S&P 500: Current dynamics and near-term prospects

Investors in the American stock market remain optimistic by buying American securities. They and big business seem to have adjusted to high interest rates while continuing to finance the American economy. Moreover, according to Fed officials, the period of rate stabilization is already close, when it will be maintained at current levels for some period of time, and the recent banking crisis seems to have been brought under control by financial institutions that have expressed their willingness to provide banks with unlimited liquidity.

Despite the "hawkish" statements of the Fed representatives regarding the prospects for monetary policy, economists believe that it remains still soft, given high inflation and a strong labor market. In addition, the US stock market seems to have turned "north" again after the March Fed meeting, when economists' opinions became more active that the Fed's monetary policy tightening cycle would soon be put on pause. The head of the US Central Bank, Powell, noted then that the recently obtained inflation data "really indicate a long-awaited reduction in price pressure," although, in his opinion, "much more evidence is needed to be sure of a decrease in inflation."

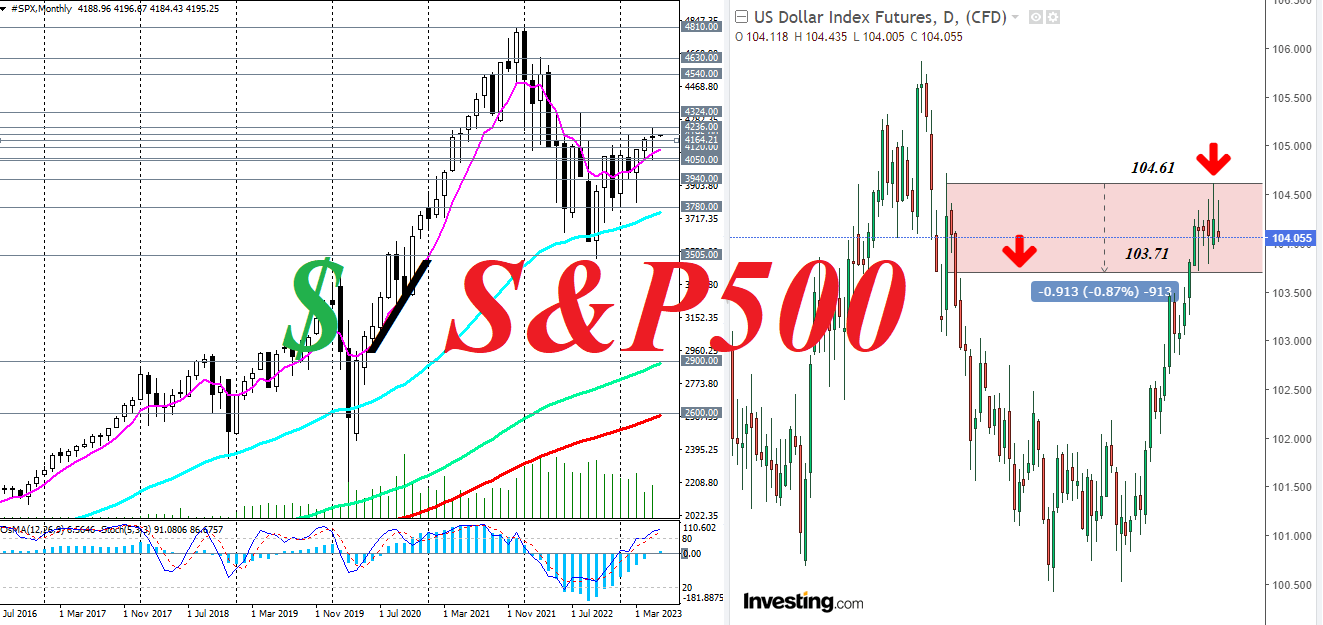

Anyway, at the moment, S&P500 futures are trading near the 4195.00 mark. The breakdown of this local resistance level and last month's maximum of 4236.00 will be additional evidence in favor of the revival of the S&P500 global bullish trend.

Nothing threatens long positions above the important support level 4120.00.

In general, the S&P500 continues to trade in the global bull market zone, being well above the support levels of 2900.00, 2600.00, separating the global bull market from the bear market, also confirming the viability of the well-known long-term "buy and hold" strategy.

Support levels: 4164.00, 4120.00, 4100.00, 4060.00, 4050.00, 4000.00, 3940.00, 3800.00, 3780.00, 3700.00, 3600.00, 3505.00.

Resistance levels: 4195.00, 4236.00, 4324.00, 4540.00, 4630.00, 4810.00.

Author

Yuri Papshev

Independent Analyst

Independent trader and analyst at Forex market. Trade experience - more than 10 years. In trade Yuri Papshev uses a combination of fundamental and technical analysis.