- Sundial Growers Inc (SNDL) announces a joint venture with SAF Group.

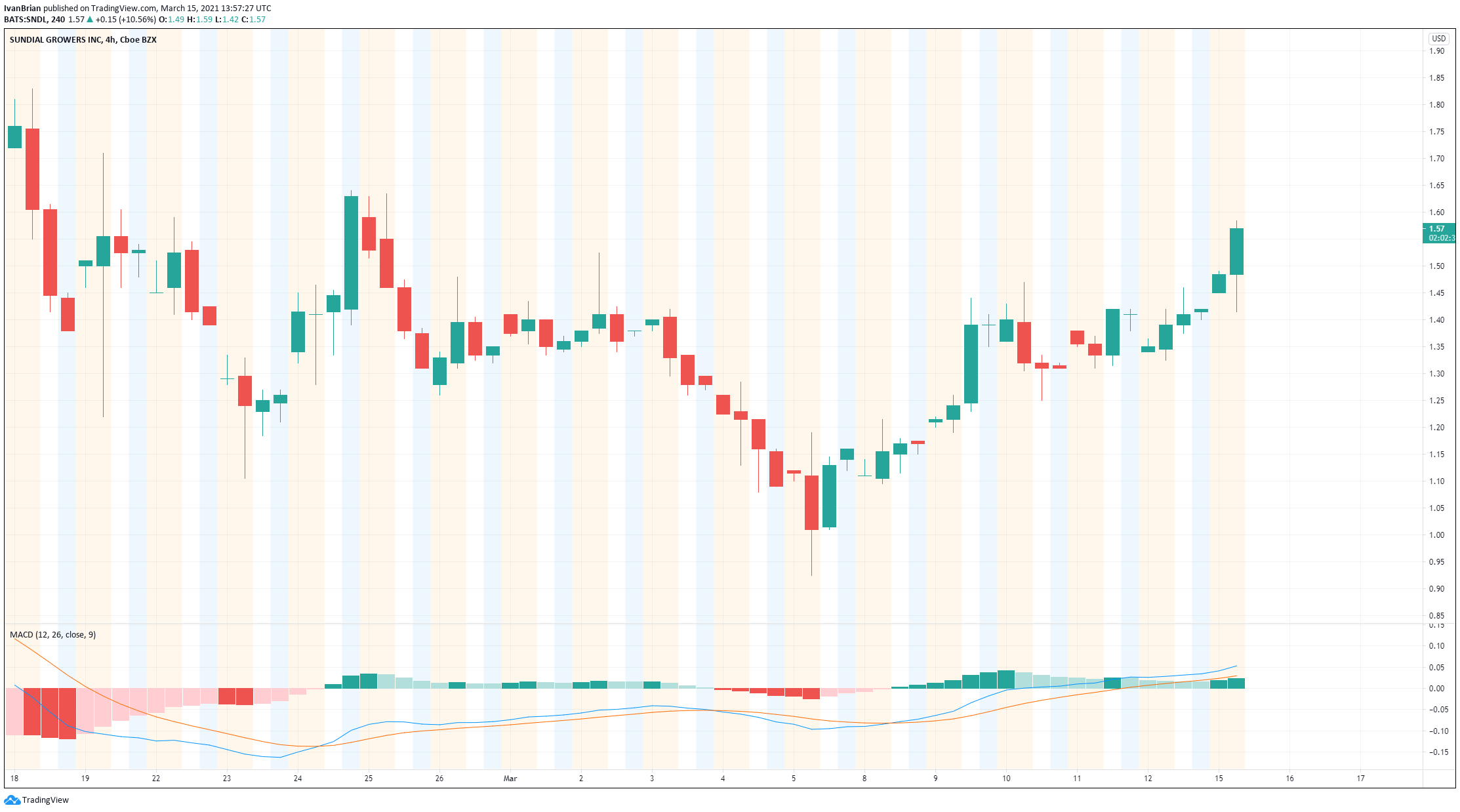

- SNDL shares up nearly 15% on Monday and up again on Tuesday.

- Sundial (SNDL) results released on Wednesday, conference call Thursday.

Update March 17: Sundial Growers Inc (NASDAQ: SNDL) has closed Tuesday's session with a fall of 6.8% to close at $1.51 – and additional declines are in the pipeline. According to Wednesday's premarket data, another fall of 4.6% to $1.44 is on the cards. The Calgary-based weed stock is suffering from profit-taking after news of the joint venture with the SAF Group seems to be fully priced. However, prospects for Sundial may still seem sunny to some – bargain-seeker with munchies for more may grab shares at these lower prices.

Sundial Growers Inc and SAF Opportunities LP (part of SAF Group) have announced on Monday that they are to enter into a 50/50 joint venture, setting up a new corporation called SunStream Bancorp Inc.

Sundial is a Canadian cannabis company headquartered in Alberta, listed on the Nasdaq.

Stay up to speed with hot stocks' news!

Sundial (SNDL) Stock news

Sundial has announced it is to form a 50/50 joint venture with SAF Opportunities LP (part of SAF Group). According to the statement released by Sundial earlier on Monday, the JV will look to generate opportunities in the cannabis industry.

