S&P 500 bounces back amid rising US Treasury bond yields, strong US Dollar

- S&P 500 and Nasdaq closed with gains of 0.40% and 0.45%, respectively, despite the Fed’s decision to hold rates and upward revised rate forecasts.

- US Treasury bond yields soared, with the 10-year benchmark note reaching a 16-year high at 4.533%.

- Energy, Materials, and Consumer Discretionary sectors were the biggest gainers.

Wall Street finished Monday’s session with solid gains, while the Greenback extended its gains to a new year-to-date (YTD) high; at the same time, US Treasury bond yields climbed.

US equities register gains despite the Federal Reserve's upward revised rate forecasts, with Energy, Materials, and Consumer Discretionary sectors leading the way

The S&P 500 registered gains of 0.40% and ended at 4,337.44, while the heavy-tech Nasdaq led US equities gains with a .45% advance, closing at 13,271.32. The Dow Jones Industrial barely missed gains and was last up 0.13%, at 34,006.88.

Sector-wise, the biggest gainers were Energy, Materials, and Consumer Discretionary, each gaining 1.28%, 0.80 %, and 0.67%. The laggards were Consumer Staples, Utilities, and Real Estate, erasing from its value 0.43%, 0.20%, and 0.17%, respectively.

Equities climbed despite last week’s US Federal Reserve’s (Fed) decision to hold rates unchanged but upward revised forecast for the following year. The Federal Fund Rates (FFR) is expected to stay above 5% for 2023 and 2024, as revealed by the latest “dot-plots.”

Therefore, US Treasury bond yields exploited to the upside, with the 10-year benchmark note touching a 16-year high at 4.533%. The Greenback followed suit, with the US Dollar Index (DXY), which tracks the buck’s performance versus six currencies, touching 106.10, a level last seen in November 2022.

Federal Reserve speakers continued to cross newswires with Austan Goolsbee from the Fed of Chicago, saying the path for a soft landing is possible, though a “lot of risks and the path is long and winding.” Last week, two Fed officials called for patience on the US central bank, Boston and San Francisco’s Fed Presidents Sussan Collins and Mary Daly.

In the meantime, Fed Governor Michelle Bowman stressed an additional rate hike is needed, maintaining her hawkish stance.

Data-wise, the US economic agenda, the Dallas Fed Manufacturing Index plunged -18.1 in September, from a -10.2 drop in August.

Gold remained pressured at around the $1,915.00 zone in the commodity space, weighed by the rise in US bond yields. WTI lost 0.50% in the day, as a strong US Dollar and Russia’s lifting fuel ban weighed on the “black gold” price, despite being underpinned by tight supplies after Saudi Arabia and Russia’s 1.3-million-barrel crude oil cut.

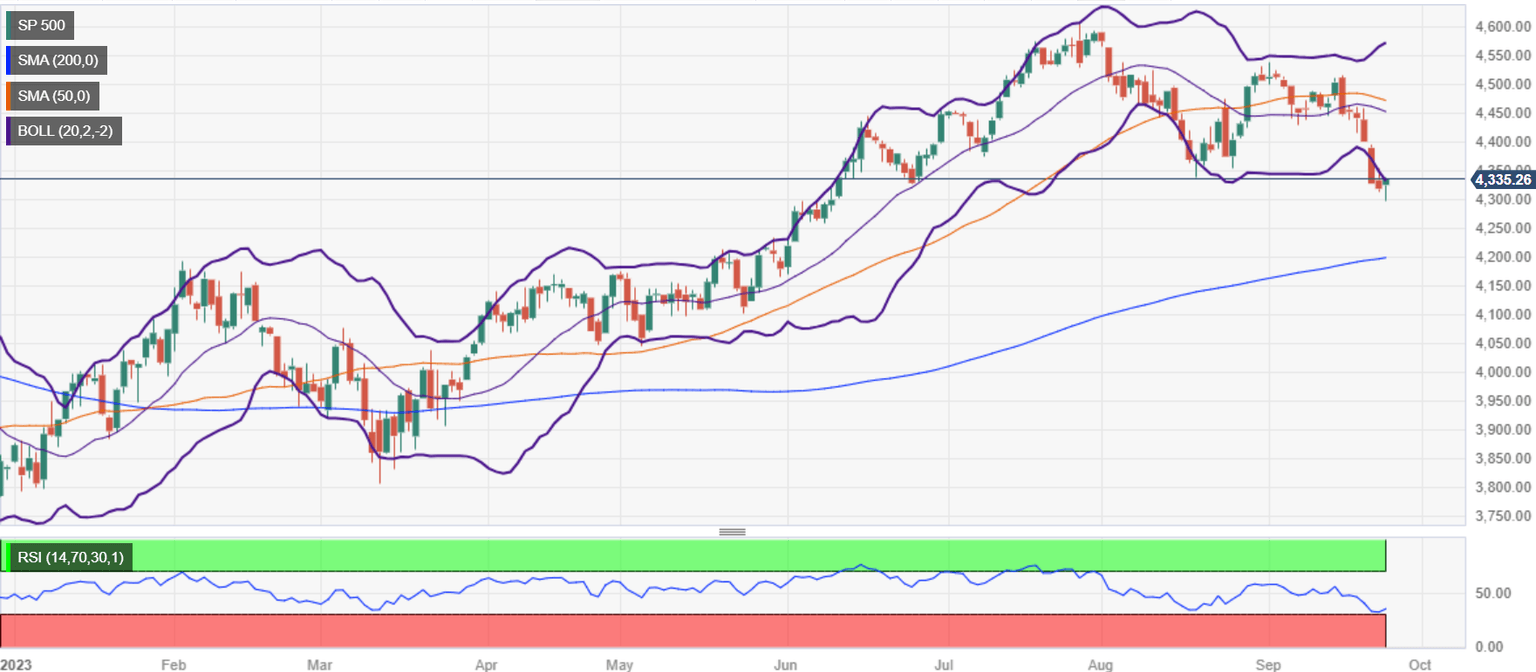

S&P 500 Price Action – Daily Chart

S&P 500 Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.