Stocks extended their post-election rally on Friday, with the S&P 500 index setting a new record high of 6,012.45, gaining 0.38%. Although Thursday’s Federal Reserve announcement failed to sustain a rally as the market moved sideways afterward, sentiment improved on Friday. This morning, S&P 500 futures indicate a 0.4% higher open for the index, suggesting the potential for yet another record high.

Last week, the investor sentiment improved once again, as shown in the Wednesday’s AAII Investor Sentiment Survey, which reported that 41.5% of individual investors are bullish, while 27.6% of them are bearish.

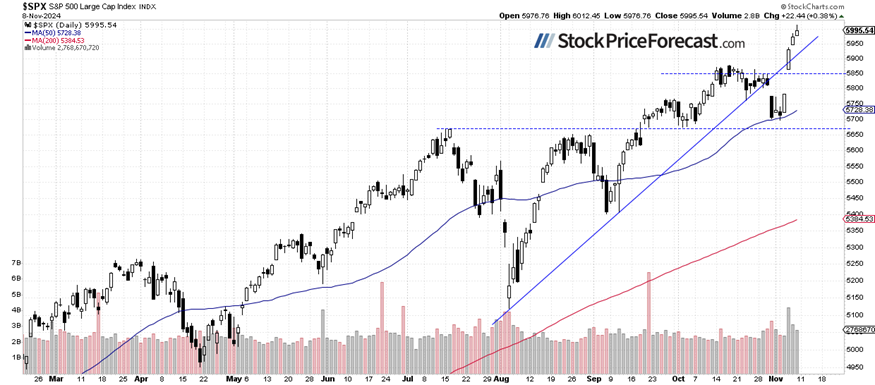

The S&P 500 continued its rally after last Tuesday’s election, as we can see on the daily chart.

S&P 500: Almost +5% in a week

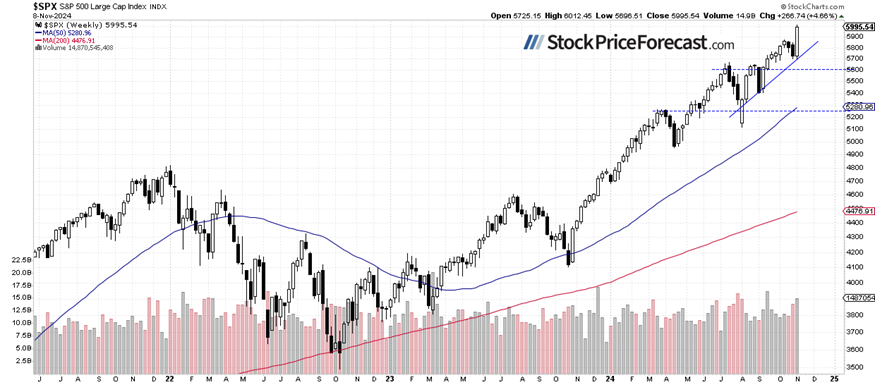

The S&P 500 surged by 4.66% compared to the prior Friday's close, reaching new record highs and extending its multi-year bull market. The key medium-term support level is now around 5,700, marked by recent lows.

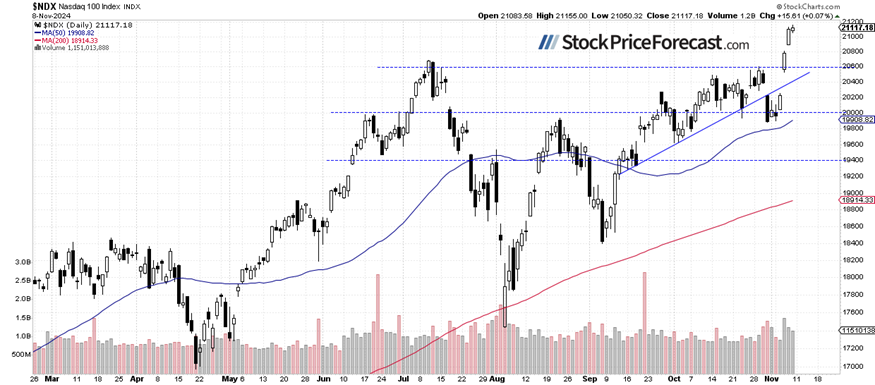

Nasdaq 100: Breaching the 21,000 level

The Nasdaq 100 gained just 0.07% on Friday, achieving a new record high of 21,155. Today, it is expected to open 0.5% higher. The index appears technically overbought in the short term and may be due for a correction or consolidation. The support level is between 20,800 and 20,900, marked by the Thursday’s gap up.

