- Silver prices climb for the fourth consecutive day, spurred by a weak USD and expectations of the upcoming Fed meeting minutes.

- Amid disappointing US economic data, China-US trade tensions may further drive XAG’s appeal as a haven asset.

- Market anticipation builds ahead of key US labor market data and Nonfarm Payrolls report, which could shape future Fed actions.

Silver price climbs for the fourth consecutive trading day as the US Dollar (USD) weakened ahead of the release of June’s Federal Reserve (Fed) last meeting minutes, which would give some cues about the US central bank’s forward path on monetary policy. The XAG/USD trades above the $23.00 figure after hitting a daily low of $22.77.

Slowdown in the US economy and geopolitical tensions bolster Silver prices

Wall Street is back though operating with losses ahead of the release of the Fed’s minutes. Data from the US Census Bureau revealed that Factory Orders for May came at 0.3%, unchanged compared to April’s data, but missed estimates of a 0.8% increase. Excluding transports, orders plunged -0.5%, less than the prior’s month downward revised metric of -0.6% and below the 0.5% expansion projected by the consensus.

XAG/USD reacted upwards to the data, as it shows the US economy is slowing down, as data revealed on Monday showed June’s ISM Manufacturing PMI plummeting into the recessionary territory at 46.0, below April’s 46.9. US Treasury bond yields are almost unchanged, while US real yields, calculated with the nominal yield minus inflation, stay at 1.630%, capping XAG/USD’s rally.

Regarding monetary policy, futures traders see the Fed raising rates just once, contrary to what Fed Chair Powell said on his last two public appearances, as shown by the CME FedWatcth Tool odds for a 25 bps rate hike in July, at 88.7%. The minutes could cement the Fed’s dot-plot case for two rate increases, which market participants do not project.

Meanwhile, China-US tussles could augment appetite for precious metals as tension around IT, technology, and raw materials exports from China to the US to produce chips could shift sentiment sour and bolster precious metals. In that regard, US Treasury Secretary Janet Yellen travels to China Thursday for meetings with Chinese officials.

Upcoming events

The US agenda will deliver labor market data on Thursday and the ISM Services PMI. On Friday, the US Nonfarm Payrolls report could dictate what the Fed could do at the next monetary policy meeting.

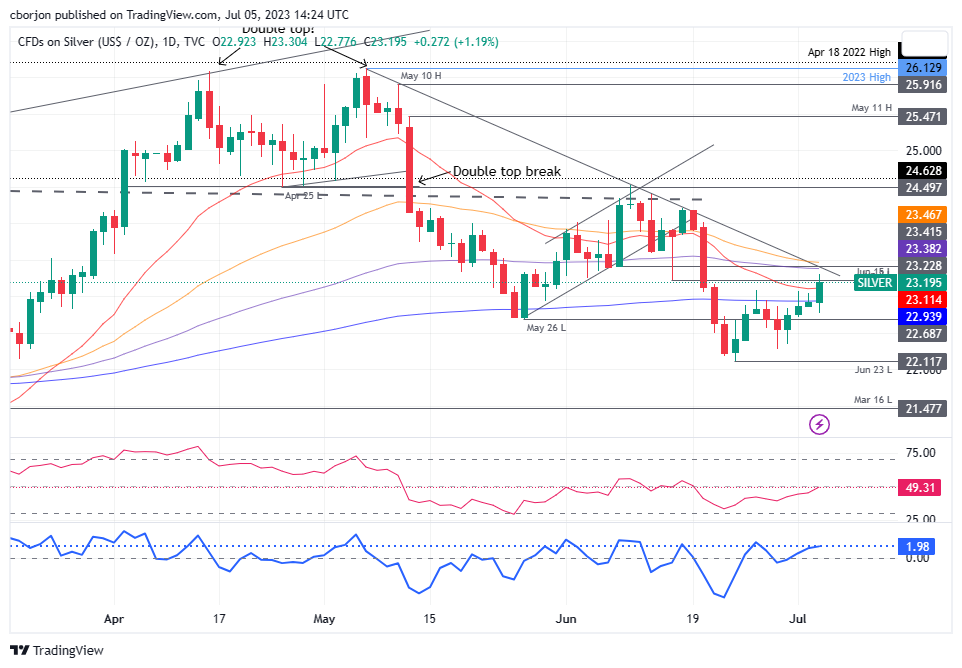

XAG/USD Price Analysis: Technical outlook

The XAG/USD extended its recovery, though it remains below technical resistance levels, which, once cleared, could pave the way for further upside. The first resistance is the 20-day Exponential Moving Average (EMA) at $23.10, followed by the confluence of a downslope resistance trendline and the 50-day EMA at around $23.46. Break above will expose the June 16 daily high at $24.20. Conversely, a drop below $23.00 would keep sellers in charge and exacerbate a fall to the June 23 swing low of $22.11.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Gold trades near record-high, stays within a touching distance of $3,100

Gold clings to daily gains and trades near the record-high it set above $3,080 earlier in the day. Although the data from the US showed that core PCE inflation rose at a stronger pace than expected in February, it failed to boost the USD.

EUR/USD turns positive above 1.0800

The loss of momentum in the US Dollar allows some recovery in the risk-associated universe on Friday, encouraging EUR/USD to regain the 1.0800 barrier and beyond, or daily tops.

GBP/USD picks up pace and retests 1.2960

GBP/USD now capitalises on the Greenback's knee-jerk and advances to the area of daily peaks in the 1.2960-1.2970 band, helped at the same time by auspicious results from UK Retail Sales.

Donald Trump’s tariff policies set to increase market uncertainty and risk-off sentiment

US President Donald Trump’s tariff policies are expected to escalate market uncertainty and risk-off sentiment, with the Kobeissi Letter’s post on X this week cautioning that while markets may view the April 2 tariffs as the "end of uncertainty," it anticipates increased volatility.

US: Trump's 'Liberation day' – What to expect?

Trump has so far enacted tariff changes that have lifted the trade-weighted average tariff rate on all US imports by around 5.5-6.0%-points. While re-rerouting of trade will decrease the effectiveness of tariffs over time, the current level is already close to the highest since the second world war.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.