- SNAP shares are weaker on Monday after a surge on Friday.

- Investors SNAP up shares after solid results on Thursday.

- Morgan Stanley adds to the recent upgrades for SNAP.

Update: Shares in SNAP were softer in early trading on Monday after the stock surged 9% higher on Friday. The catalyst had been the solid results released by SNAP on Thursday. Analysts upgraded the company following the release of results and this trend continued on Monday with Morgan Stanley raising its price target to $50. At the time of writing, shares in SNAPare trading at $62.45, down 1.7%.

SNAP is Snapchat, the eponymous social media upstart beloved of millennials, Generation Z! Snapchat is a WhatsApp, Instagram and Facebook competitor and has been growing steadily under the radar of its bigger competitors. Snapchat has nearly 300 million daily active users and generates most of its revenue from advertising.

SNAP Stock Forecast

SNAP reported fourth-quarter results last Thursday. Results were positive, beating analyst expectations. Earnings per share (EPS) came in at $0.09 versus Wall Street expecting $0.07. Revenue was $911 million ahead of analyst expectations for $857 million. Revenue gained 62% year on year, daily active users jumped to 265 million, a gain of 22% on the year.

Snapchat (SNAP) also guided revenue to climb to $720-$740 million for Q1 2021. SNAP said it is to strengthen its advertising to help further monetize the app.

Analysts and investors SNAP it up!

Investors clearly liked what they saw as shares in SNAP climbed 9% on Friday to close out the week at $63.64.

Analysts also liked the announcement with multiple upgrades coming though from Wall Street firms on Friday.

Rosenblatt increased its price target to $70, KeyBanc increased its price target to $63. Needham and Raymond James maintained their hold and market perform rating respectively.

Pandemic boom, privacy concerns

SNAP appears to be riding the pandemic induced communication boom well with CEO Evan Spiegel saying “Our team has worked tirelessly to help people stay close with their friends and family even while they are physically apart, and we're proud of the strong results we delivered for our advertising partners this quarter and over the full year.”

The only caveat is the increasing user attention on privacy concerns. This increased privacy awareness could “present another risk of interruption to demand”, according to SNAP CFO Derek Anderson.

SNAP Technical analysis

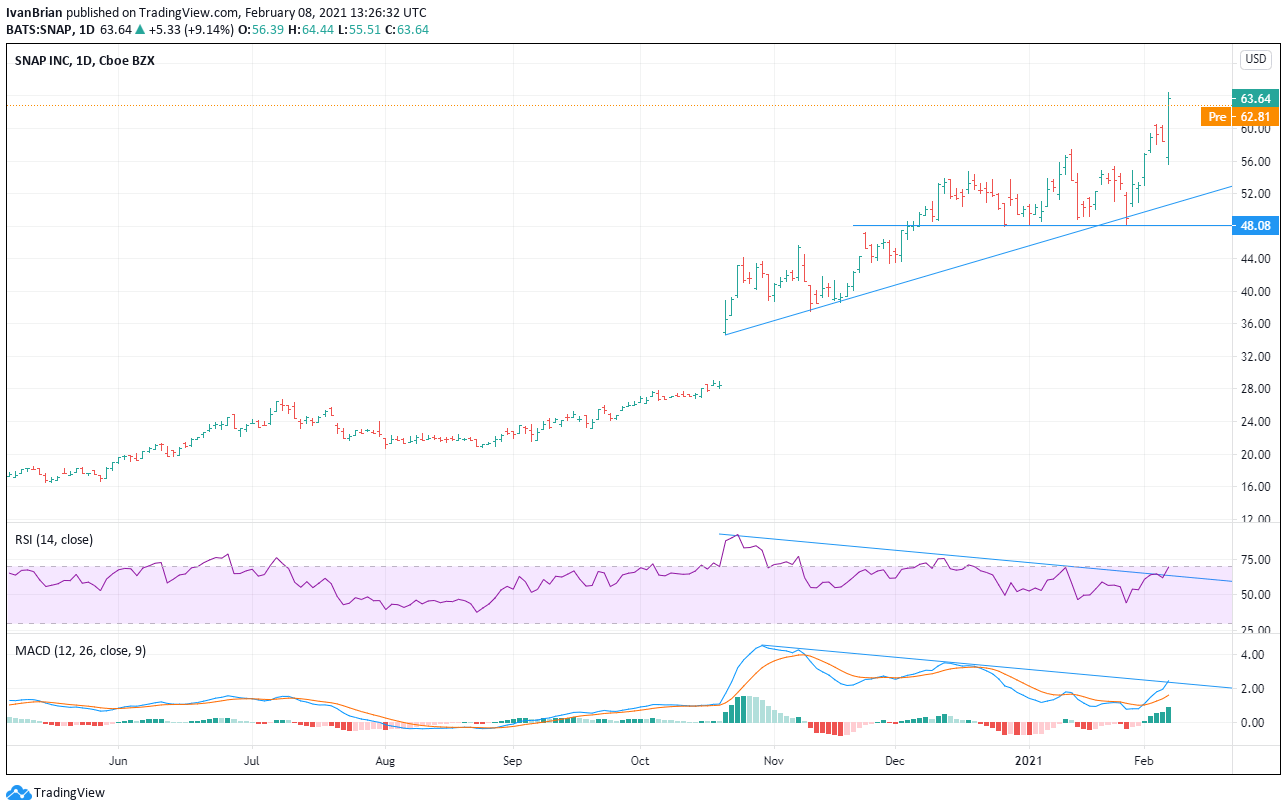

SNAP is clearly in a powerful bullish trend with new record highs on Friday. Key support for this trend continuance is at $48.08, the last major low. RSI and MACD have both just broken downtrend lines. MACD has crossed the signal line on Feb 1 to confirm the start of the bullish move.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD drops back to 0.6200 despite strong Chinese data

AUD/USD returns to the red at around 0.6200 early Friday. The Aussie fails to sustain stronger-than-expected China's growth and activity data-led upswing as the RBA's dovish shift and looming Trump's tariff plans remain a drag.

EUR/USD: Trump round two and what it means for EUR/USD

A hawkish Federal Reserve and a dovish European Central Bank put pressure on EUR/USD. US President-elect Donald Trump’s policies set to overshadow macroeconomic releases. EUR/USD set to pierce the year low at 1.0177 and test parity in the upcoming days.

Gold: Weaker US Dollar keeps buyers hungry for the precious metal Premium

The corrective move in Gold remained well in place for yet another week, this time surpassing the $2,720 mark per troy ounce for the first time since mid-December, where an initial resistance zone appears to have emerged.

Week ahead: Markets on edge as Trump’s inauguration and BoJ decision loom

Markets brace for impact ahead of Trump’s inauguration. BoJ seen raising rates at first gathering of 2025. Euro and Pound traders turn gaze to PMIs. Canada and New Zealand CPI data to shape BoC and RBNZ bets. World Economic Forum in Davos also in focus.

Five keys to trading Trump 2.0 with Gold, Stocks and the US Dollar Premium

Donald Trump returns to the White House, which impacts the trading environment. An immediate impact on market reaction functions, tariff talk and regulation will be seen. Tax cuts and the fate of the Federal Reserve will be in the background.

Trusted Broker Reviews for Smarter Trading

VERIFIED Discover in-depth reviews of reliable brokers. Compare features like spreads, leverage, and platforms. Find the perfect fit for your trading style, from CFDs to Forex pairs like EUR/USD and Gold.