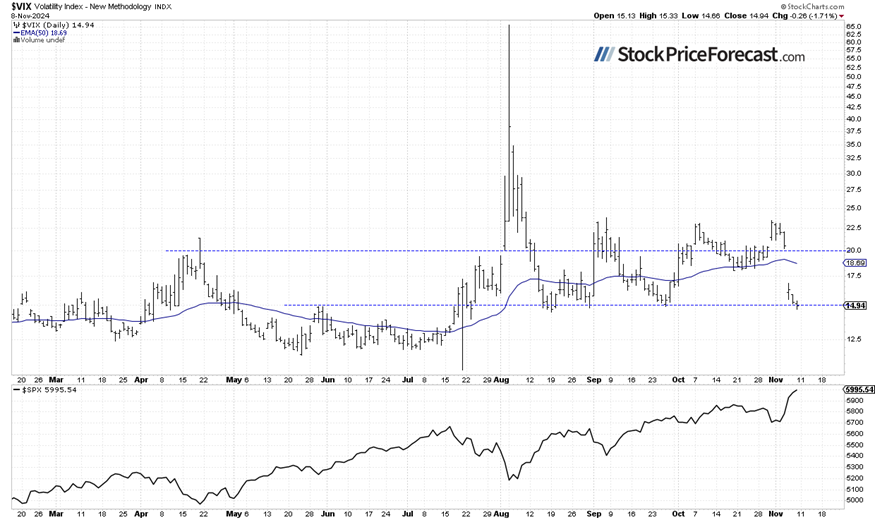

VIX remains near 15

The VIX index, a measure of market volatility, declined by over 20% last Wednesday, moving back below the 20 level and nearing the 15 level. This confirmed risk-on sentiment and a lack of fear in the market.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal. Conversely, the higher the VIX, the higher the probability of the market’s upward reversal.

Futures contract advancing beyond 6,000

The S&P 500 futures contract is approaching another new high this morning, moving slightly above the 6,050 level. Support is now at around 5,980-6,000. Although the market appears overbought in the short term, no confirmed negative signals are evident.

Conclusion

Stocks rallied last week, reaching record highs on the back of election results, bolstered by the Fed’s interest rate cut on Thursday. However, this week could see a period of increased volatility or consolidation. Despite this, no negative signals are evident. Investors will be waiting for the important Consumer Price Index release on Wednesday.

In my Stock Price Forecast for November 2024, I wrote “The key question is: Will this sell-off mark the start of a medium-term downtrend, or is it merely a downward correction within an uptrend? For now, it appears to be a correction, but next week’s presidential elections could add to volatility.”

For now, my short-term outlook is neutral.

Here’s the breakdown:

-

The S&P 500 continued its rally last week; another record-breaking advance is anticipated today.

-

A short-term consolidation may be on the horizon.

-

In my opinion, the short-term outlook is neutral.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended content

Editors’ Picks

AUD/USD: Rebound remains capped at 0.6200 despite gradual US tariff plan

AUD/USD stalls the overnight bounce to near 0.6200 despite reports of gradual Trump tariffs boost investors' sentiment and weigh on the US Dollar. Bets that the Fed will pause its rate-cutting cycle, the RBA's dovish shift, China's economic woes and geopolitical risks act, however, remain a headwind for the Aussie.

USD/JPY volatile within range below 158.00 after BoJ Himino's comments

USD/JPY is seeing a volatile Asian session below 158.00 on Tuesday, courtesy of a dovish commentary from BoJ Deputy Governor Himino as he ruled out a rate hike later this month. However, a negative sentiment on Japanese stocks and a broad US Dollar retreat drag the pair lower.

Gold price regains positive traction amid retreating US bond yields, softer USD

Gold price attracts some dip-buyers during the Asian session on Tuesday and reverses a part of the previous day's retracement slide from a one-month top. Reports that Trump's top economic advisers are mulling a slow ramp-up in tariffs to avoid a sudden spike in inflation trigger a pullback in the US bond yields, which keeps the USD bulls on the defensive and benefits the XAU/USD.

Crypto Today: BTC price plunges 4%, Litecoin X account hacked; traders position for US inflation report

The cryptocurrency sector plunged by 5% on Monday, with over $148 billion wiped off the aggregate market capitalization. Bitcoin price dropped below $90,600 for the first time in 24 days, as traders anticipate the upcoming US CPI report.

Bitcoin falls below $92,000 as exchanges show overheating conditions

Bitcoin (BTC) continues its ongoing correction, falling below $92,000 on Monday after declining almost 4% last week. CryptoQuant data shows that BTC is overheating in exchanges and suggests further decline ahead.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.