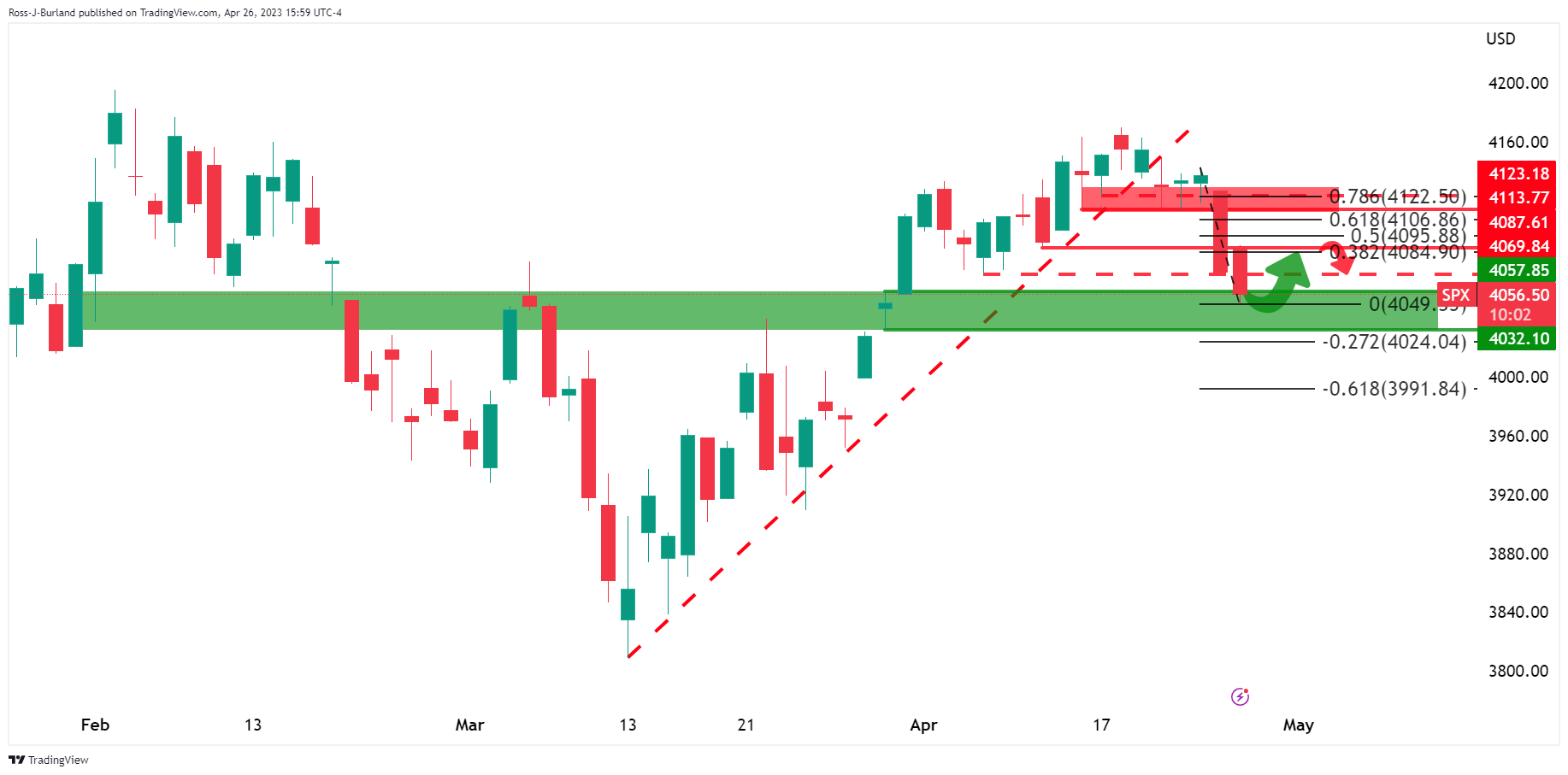

- S&P 500 index is moving into what could be a support area after breaking the structure of 4,069.

