SoFi Technologies Stock Price and Forecast: Why does SOFI keep going up?

- SOFI shares give up some gains on Friday, closing down 1.2%.

- SoFi Technologies stock is closely followed by retail traders.

- SOFI only went public in June of this year.

SOFI price took a little breather on Friday as it closed down despite some strong showings from other retail names. The stock only launched on the market less than a year ago but has become a firm favourite with retail traders who like the growth story and sector the company operates in. SoFi Technologies is a financial services company that offers a number of investment and banking solutions to its clients or members. The company originated in 2011 and initially focused on the student loan business but gradually expanded to cover more of the personal financial needs of its customers. Members can avail a number of services via three distinct areas of business – lending, financial services and technology. The lending segment or platform allows members to take out personal, student or home loans, while the financial services segment is more broadly focused on protecting members' money via investments, cash management and credit card services. The company operates totally online via its mobile app and website.

SOFI launched on the stock market in June 2021 via a SPAC deal with Social Capital Hedosophia Corp V. This was a blank cheque company run by well-known investor Chamath Palihapitiya.

SOFI key statistics

| Market Cap | $15.4 billion |

| Price/Earnings | |

| Price/Sales | |

| Price/Book | 2.9 |

| Enterprise Value | $9 billion |

| Gross Margin | 40% |

| Net Margin |

-108% |

| 52 week high | $28.26 |

| 52 week low | $10.10 |

| Short Interest | 4% Refinitiv |

| Average Wall Street Rating and Price Target | Buy $24.50 |

SOFI stock news

SOFI recently announced details on its conference call and results slated for November 11. Results will be closely watched by investors, especially as Morgan Stanley only last week began coverage of SOFI stock with an overweight rating and a price target of $25. Sofi also recently completed an upsized $1.1 billion convertible note offering. This means the company has essentially borrowed money for free (zero coupon), but the holder of the convertible notes can convert into ordinary shares at a strike price of $22.41 after 2026. The current share price is lower at $19.38, so it is like a 5-year call option with a $22.41 strike.

SOFI stock forecast

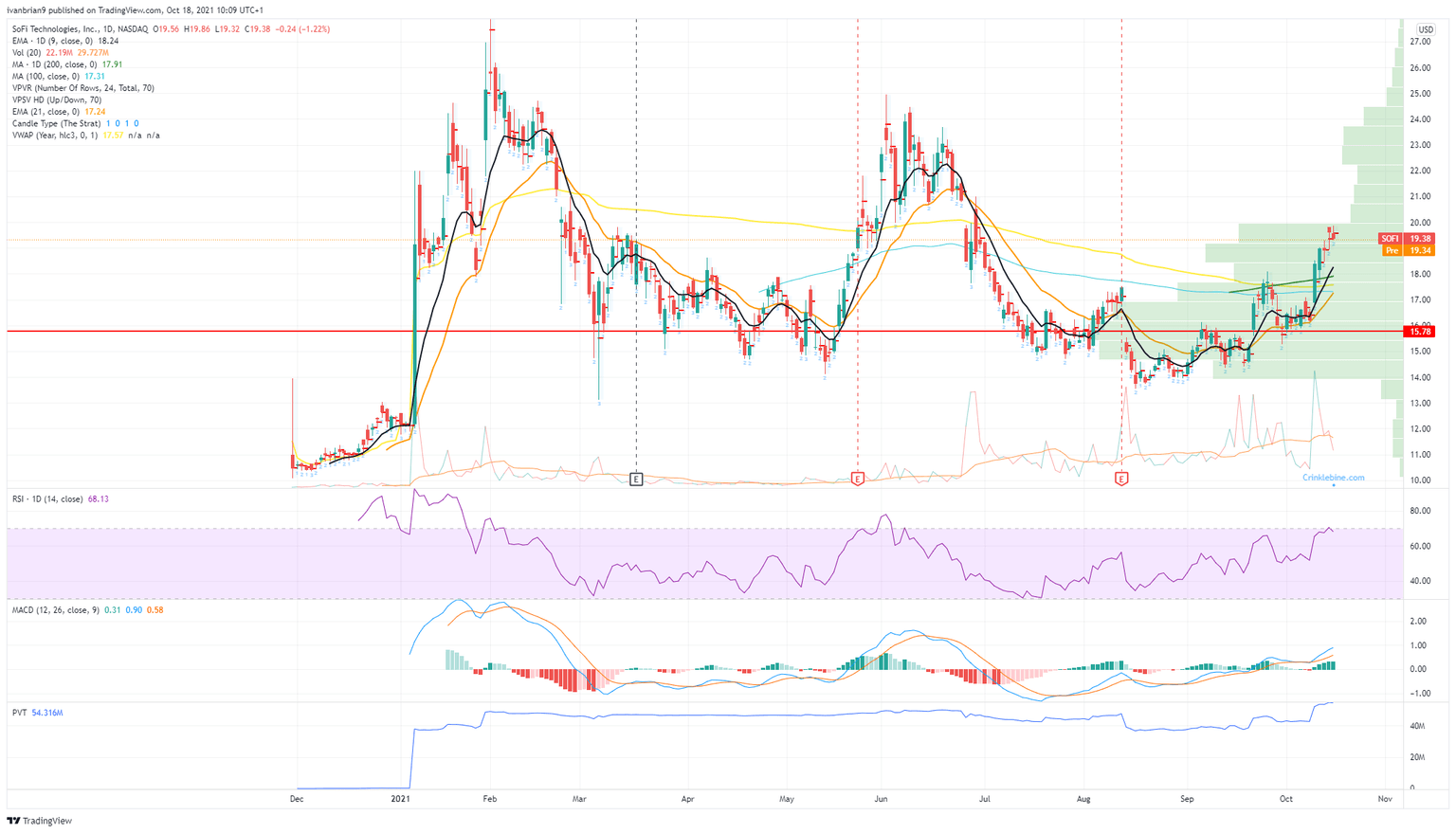

The trend is clearly upward with this one with the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) trending higher with the price. The stock is trading above the main moving averages and above the Volume Weighted Average Price (VWAP). $20 is obviously a psychological round-number resistance and the last step before SOFI gets into a low volume profile area. The move is close to overbought from the RSI, and we would not be chasing fresh longs up here. However, if you are long already, then ride the trend with a trailing stop. Support zones at $17 and $15.50 can be used for entries.

FXStreet View: Bullish, neutral below $18.

FXStreet Ideas: Entry support zones at $17 and $15.50.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.