- SOS shares soar as company says it received its first Bitcoin.

- SOS sees strong retail investor interest as Bitcoin remains bid!

- SOS says expects to mine at least 41 Bitcoins in Q1.

Update March 15: Shares in SOS surged by over 20% on Monday to $7.95 as SOS announced it had installed an extra 5,000 pieces of crypto mining rigs. SOS also said it was awarded its first Bitcoin on Feb 24 from successful mining activities. SOS said it expects to mine at least 41 bitcoins and 909 etherum in Q1 2021.

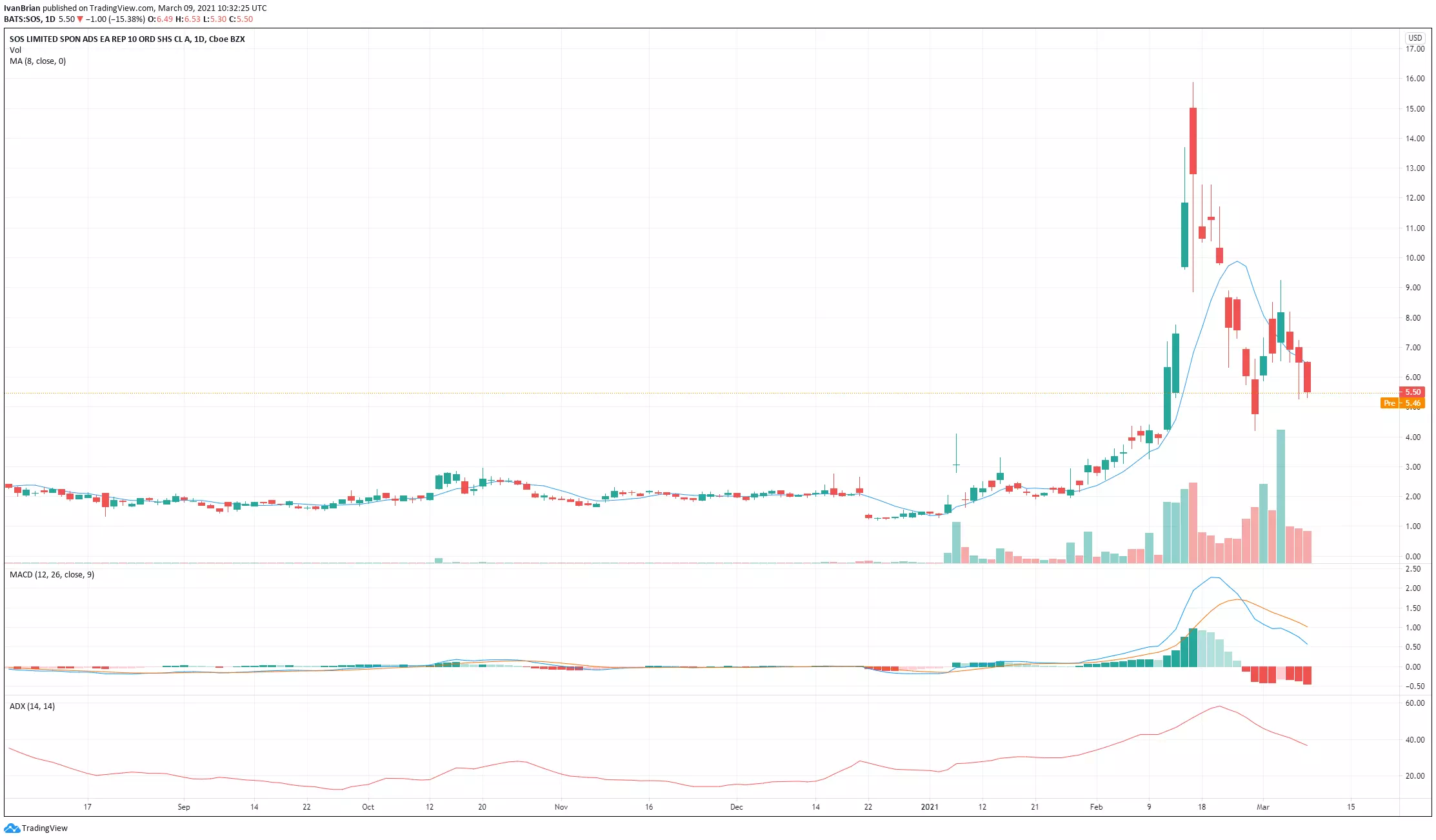

Update March 11: Shares in SOS continue to struggle, having retreated from highs of nearly $16 in February. Shares in SOS are currently trading at $6.40 up 1.2% in Thursday's regular session. SOS shares ahve taken retail investors on a volatile ride like alot of meme stocks in 2021. SOS shares are currently back ot levels seen in mid February, prior to the spike up to nearly $16.

SOS shares are taking investors on a volatile ride of late as the stock struggles for direction amid competing analysis. SOS shares closed at $5.50 on Monday for a loss of 15% but at the time of writing SOS shares are up 11% in Tuesday's pre-market, go figure!

SOS is a Chinese company involved in providing cloud-based emergency services to businesses and individuals. SOS provides information security solutions for emergency roadside assistance, emergency healthcare, and emergency living assistance. SOS also has an involvement in the cryptocurrency mining business.

Stay up to speed with hot stocks' news!

SOS Stock forecast

Ok, so we have a bit to get through here so let's dig in!

