SNDL Stock Forecast: Sundial Growers sinks after news it is acquiring the Valens Company

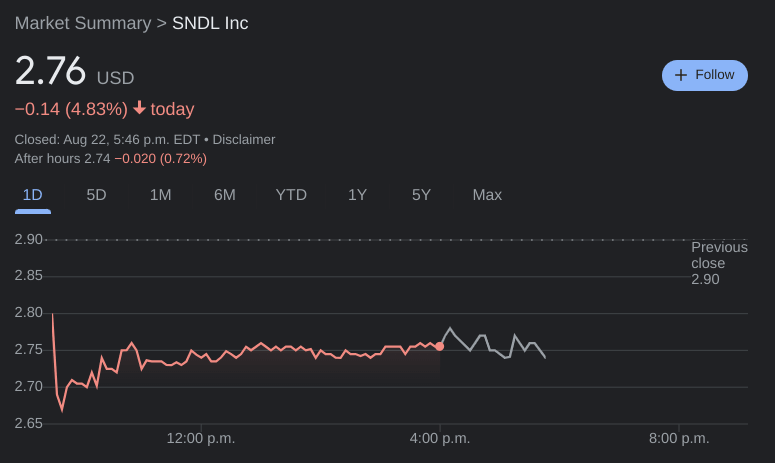

- NASDAQ:SNDL fell by 4.83% during Monday’s trading session.

- Sundial announces it is set to acquire the remaining share of the Valens Company.

- Shareholders aren’t too impressed with the acquisition for Sundial.

NASDAQ:SNDL started the week off in the same way that most stocks were trading: well into the red and below water. On Monday, shares of SNDL dropped by a further 4.83% and closed the trading session at a price of $2.76. All three major indices tumbled on Monday as investors are clearly apprehensive ahead of the key Fed speech from the Jackson Hole Symposium later this week. Overall, the Dow Jones dropped by 643 basis points, the S&P 500 sank by 2.14%, and the NASDAQ posted a loss of 2.55%. It was the worst trading session for US stocks since June.

Stay up to speed with hot stocks' news!

It wasn’t just a market sell off that had shares of Sundial plummeting though. The company announced that it is purchasing the remaining stake of the Valens Company (TSE:VLNS), a Canadian-based cannabis rival. Sundial already owned a 10% stake in the company, and is now set to take over all of its operations. Sundial’s stock was down by more than 10% at one point during intraday trading, and shares of Valens which trades on the Toronto Stock Exchange closed the day down by 14.40% in Canada.

SNDL stock price

Shareholders of Sundial clearly weren’t impressed by the announcement. In its time of owning its stake in Valens, the investment hasn’t seen Sundial reap many rewards as of yet. Investors are also likely getting impatient with Sundial after several acquisitions over the past couple of years that have not borne any meaningful returns for the stock. On top of that, Sundial is coming off of its recent reverse stock split, which has certainly further upset its loyal shareholders.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet