S&P 500 Index opens in the red despite upbeat US data

- Wall Street's main indexes started the day in the negative territory.

- Energy stocks suffer heavy losses amid falling crude oil prices.

- CBOE Volatility Index rises nearly 4% despite strong US data.

Major equity indexes in the US opened lower on Thursday as the upbeat macroeconomic data releases from the US failed to help the market sentiment improve. Reflecting the souring market mood, the CBOE Volatility Index (VIX), Wall Street's fear gauge, is up nearly 4% at 22.

As of writing, the Dow Jones Industrial Average was losing 0.5% at 3,869, the Dow Jones Industrial Average was down 0.6% at 32,226 and the Nasdaq Composite was falling 0.35% at 12,753.

Earlier in the day, the weekly report published by the US Department of Labor showed that the weekly Initial Jobless Claims dropped to its lowest level since the beginning of the pandemic at 684,000 in the week ending March 20. Additionally, the US Bureau of Economic Analysis revised its fourth-quarter GDP growth to 4.3% from 4.1%.

Among the 11 major S&P 500 sectors, the Energy Index is down 2.2% pressured by a 1% decline in crude oil prices. On the other hand, the defensive Utilities Index is posting small gains.

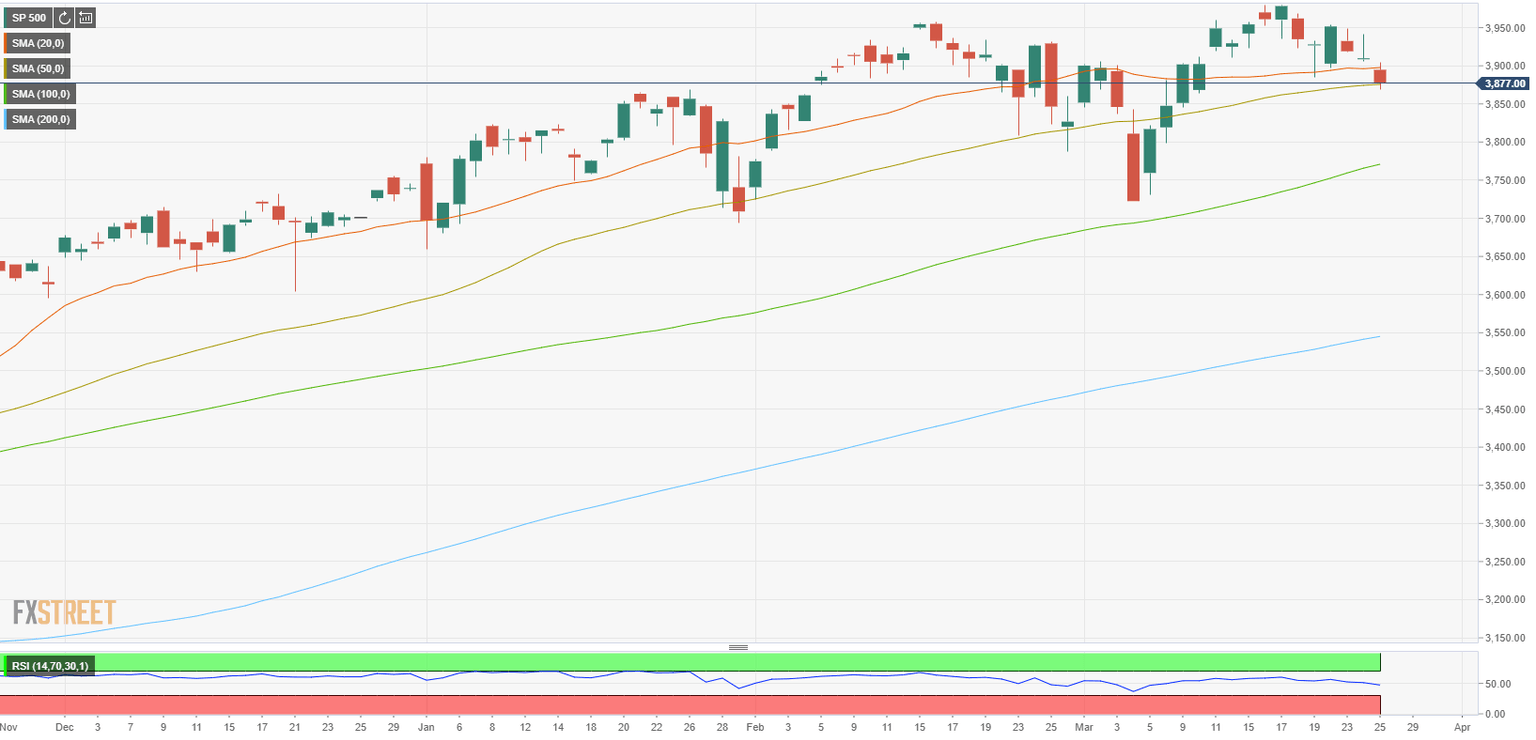

S&P 500 chart (daily)

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.