SOS shares have been strong in 2021 with a gain of 270% plus so far. The main reason for this has been the company getting involved in the cryptocurrency mining sector and blockchain.

Feb 11 saw the bullish fever really take hold as SOS Ltd jumped nearly 60%. This was likely on the back of an announcement made by SOS Ltd on February 9 that it had received five thousand pieces of mining rigs for cryptocurrency. SOS Chairman Yandai Wang commented, "we have secured supply of crypto mining equipment that is expected to generate sufficient crypto hash power to allow us to promptly capture the rising cryptocurrency price.”

On February 9 SOS shares opened at $3.80 and by February 17 they had hit a high of $17.88.

On February 12 according to Benzinga SOS priced 22 million shares at $5 to raise $110 million. Also in February on the 18th Benzinga further reported the company announced a raise of $86 million in a secondary offering of 8.6 million shares at $10 a share.

On February 24 SOS announced the second delivery of 5,000 pieces of crypto mining. During February the price of Bitcoin was appreciating sharply so this was timely news for investors.

On Feb 26 Hindenburg Research issued a bearish note saying they were short the stock "We are short $SOS, which we believe to be an obvious China-based shell game reanimating the corpse of a former China based company that earlier imploded 90% from its highs".

Culper Research also issued a note on February 26 saying "We are short SOS Ltd. (NYSE:SOS), (“SOS”, “the Company”). SOS is a China-based reverse merger which has languished since its April 2017 IPO until its torrent of crypto-related hype has taken shares up over 600% at their peak. However, we find the Company’s claims regarding its supposed cryptocurrency mining purchases and acquisitions to be extremely problematic, if not fabricated entirely. Meanwhile, insiders – including Chairman Yandai, Wang Yilin, CFO Li Sing Leung, and Jonathan Zhang – as well as the Company’s largest shareholders are already selling their shareholdings as of filings made as early as February 2 and as recently as 3 days ago. We think the ship is already sinking and there’s nothing worth saving. We’re short SOS and believe shares are worthless".

Shares in SOS Ltd fell over 20% on Feb 26 to close at $4.77

SOS Ltd issued a response to the short-sellers on March 1

"QINGDAO, China, March 1, 2021 -- SOS Limited (NYSE: SOS) (the "Company" or "SOS") was recently attacked by short sellers with distorted, misleading, and unsubstantiated claims regarding the Company. The Company also believes certain social media accounts of some Company board members may have been impersonated or disabled for short periods of time. The Company believes these attacks were purposefully designed to manipulate the price of the Company’s shares, with the aim of causing a stock price decline in order to economically benefit the short sellers, to the detriment of the Company’s public shareholders.

SOS stands behind the integrity of the Company and remains committed to maintaining transparency and the highest ethical principles. SOS reserves all rights that it may have against these short sellers and will defend itself vigorously against those behind these attacks and misleading allegations. The Company is preparing a more detailed response to the false innuendo and lies that are being spread about the Company. SOS looks forward to vigorously defending itself, addressing these matters and providing more information in the coming days".

Shares in SOS Ltd recovered sharply to close up over 40% at $6.69 on Monday, March 1.

On Wednesday, March 3 Benzinga reported that traders were circulating a bullish note on SOS issued by Scorpio VC and SOS shares duly rallied 20% to close at $8.17.

Since then SOS shares have once again slid back to trade at $5.46 at the time of writing. The reasons, as ever, can be attributed to many developments. Benzinga and Reuters carried a report on March 6 saying Hagens Berman National Trial Attorneys encourages investors in SOS to contact them.

Guo Yi of Univest Securities which has helped raise money for several Chinese crypto companies said the market has zero-tolerance toward cheating, but there's nothing improper about Chinese companies jumping on to the bitcoin bandwagon, Reuters reports.

So just a few things for investors to try to get to grips with. What to do now? Well, my head is hurting now trying to work it all out, I think it's time to sit down! This one is way too volatile for my liking, if you fancy a go please make sure you look after your risk!

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD remains subdued following China Trade Balance data

The Australian Dollar remains subdued against the US Dollar for the second consecutive day on Friday. The AUD/USD pair holds losses following the release of China's Trade Balance data. Traders shift their focus on the US Nonfarm Payrolls report later in the North American session.

USD/JPY: Japanese Yen stands firm near a multi-month high against a broadly weaker USD

The Japanese Yen continues to be underpinned by increasing bets for more BoJ rate hikes. Trade tariff jitters and the risk-off mood further seem to underpin demand for the safe-haven JPY. Expectations for further policy easing by the Fed weigh on the USD and the USD/JPY pair.

Gold price remains depressed ahead of US NFP; trade jitters to limit losses

Gold price trades with negative bias for the second straight day, though a combination of factors continues to act as a tailwind ahead of the crucial US NFP report later this Friday. Rising trade tensions continue to weigh on investors' sentiment.

Bitcoin: President Trump confirms new BTC policy, Sacks blames Democrats for 195,000 BTC sell-off

Bitcoin price dipped 5% to hit $85,000 on Monday, as skittish sentiment around US Trade policy and Non-Farm Payrolls data introduced fresh volatility ahead of the White House Crypto Summit.

Make Europe great again? Germany’s fiscal shift is redefining the European investment playbook

For years, Europe has been synonymous with slow growth, fiscal austerity, and an overreliance on monetary policy to keep its economic engine running. But a major shift is now underway. Germany, long the poster child of fiscal discipline, is cracking open the purse strings, and the ripple effects could be huge.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.