S&P 500 Index opens modestly higher following last week's slump

- Wall Street's main indexes started the new week in the green.

- Energy stocks post strong gains on rising crude oil prices.

- Technology shares stay in the negative territory after the opening bell.

After posting large losses last week, major equity indexes in the US started the new week modestly higher. As of writing, the Dow Jones Industrial Average was up 0.35% at 33,412, the S&P 500 was rising 0.16% at 4,173 and the Nasdaq Composite was rising 0.08% at 14,060.

In the absence of fundamental developments, Monday's rebound looks like a technical correction.

Among the 11 major S&P 500 sectors, the Energy Index is up nearly 2% on the day supported by a 1% increase in US crude oil prices. On the other hand, the Technology Index is losing 0.55% after the opening bell.

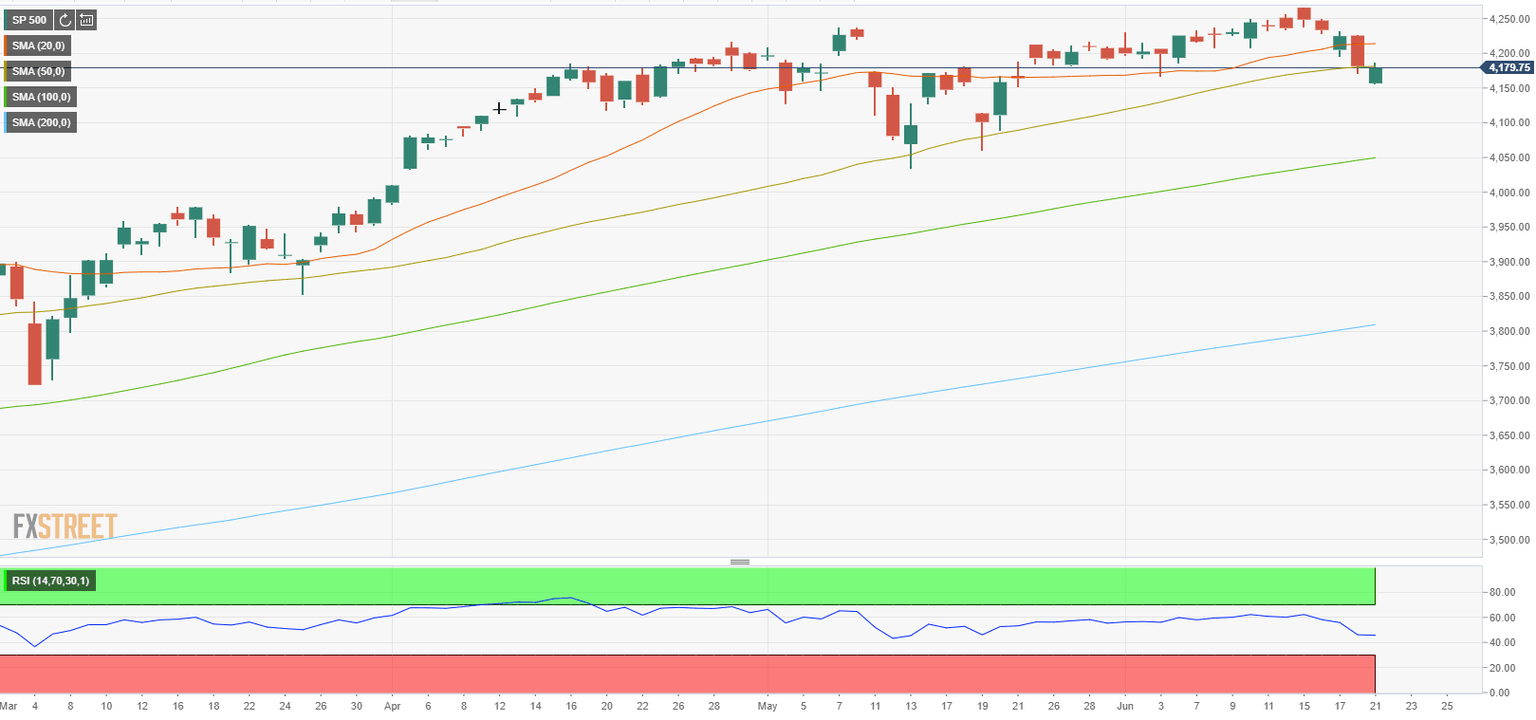

S&P 500 (ES, SPY) Technical Forecast: Fed fright causes index implosion

S&P 500 chart (daily)

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.