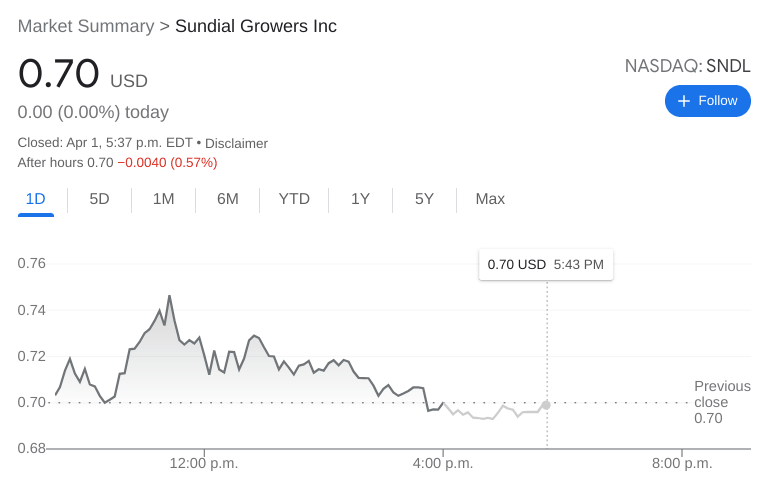

SNDL Stock Price: Sundial Growers Inc closes the week flat despite MORE Act passing

- NASDAQ:SNDL was unchanged during Friday’s trading session.

- The MORE Act passes through the House of Representatives on Friday.

- The challenge will still be making its way through the Senate.

NASDAQ:SNDL erased its early session gains once again on Friday, as the positive outcome of the MORE Act was not enough to boost the stock to a positive day. Shares of SNDL traded even and were unchanged on Friday, as shares closed the week down by 8.62%. Wall Street kicked off the second quarter of 2022 in the green as all three major indices closed the session higher. It was a nice start to April, although stock pared their gains by the closing bell. The Dow Jones added 139 basis points, the S&P 500 gained 0.34%, and the NASDAQ climbed by 0.29% during the session.

Stay up to speed with hot stocks' news!

The major news in the cannabis industry on Friday was that the MORE Act vote passed in the House of Representatives. This was somewhat of an expected outcome, especially as the bill received mostly bipartisan support earlier in the week. While most would view this as a positive result, cannabis investors were clearly not as bullish. Most stocks in the sector traded lower during Friday’s session, including industry leaders like Tilray (NASDAQ:TLRY), Canopy Growth (NASDAQ:CGC), and Aurora Cannabis (NASDAQ:ACB). The sector also posted a loss for the week, despite the news.

SNDL stock forecast

While the vote passing in the House of Representatives is a net positive, the true challenge for the MORE Act will be successfully making its way through the Senate. Investors have been reminded over and over again that this exact situation happened in 2020, where the Senate ultimately struck the bill down. The sentiment on Wall Street is the situation might not be any different this time around.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet