S&P 500, Nasdaq 100 update – Analyzing the latest earnings and market trends

-

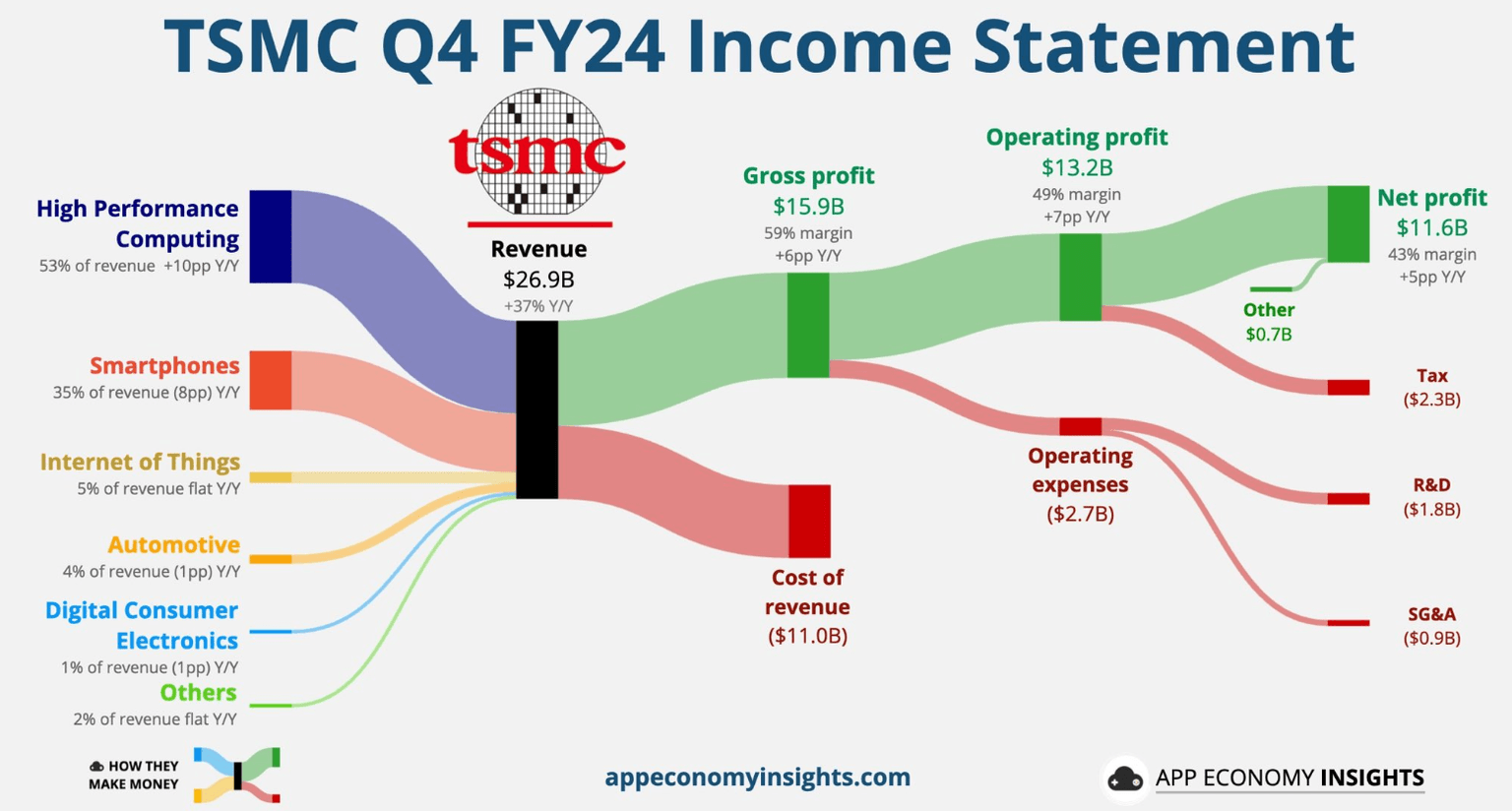

TSMC's strong Q4 2024 earnings and positive 2025 forecast boosted market sentiment and drove gains in chip stocks like Nvidia.

-

Overall corporate profits remain strong, with a high percentage of S&P 500 companies exceeding earnings estimates.

-

Technically, the S&P 500 is still in a bearish trend, but a close above the 5981 handle could signal a change in structure and potential further upside.

U.S. stocks saw a boost before the market opened, with Nasdaq 100 futures rising 0.5%, helped by positive news from TSMC, a major chipmaker for Apple and Nvidia. S&P 500 futures went up 0.3% after gaining 1.8% on Wednesday, its best day since the November election.

TSMC provides hope for AI spending

TSMC's 2025 forecast beat market expectations across all important areas, easing worries about a drop in AI spending.

TSMC's fourth-quarter revenue grew 38.8% to NT$868.46 billion, beating the expected NT$850.08 billion. In U.S. dollars, revenue reached $26.4 billion, slightly above the company’s forecast of $26.1-26.9 billion. Net income rose 57% to a record NT$374.68 billion, with earnings per share at NT$14.45. Analysts had predicted NT$366.61 billion in net income. Overall, TSMC's profit hit a record high, increasing 57% from last year, while revenue jumped nearly 39%.

Source: App Economy Insights

More interestingly however, TSMC expects to spend up to 19% more than analysts thought which adds to the belief that a slowdown in AI spending may not materialize. Speaking on the results, Chief Financial Officer Wendell Huang. "Moving into first quarter 2025, we expect our business to be impacted by smartphone seasonality, partially offset by continued growth in AI-related demand."

The news left TSMC trading 3.76% up on the day and helping drag other chipmakers along for the ride. Nvidia is one of the major beneficiaries, trading up around 3.3% at the time of writing.

