Silver Price Forecast: XAG/USD retreats from YTD highs but braces to $26.00

- Silver’s appetite decreased as investors sought higher returns on an upbeat market mood.

- US Treasury yields rise, a headwind for the white metal.

- XAG/USD Technical Outlook: Still upward biased, despite the correction to the $25.60 area.

Silver (XAG/USD) retreats from eight-month-old highs near the $27.00 mark due to market players’ increase of risk appetite, spurred in part by Ukraine’s openness to discuss Russia’s demand for neutrality. At the time of writing, XAG/USD is trading at $26.13 during the North American session.

European and US equity markets lick their wounds and rise sharply as dip buyers snap a four-day sell-off, as Russia-Ukraine hostilities appear to diminish some, decreasing appetite for safe-haven assets, a reason why silver is down.

The greenback is trading softer in the US, with the US Dollar Index plummeting 0.90%, sitting near the 98.00 mark, while US Treasury yields rise, with the 10-year T-note up five basis points, at 1.922%, a headwind for the white metal.

Russia – Ukraine update

The Russia-Ukraine conflict appears to be finding a way out. On Tuesday, Ukraine’s President Volodymyr Zelensky said that Ukraine is not pushing for membership with NATO. He is open for talks with Russia as long as it’s given security guarantees. On Wednesday, Ukrainian President Deputy Chief of Staff Zhovkva said that “Ukraine is ready for a diplomatic solution” and added that Ukraine wouldn’t trade a “single inch” of its territory.

Aside from this, an absent US economic docket and the Federal Reserve blackout would keep silver traders adrift on pure market plays. Nevertheless, on Thursday, the US docket would feature the Consumer Price Index (CPI) for February, alongside Core CPI, just five days before Fed’s March meeting.

Money markets futures have priced in a 25 bps rate hike in March, while the chances of a 50 bps hike are less than 2%. For December of 2022, market players expect the Federal Funds Rate (FFR) to sit at 1.50%, meaning that investors expect at least six hikes of a quarter bps for the rest of the year.

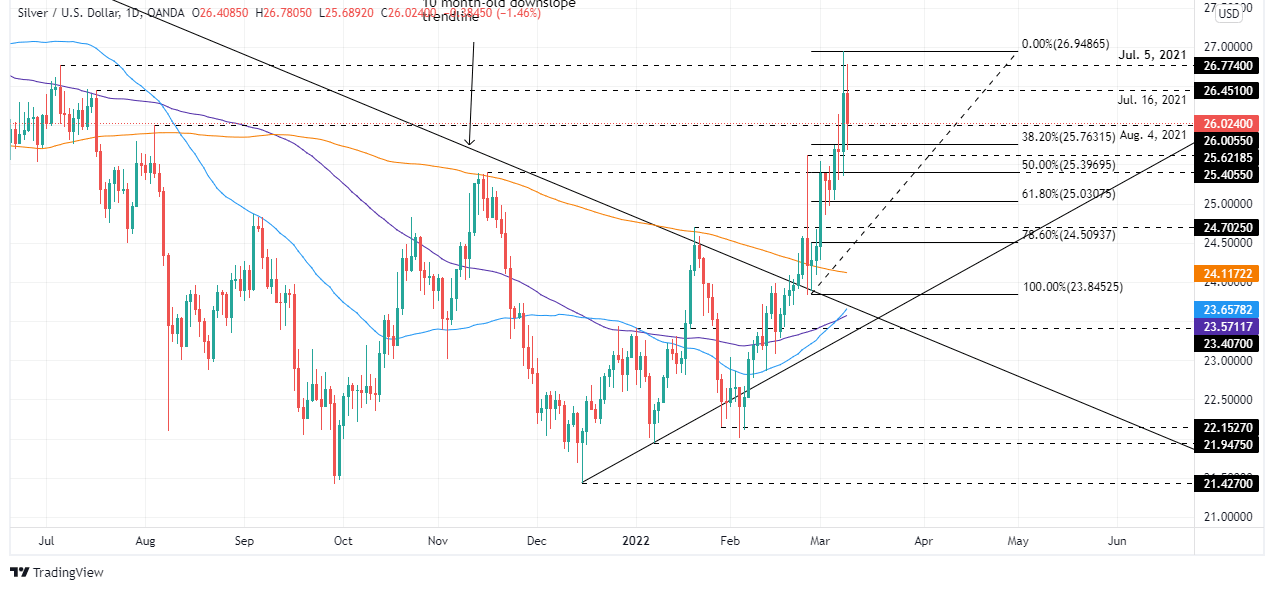

XAG/USD Price Forecast: Technical outlook

XAG/USD’s despite falling is upward biased. In fact, Wednesday’s dip near $25.62 February 24 daily high, resistance-now-support, witnessed a quick bounce at it, as XAG’s buyers pushed the price above the $26.00 mark, keeping the rally intact.

If XAG/USD holds above $26.00, the first resistance would be $26.45, July 16, 2021 high. Breach of the latter and $26.77 would be the next price to challenge, followed by the YTD high at $26.94.

Otherwise, XAG/USD might correct towards the 50% Fibonacci level, which also confluences with November 2021 highs around $25.35-40, which could be a better price for dip buyers as they resume the uptrend.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.