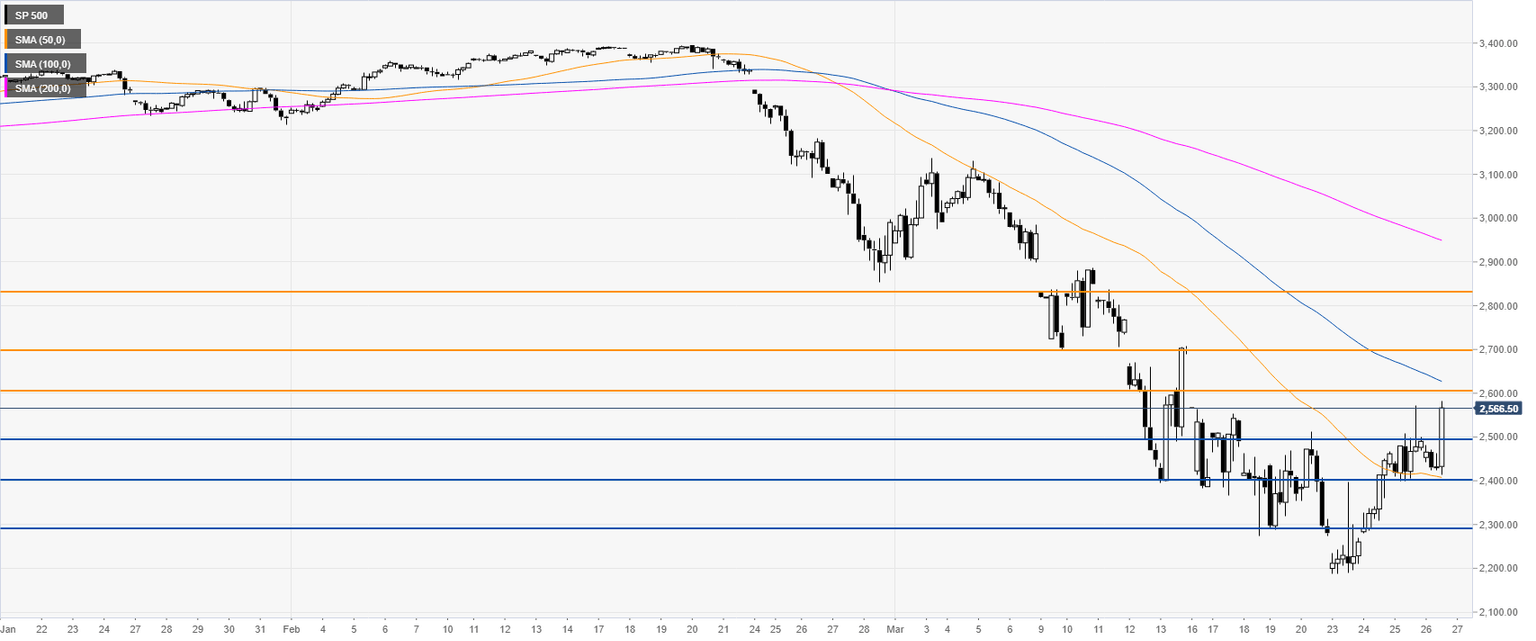

S&P 500 Price Analysis: US stocks trades in 7-day’s highs, strong resistance ahead

- S&P 500 is bouncing off 37-month lows and is nearing the 2600 mark.

- Strong resistance is expected in the 2600/2700 zone.

S&P 500 four-hour chart

Additional key levels

Author

Flavio Tosti

Independent Analyst