Silver price rallies on bullish long-term fundamentals

- Silver nears the top of a range as the bulls push prices higher.

- Long-term fundamentals support, including positive global growth and robust demand.

- US Industrial Production data beats to the upside suggesting increased demand by industry.

Silver price (XAG/USD) pushes higher, trading up over one and a half percentage points in the $25.20s on Friday, on technical buying mainly – and long-term bullish fundamentals.

The precious metal, which is used in industrial processes as well as to store value, sees gains after the release of US Industrial Production data beat estimates with a 0.1% rise in February when economists had expected flat growth. The data, released by the US Federal Reserve (Fed), was also an improvement on the negative 0.5% of the previous month.

A positive outlook for global growth has led analysts such as Macquarie's Marcus Garvey to speculate Silver could be in for more gains as demand increases for its use in the manufacture of Solar Panels, a wide variety of electronic devices and jewelry.

Recent higher-than-expected inflation data from the US has failed to dissuade Silver bulls, despite the data pointing to further delays before the Federal Reserve pushes the button on cutting interest-rates. Usually a higher interest rate outlook would be bearish for Silver in its role as an investment since it is non-yielding so loses out in a high inflation environment, however, this has not been the case this time.

The Silver Institute, a not-for-profit organization based in the US, has forecast robust demand for Silver in 2024, predicting it will see its second best year on record with demand rising to 1.2 billion ounces.

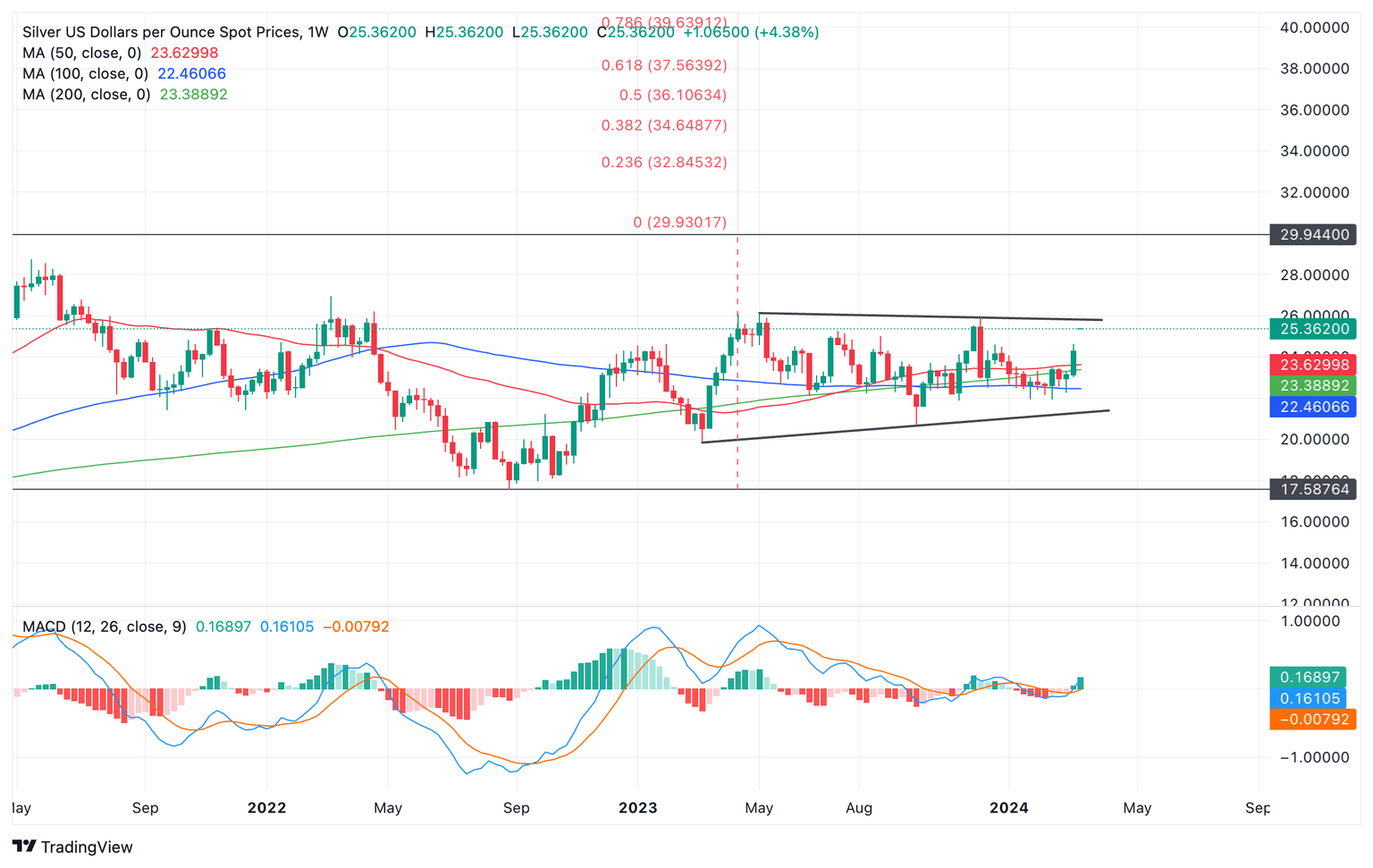

From a technical perspective, XAG/USD remains stuck in a range between $19.00 and $26.00 (thick lines), which itself sits within a broader range between $17.50 and $30.00.

It is rallying in a short-term bullish uptrend within its ranges, and is now quite near the narrower range’s highs. A decisive break above $25.85 would probably indicate a breakout to the upside, further increasing bullish enthusiasm.

Such a breakout would probably see Silver rally to between around $29.50, if using the 0.618 Fibonacci ratio of the range, or just shy of $32.00 if extrapolating the full height of the range higher.

Silver versus US Dollars: Weekly chart

If the latter, then it will mean the pair has also broken out of the top of the broader range, indicating even greater upside, potentially to a target at $37.50.

Alternatively the precious metal could meet tough resistance at the range highs in the $25.80-90s and pullback down.

Traders should watch for a decisive break higher before jumping in. A “decisive” break is one characterized by a long green daily candle piercing clearly above the level and closing near its high, or three green candles in a row, breaching the level.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.