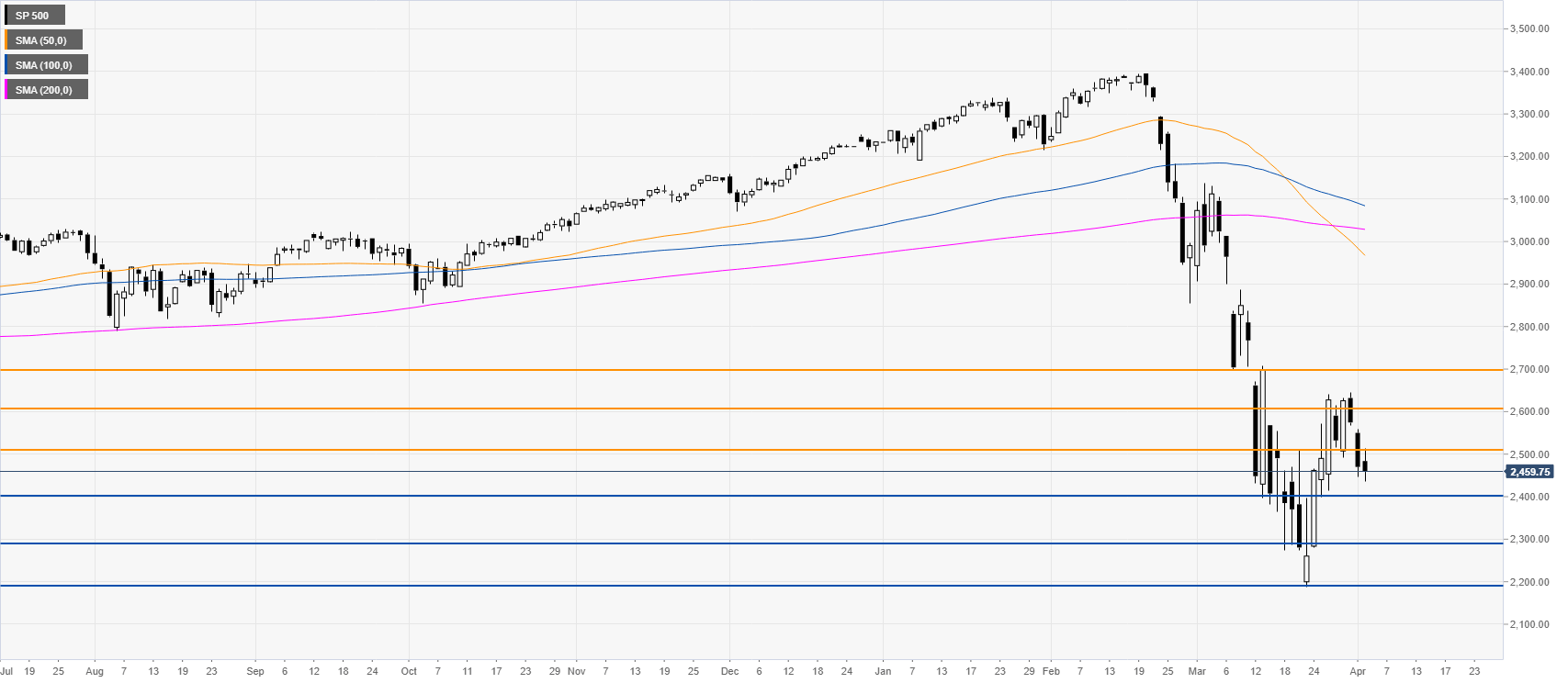

- S&P 500 is under pressure below the 2515 level.

- US jobless claims reach a new historic high at 6.648 million which could weigh heavily on the economy.

S&P 500 daily chart

Additional key levels

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD holds above 1.0450 after German sentiment data

EUR/USD stays in positive territory above 1.0450 after retracing a portion of its bullish opening gap. The data from Germany showed that the IFO - Current Assessment Index declined to 84.3 in November from 85.7, while the Expectations Index edged lower to 87.2 from 87.3.

GBP/USD pulls back toward 1.2550 as US Dollar sell-off pauses

GBP/USD is falling back toward 1.2550 in the European session on Monday after opening with a bullish gap at the start of a new week. A pause in the US Dollar decline alongside the US Treasury bond yields weighs down on the pair. Speeches from BoE policymakers are eyed.

Gold price manages to hold above $2,650 amid sliding US bond yields

Gold price maintains its heavily offered tone through the early European session on Monday, albeit manages to hold above the $2,650 level and defend the 100-period Simple Moving Average (SMA) on the 4-hour chart. Scott Bessent's nomination as US Treasury Secretary clears a major point of uncertainty for markets.

Bitcoin consolidates after a new all-time high of $99,500

Bitcoin remains strong above $97,700 after reaching a record high of $99,588. At the same time, Ethereum edges closer to breaking its weekly resistance, signaling potential gains. Ripple holds steady at a critical support level, hinting at continued upward momentum.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.