- The market will remain biased to the downside while below the 78.6% Fibonacci level and on the backside of the prior bullish trendline.

the S&P 500 dropped again on Wednesday and took out structure on the daily chart at 4,069 to print a low of 4,049.35 so far at the time of writing. The market remains offered towards the close and bears have been motivated by bank stocks which remained under pressure.

´´Support from tech stocks following Q1 earnings from Google’s parent Alphabet Inc. and Microsoft Corp. beating expectations was offset by a further 20% fall in First Republic Bank,´´ analysts at ANZ Bank explained.

First Republic Bank's shares sank more than 20%, hitting a fresh record low for the second day in a row, on a report that the US government was unwilling to engineer its rescue, after the lender reported plunging deposits earlier this week.

Analysts at ANZ bank explained that ´´the latest survey of US community banks showed that expectations of tighter regulation are now their biggest concern. If smaller banks in the US are to be regulated more tightly, that could precipitate a keener focus on bank asset quality, which amid high inflation and expected slower growth, could underpin more cautious lending behavior.´´

The analysts added that ´´it will take time to observe how behaviors are changing and the impact that can have on credit provision, but the ongoing concerns over the future of First Republic are continuing to unsettle risk.´´

Still, analysts are expecting a 3.2% contraction in first-quarter profit for S&P 500 companies compared with expectations for a 3.9% decline just a day ago, Reuters reported.

´´Of the 163 S&P 500 companies that reported first-quarter profit through Wednesday, 79.8% topped analysts' expectations, as per Refinitiv IBES data. In a typical quarter, 66% of companies beat estimates.´´

Meanwhile, the Federal Reserve's monetary policy decision on May 3 is coming up and traders will be on the lookout for clues on policymakers' next steps regarding interest rates. Traders have priced in a 79% chance of the U.S. central bank hiking rates by 25 basis points next week, as per CMEGroup's Fedwatch tool.

Elsewhere, ´´the US House of Representatives could vote as early as Wednesday on a bill that sharply cuts spending for a decade in exchange for a short-term hike in the debt ceiling, though it was unclear if it had enough support in the Republican majority to pass,´´ Reuters reported.

S&P 500 technical analysis

The daily chart shows the index moving into what could be a support area after breaking the structure of 4,069. A move back to 4,080s could be on the cards but the market will remain biased to the downside while below the 78.6% Fibonacci level and on the backside of the prior bullish trendline.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD consolidates around 0.6400; remains close to YTD top

AUD/USD holds steady around the 0.6400 mark on Friday and remains well within striking distance of the YTD peak touched earlier this week. A positive risk tone, along with the potential for a de-escalation in the US-China trade war, act as a tailwind for the Aussie amid a bank holiday in Australia and the lack of any meaningful USD buying.

USD/JPY edges higher to 143.00 mark despite strong Tokyo CPI print

USD/JPY attracts some dip-buyers following Thursday's pullback from a two-week high as hopes for an eventual US-China trade deal tempers demand for the JPY. Data released this Friday showed that core inflation in Tokyo accelerated sharply in April, bolstering bets for more rate hikes by the BoJ.

Gold price bulls seem reluctant amid the upbeat market mood

Gold price trades with positive bias for the second straight day, though it lacks bullish conviction. Hopes for a faster resolution to the US-China standoff remain supportive of a positive risk tone. Adding to this modest USD uptick caps the upside for the commodity.

TON Foundation appoints new CEO after $400M investment: Will Toncoin price reach $5 in 2025?

TON Foundation has appointed Maximilian Crown, co-founder of MoonPay, as its new CEO. Toncoin price remained muted, consolidating with a tight 2% range between $3.08 and $3.21 on Thursday.

Five fundamentals for the week: Traders confront the trade war, important surveys, key Fed speech Premium

Will the US strike a trade deal with Japan? That would be positive progress. However, recent developments are not that positive, and there's only one certainty: headlines will dominate markets. Fresh US economic data is also of interest.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.