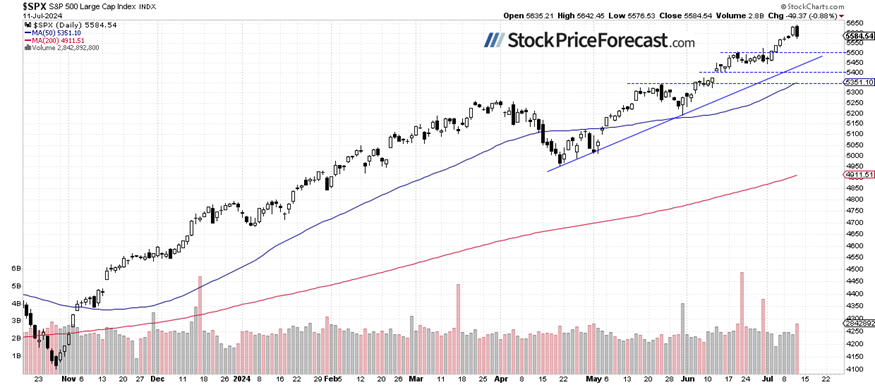

Thursday’s trading session brought declines for the stock market, with the S&P 500 index closing 0.88% lower. It was a typical sell-the-news price action following lower-than-expected consumer inflation data. But was that a change of trend or just a quick downward correction? For now, it looks like a correction, but it seems that bulls will be in a defensive stance for a while.

Although there have been no confirmed negative signals, I decided to open a speculative short position on Tuesday. Today, the market is fluctuating along that level, and I think that the position is still justified.

This morning, the S&P 500 is likely to open virtually flat after the important Producer Price Index release. The PPI number came in at +0.2%, which was slightly higher than the expected +0.1% month-over-month. Today, we also received quarterly earnings releases from big banks (JPM, WFC, C); they were generally better than expected, but stocks see some profit taking.

Investor sentiment has increased significantly, as indicated by the AAII Investor Sentiment Survey on Wednesday, which showed that 49.2% of individual investors are bullish, while only 21.7% of them are bearish.

As I mentioned in my stock price forecast for July, “While more advances remain likely, the likelihood of a deeper downward correction also rises. Overall, there have been no confirmed negative signals so far, but the May gain of 4.8% and June gain of 3.5% suggest a more cautionary approach for July (…) The market will be waiting for the quarterly earnings season in the second half of the month. Plus, there will be a series of economic data, including the CPI release on July 11, the Advance GDP number on July 25, and the FOMC Rate Decision on July 31.”

The S&P 500 index reversed from a new record high of 5,642.45 yesterday, retracing its Wednesday’s advance, as we can see on the daily chart.

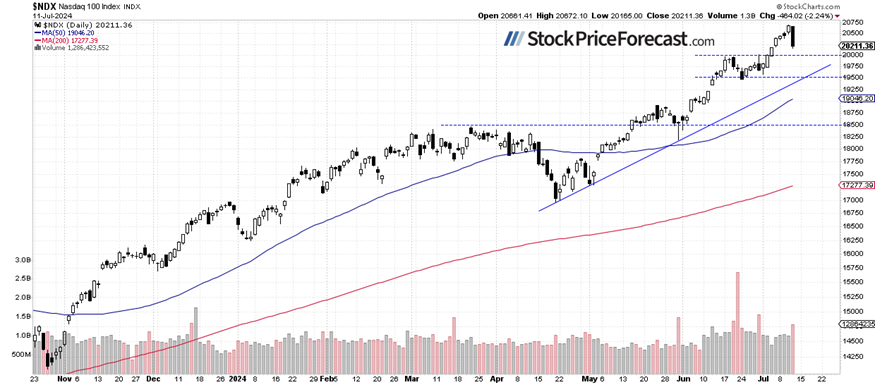

Nasdaq 100: A much bigger sell-off

The technology-focused Nasdaq 100 index closed 2.24% lower, retracing a few days of advances, led by big declines in NVDA, TSLA stocks, among others.

Yesterday, I concluded that “There are short-term overbought conditions, and the market is likely to top at some point.” It proved accurate as the Nasdaq 100 reversed sharply from its Wednesday’s record high. This morning, the Nasdaq 100 is likely to open 0.1% higher.