Most catching for retail investors is the venture could lead to the formation of a special opportunities fund with a potential Canadian SPAC in the pipeline. As we know from the Churchill Lucid SPAC deal, retail investor interest in the SPAC sector is currently at a fever pitch and this development from Sundial will likely find favour with retail investors.

Sundial Growers is already trending heavily on social media sites discussing the stock market.

"Following early success with our internal capital investment program, we are pleased to announce this new partnership with SAF, as we continue to identify innovative ways to deliver on our commitment to shareholder value creation," said Zach George, Chief Executive Officer for Sundial. "SunStream will enable Sundial to remain focused on our core operations, while leveraging the strength of SAF's private equity and credit investment expertise on a global scale. We look forward to working together to generate attractive returns for our stakeholders through broader capital deployment opportunities in the global cannabis market."

"Our joint venture with Sundial is a capital efficient way to bolster our participation in the fast-growing and attractive global cannabis industry," said Ryan Dunfield, Principal and Chief Executive Officer of SAF Group. "This long-term partnership aligns us with a premier cannabis licensed producer, while bringing financial benefits to our investors."

Sundial has been raising and spending cash. On February 4 SNDL announced the closing of a registered offering, "Sundial's gross proceeds from the offering were approximately US$74.5 million, before deducting underwriting discounts and estimated offering expenses. Following the closing of the offering, Sundial has unrestricted cash of approximately $610 million, in addition to marketable securities and loans receivable of approximately $61 million, and approximately 1.56 billion common shares outstanding".

This marks a remarkable improvement from 2020. On December 21 2020 SNDL announced it had become debt-free, "While many cannabis companies have significant debt burdens, Sundial is proud to announce that we are now debt-free," said Zach George, Sundial's CEO.

SNDL Forecast

Sundial Growers Inc (SNDL) will release Q4 earnings on March 17, 2021. Sundial results for Q3 2020 showed an EPS loss of $0.09 which was 71 cents higher than Q3 2019 and ahead of estimates for an $0.11 loss. Revenue was $9.85 million, expectations had been for revenue of $16.89 million. Earnings data from Refinitiv, Refinitv states converted from CAD$ to US$.

Recent capital raises while boosting SNDL's cash position, have been dilutive. On Dec 21, 2020, Sundial said it had 840 million shares outstanding and by February 4 2021 it said it had 1.56 billion shares outstanding.

Sundial reports unless otherwise stated in Canadian dollars so caution needs to be taken around $ symbols used.

Previous updates

Update: Sundial (SNDL) shares are up 7% now during Monday's first half as news is digested of the joint venture with SAF Group. SNDL shares are trading at $1.52. Sundial is to release results on Wednesday with a conference call on Thursday to discuss those results.

Update March 16: Sundial Growers (SNDL) continues to probe higher on Tuesday after the positive reaction to Monday's SAF Group joint venture. SNDL shares closed 14% higher on Monday and are 1.5% on Tuesday at $1.64. Sundial (SNDL) results are due tomorrow March 17 with a conference call on March 18.

Update: Sundial Growers Inc (NASDAQ: SNDL) has jumped by 14% on Monday – and more may be in store. According to Tuesday's premarket data, shares of the Canadian cannabis company are set to leap by another 14.8% to $1.86 – thus hitting the highest in a month. As described below, the primary push for the pot stock comes from a joint venture that may be beneficial for the firm.

Every effort has been made to accurately report the appropriate dollar currency US$ or CAD$. But readers must exercise caution as Sundial is a Canadian company reporting in CAD, listed in the US Nasdaq exchange, but news providers typically convert into $US for earnings comparisons. In some cases, it is not clear in reports from news providers and Sundial which dollar CAD or US is being reported as just the $ symbol is used. For the most part, Sundial does specify CAD$ in press releases unless otherwise stated and this assumption is used in statements above re cash reserves.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD consolidates gains below 1.1400 on weaker US Dollar

EUR/USD consolidates its recovery gains below 1.1400 in early Europe on Monday. Upbeat risk sentiment on Trump's tairff concession news fails to lift the US Dollar, supporting the pair. US-China trade headlines will continue to dominate ahead of Fedspeak.

GBP/USD holds above 1.3100 as USD sellers refuse to give up

GBP/USD preserves its bullish momentum and regains the 1.3100 mark in the European morning on Monday. The sustained US Dollar weakness suggests that the path of least resistance for the pair remains to the upside. US-China trade updates remain in focus.

Gold price extends its consolidative price move near record high; rising US-China trade tensions favor bulls

Gold price trades with a mild negative bias just below a fresh all-time peak touched during the Asian session on Monday as bulls pause for a breather amid slightly overbought conditions on the daily chart. Furthermore, a further recovery in the global risk sentiment contributes to capping the upside for the commodity.

TRUMP token leads $906 million in unlocks this week with over $330 million release

According to Tokenomist, 15 altcoins will unlock more than $5 million each in the next 7 days. Wu Blockchain data shows that the total unlocked value exceeds $906 million, of which the TRUMP token will unlock more than $330 million.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.