Silver Price Forecast: XAG/USD struggles at $24.00 as traders book profits amid tensions in Ukraine

- Silver retreats from weekly tops around $24.00 as the Russian President recognize Donetsk and Luhansk as independent states.

- The white-metal falls despite a weaker US dollar across the board.

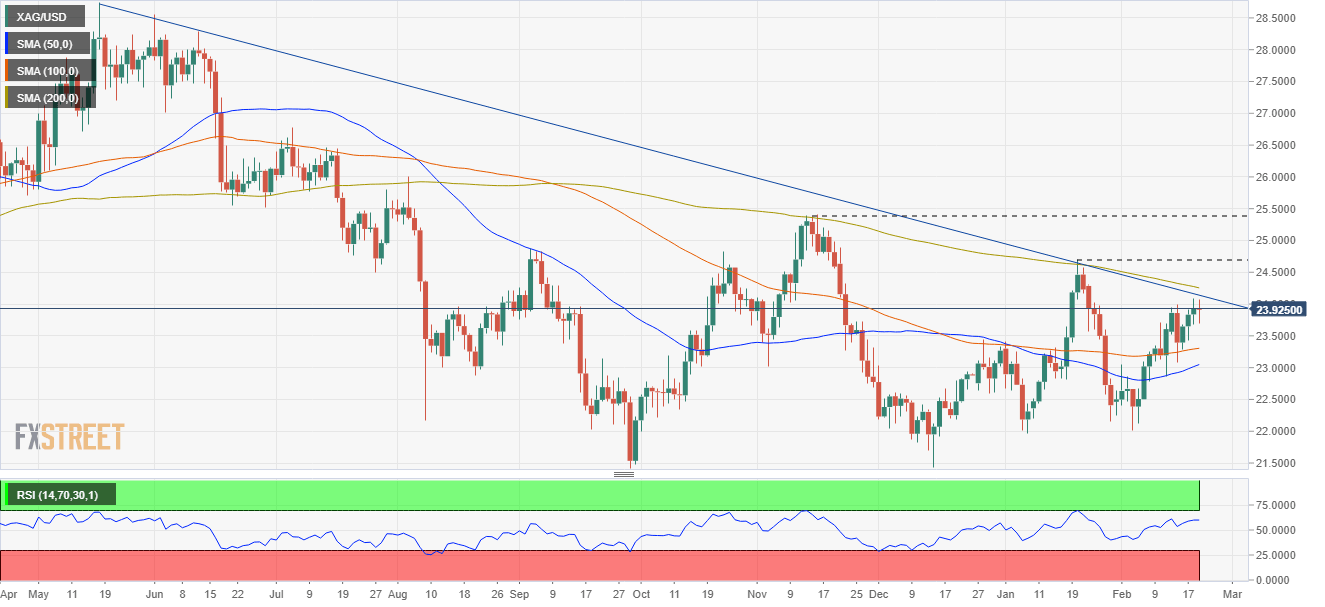

- XAG/USD Technical Outlook: Faces strong resistance around $24.00-$24.25 area.

Silver (XAG/USD) retreats from $24.00 despite growing concerns in geopolitical jitters in Eastern Europe. At the time of writing, XAG/USD is trading at $23.90.

Russia’s signed a decree recognizing Donetsk and Luhansk as independent states

War concerns between Russia and Ukraine increase. In the last couple of hours, amid a US bank holiday, the conflict in Eastern Europe grabs all the attention. Leaders from two Eastern Ukraine separatist regions urged Russian President Vladimir Putin, who, at 18:00 GMT, signed a decree recognizing them as independent states.

That said, the XAG/USD barely blinked at the reaction of the headline crossing the wires, steady around the $23.80 region.

During the overnight session for North American traders, the white metal failed to gain acceptance above the $24.00 mark, protected above by a ten-month-old downslope trendline and the 200-day moving average (DMA) at $24.25. It is worth noting that based on the price action, the $0,15 mean reversion move could be attributed to profit-taking, as the non-yielding metal, as shown by the 1-hour chart, stalled at the 50-hour moving average (HMA) around $23.86.

XAG/USD Price Forecast: Technical outlook

XAG/USD is neutral biased, depicted by the daily chart. The shorter time-frame daily moving averages (DMAs) reside below the spot price, indicating that XAG/USD aims upward. However, the presence of a ten-month-old trendline around the $24.00 mark, alongside the 200-DMA at $24.25, would be crucial resistance levels to overcome for XAG bulls if they would like to aim higher.

At press time, XAG/USD first resistance would be $24.00. Once cleared, it would expose the 200-DMA at $24.25. Breach of the latter would pave the way towards last year’s November 16 daily high at $25.40.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.