade tension between the United States and the European Union exerts some selling pressure on the Euro against the Greenback.

Gold price retains positive bias for the third straight day; remains close to all-time peak

Gold price attracts buyers for the third successive day and climbs to the $2,947 region during the Asian session on Thursday, back closer to the all-time peak touched on February 24.

GBP/USD maintains position above 1.2950 near four-month highs

GBP/USD attempts to extend its gains for the third successive day, trading around 1.2960 during the Asian session on Thursday. The GBP/USD pair rises as the US Dollar faces headwinds amid ongoing tariff uncertainty from Trump and growing concerns over a potential US recession.

Ethereum: Staking could be catalyst to drive ETH's price 'more than Pectra upgrade': K33 Research

Ethereum traded around $1,860 in the Asian session on Thursday as its price remained largely subdued by bearish sentiment weighing on the general crypto market.

Brexit revisited: Why closer UK-EU ties won’t lessen Britain’s squeezed public finances

The UK government desperately needs higher economic growth as it grapples with spending cuts and potential tax rises later this year. A reset of UK-EU economic ties would help, and sweeping changes are becoming more likely.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.