Earnings season - Corporate profits remain strong

Earnings season got off to a bright start yesterday with three of the country's biggest banks smashing their earnings estimates. Of the 28 companies in the S&P 500 that have reported fourth-quarter earnings as of Wednesday, 82.1% have surpassed estimates, according to data compiled by LSEG.

The good news continued today as both Bank of America and Morgan Stanley saw their earnings reports beat expectations as well. Morgan Stanley's profit grew in the fourth quarter, driven by a surge in deals and stock sales, pushing its yearly revenue to a record high.

Bank of America reported higher-than-expected profits on Thursday as its traders took advantage of busy fourth-quarter activity, and the bank said it expects to earn more interest income in 2025. On an adjusted basis, BofA earned 82 cents per share in the fourth quarter, beating analysts' expectation of 77 cents per share, according to estimates compiled by LSEG.

Shares were up 2.7% in premarket trade.

The week ahead

This week earnings are largely done for now with major earnings releases set to continue next week Tuesday January 21, 2025. Netflix will report after the market close on Tuesday which will come a day after the inauguration of Donald Trump as US President.

The next 10 days will be crucial for markets as incoming President Trump has promised major moves from day one, many of which may have an impact on US Equities and markets in general.

Technical analysis

S&P 500

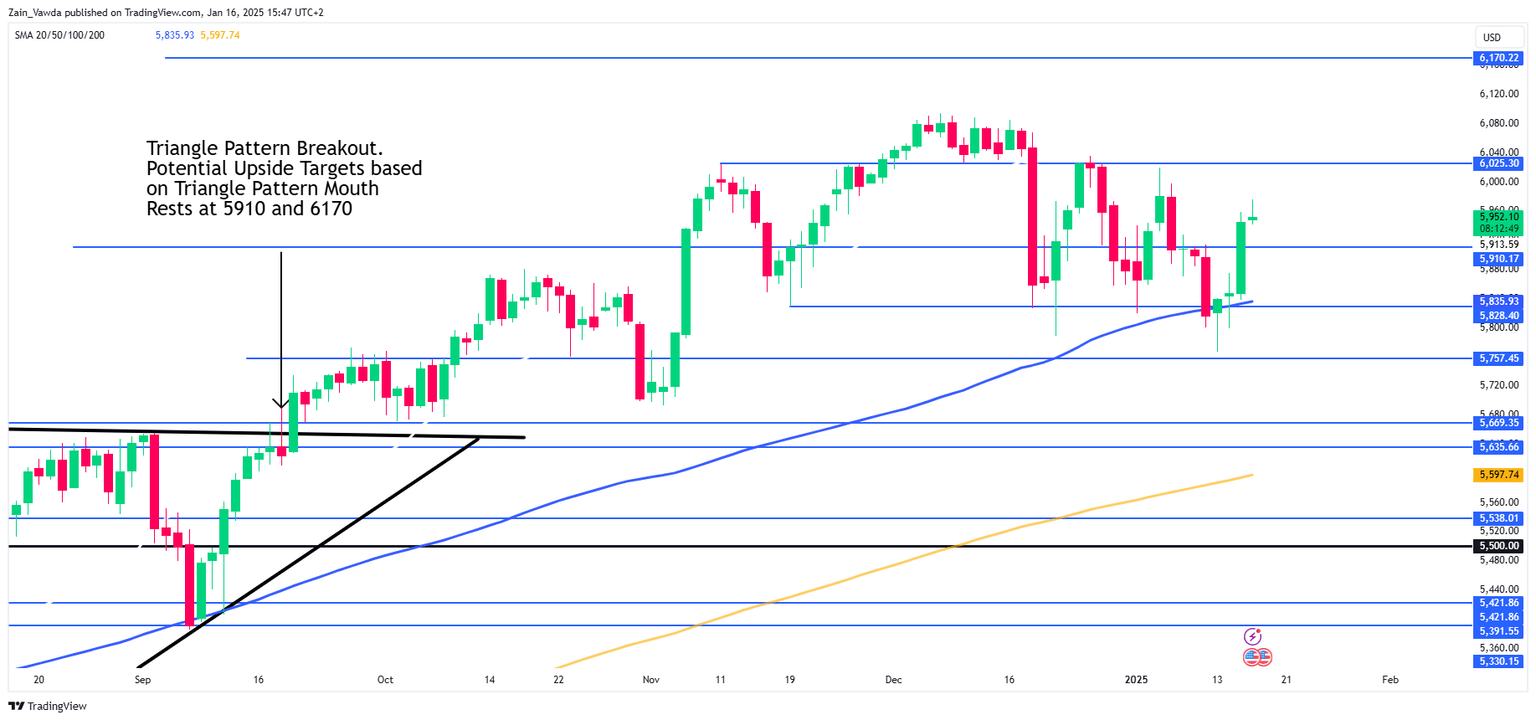

From a technical standpoint, the S&P 500 remains in a bearish trend on the daily timeframe.

The swing high of Monday January 6, continues to hold firm with a daily candle close above the 5981 handle needed for a change in structure.

If this does not materialize the S&P 500 remains vulnerable to further downside.

Immediate support rests at 5910 before the confluence level at 5828-5835 comes into focus. Here we have a key area of support as well as the 100-day MA. Lower down we have support at 5757 and 5668 respectively.

If the S&P is able to close above the 5981 handle then 6025 and the ATH print around 6094 come into focus.

S&P 500 Daily Chart, January 16, 2025

Source: TradingView (click to enlarge)

Support

-

5910

-

5828

-

5757

Resistance

-

6000

-

6025

-

6094

Author

Zain Vawda

MarketPulse

Zain is a seasoned financial markets analyst and educator with expertise in retail forex, economics, and market analysis.