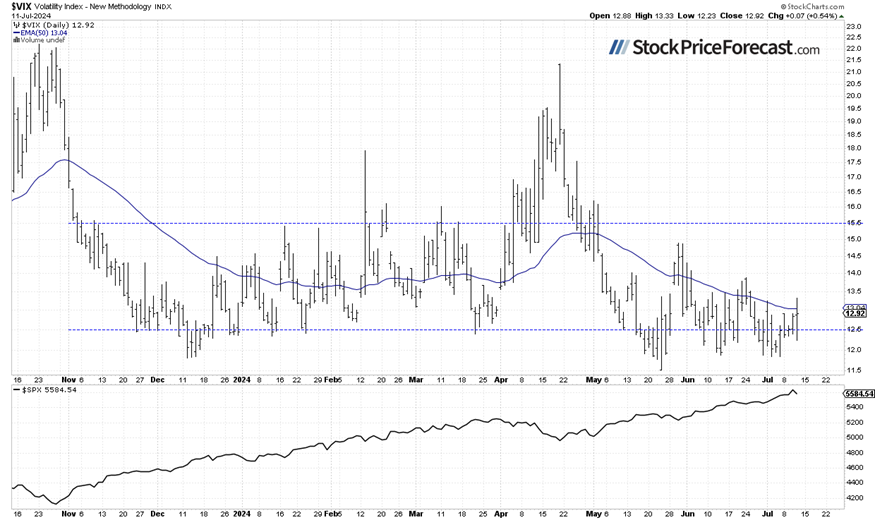

VIX remaining relatively low

The VIX index, also known as the fear gauge, is derived from option prices. Recently, it has been hovering around the 12 level, which historically is relatively low, indicating low fear in the market. Yesterday, it rebounded above 13, before closing slightly below that level.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal.

Futures contract: Sideways following PPI

Let’s take a look at the hourly chart of the S&P 500 futures contract. Yesterday’s CPI release led to a pullback from a new record high of around 5,708. The market retraced its Wednesday’s advance, and this morning, it’s trading below the 5,650 level after slightly extending its decline. The nearest important support level is at around 5,580-5,600, marked by the recent highs.

Conclusion

The PPI release didn’t lead to a big move, such as yesterday’s CPI. However, the market remained near its lows. The index is likely to open virtually flat today. The risk of a more pronounced downward correction is increasing.

Quoting my last Monday’s stock price forecast for July, “Investors continue pricing in the Fed’s monetary policy easing that is supposed to happen this year. Hence, a medium-term downward reversal still seems a less likely scenario. However, the recent record-breaking rally may be a cause for some short-term concern as a downward correction may be coming.”

For now, my short-term outlook remains bearish.

Here’s the breakdown:

-

The S&P 500 reversed lower in a sell-the-news price action yesterday; it may be the beginning of a correction.

-

Investors are waiting for the coming quarterly earnings season.

-

In my opinion, the short-term outlook is bearish.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended content

Editors’ Picks

AUD/USD hung out to dry on familiar low end

AUD/USD tried and failed to spark a bull run during the first trading session of 2025, rising on thin volumes before collapsing back into the 0.6200 handle in the later hours of the day. A broad-market push into the safe haven Greenback kept the Aussie pair on the defensive, and the AUD is mired in congestion on the weak side of two-year lows.

USD/JPY flirts with multi-month highs in the 158.00 region

The USD/JPY pair traded as high as 157.84 on Thursday, nearing the December multi-month high of 158.07. Additional gains are on the docket amid prevalent risk aversion.

Gold flat lines above $2,650 ahead of US PMI release

Gold price consolidates its gains near $2,660 after reaching a two-week high during the early Asian session on Friday. The safe-haven flows amid the geopolitical tensions provide some support to the precious metal.

Could XRP surge to new highs in January 2025? First two days of trading suggest an upside bias

Ripple's XRP is up 7% on Thursday, extending its rally that began during the New Year's Day celebration. If long-term holders continue their recent accumulation, XRP could overcome the $2.9 resistance level and aim for a new all-time high.

Three Fundamentals: Year-end flows, Jobless Claims and ISM Manufacturing PMI stand out Premium

Money managers may adjust their portfolios ahead of the year-end. Weekly US Jobless Claims serve as the first meaningful release in 2025. The ISM Manufacturing PMI provides an initial indication ahead of Nonfarm Payrolls.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.