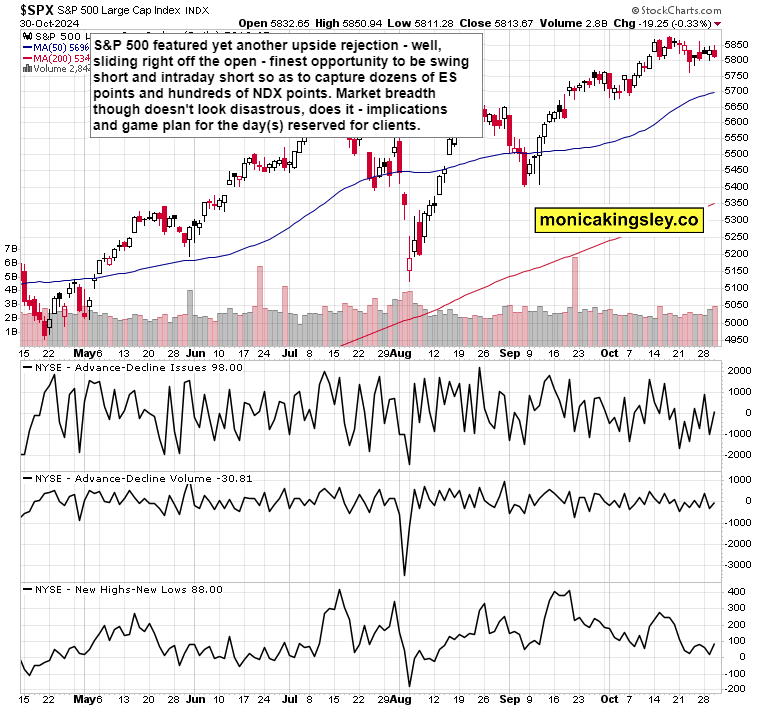

Slide was to come

And it just may not be over, or is it? S&P 500 was lifted by earlier GOOGL earnings, AMD underwhelmed on cash flow generation, and I was bearish given the high expectations and valuations of MSFT and META. That‘s similar to my last week‘s warnings regarding XLI, XLRE and ITB.

Correct bearish positioning brought immense gains for clients, both swing and intraday – over 300 NDX points and over 50 ES points gained. What‘s been different lately, is distinct selling into the closing bell, and selling of very decent earnings MSFT and META, which is what I warned about yesterday. Pre-elections positioning snapping back, such was the theme I chose to hammer yesterday – and you see in the below snapshot from our intraday channel as well that my commentary on individual megacaps performance highlights the shifting sentiment before the all-important next week. Today‘s data also point to no recession ahead, coming in decent.

Give yourself a gift of premium real-time and in-depth knowledge coupled with messaging me quickly over Telegram if need be – the options market remains quiet while bonds show we‘re at crossroads as yields have paused their ascent in the short run. Enjoy as well the S&P 500 chart.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.