- NYSE:SOS fell by 2.79% during Thursday’s trading session.

- Bitcoin miners slump as growth stocks tumble during a late day downturn.

- SOS is banking on its recent investment in US crypto mining locations.

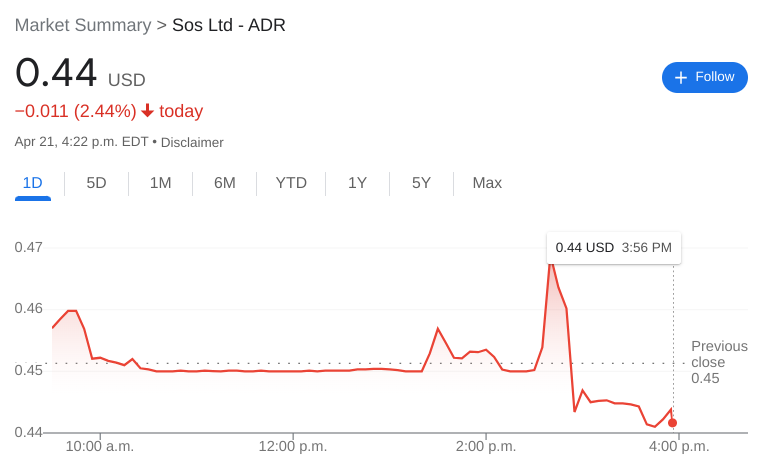

NYSE:SOS fell for the third straight day on Thursday as the broader markets continued to see downard selling pressure following a surge in the 10-year treasury yield rate. The key rate hit 2.9% on Thursday which is its highest level since 2018. Shares of SOS fell by 2.79% and closed the trading session at $0.44. The broader markets succumbed to the yield rate spike as all three major averages dropped lower into the close. The Dow Jones fell by 368 basis points, the S&P 500 lost 1.48%, and the NASDAQ plummeted by 2.07% during the session.

Stay up to speed with hot stocks' news!

As treasury yields surged on Thursday, growth sectors felt the bulk of the pressure as the NASDAQ extended its losses to nearly 17% so far this year. Bitcoin miners, like SOS, were beaten down as rivals like Ebang (NASDAQ:EBON), Canaan Inc ADR (NASDAQ:CAN), Riot Blockchain (NASDAQ:RIOT), and Marathon Digital Holdings (NASDAQ:MARA) were all trading well below water. The industry traded lower despite the price of Bitcoin rising during the session as the benchmark crypto nearly touched the $43,000 price level before falling back down to just below $41,500 at the time of this writing.

SOS stock forecast

While it’s been a tough year for SOS, the company is banking on its expansion over into the US. SOS recently established a new project in Price County, Wisconsin where it is building a Super-Computing and Hosting Center which will host over 18,500 supercomputers. It is unclear when SOS will begin to benefit from the mining activities, but needless to say, it’s a step in the right direction after China banned crypto mining earlier this year.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

USD/JPY remains below 158.00 after Japanese data

Soft US Dollar demand helps the Japanese Yen to trim part of its recent losses, with USD/JPY changing hands around 157.70. Higher than anticipated Tokyo inflation passed unnoticed.

AUD/USD weakens to near 0.6200 amid thin trading

The AUD/USD pair remains on the defensive around 0.6215 during the early Asian session on Friday. The incoming Donald Trump administration is expected to boost growth and lift inflation, supporting the US Dollar (USD). The markets are likely to be quiet ahead of next week’s New Year holiday.

Gold depreciates amid light trading, downside seems limited due to safe-haven demand

Gold edges lower amid thin trading following the Christmas holiday, trading near $2,630 during the Asian session on Friday. However, the safe-haven asset could find upward support as markets anticipate signals regarding the United States economy under the incoming Trump administration and the Fed’s interest rate outlook for 2025.

Floki DAO floats liquidity provisioning for a Floki ETP in Europe

Floki DAO — the organization that manages the memecoin Floki — has proposed allocating a portion of its treasury to an asset manager in a bid to launch an exchange-traded product (ETP) in Europe, allowing institutional investors to gain exposure to the memecoin.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.