- Silver price holds to its earlier gains but remains at risk, of closing the session below $21.00 a troy ounce.

- US ISM Manufacturing PMI missed estimates, though it showed some improvement.

- Federal Reserve officials emphasized the need to raise rates to the 5.25% - 5.50% area.

Silver price advances in the North American session after finding resistance above the $21.00 area, though it clings to gains of 0.33%. Bolstered by a softer US Dollar (USD) after United States (US) data missed estimates, the white metal is extending its gains for two straight days. At the time of writing, the XAG/USD trades at around $20.90s.

US manufacturing activity improved, but higher input prices overshadowed the data

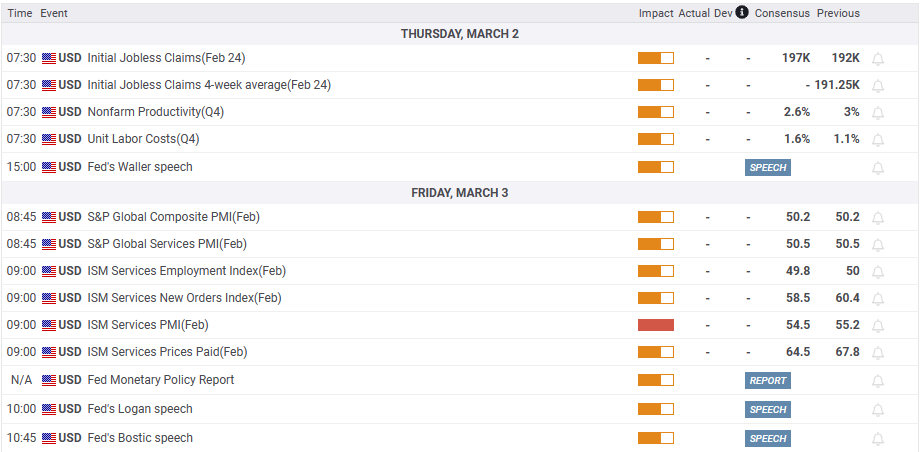

Sentiment shifted sour on US manufacturing data. The ISM revealed February’s Manufacturing PMI came at 47.7, below estimates of 48, though it appeared to stabilize, with the prior’s month reading at 47.4. However, the prices subcomponent jumped, reigniting inflation worries amongst investors, as witnessed by US money market futures, with traders expecting rates to climb as high as 5.50%, with no rate cuts in 2023.

A knee-jerk reaction tumbled the XAG/USD from $21.11 to $20.89 a troy ounce. However, Silver’s fall was capped by the US Dollar, which continued to weaken through the US session.

Earlier, Federal Reserve officials crossed newswires and continued their hawkish rhetoric. Minnesota’s Fed President Neil Kashkari (voter) said interest rates should reach 5.4% in December and stay at that level. He also mentioned that he would consider increasing rates by either 25 or 50 basis points during the upcoming Fed meeting.

Later, Atlanta’s Fed President Raphael Bostic commented that rates need to go as high as 5% - 5.25% and stood there “well into 2024.”

The Fed’s hawkish rhetoric did not help the greenback, which, by the US Dollar Index, is down 0.46% at 104.471. Contrarily, the US 10-year Treasury bond yield is advancing seven basis points, eyeing a break above the 4% threshold, a headwind for precious metals prices.

XAG/USD Technical analysis

Silver’s daily chart portrays XAG/USD as downward biased. The bearish case is further cemented by crossing the 20-day EMA below the 200-day EMA, which could exacerbate a test of the YTD low at around $20.43. XAG/USD’s recovery in the last couple of days is sponsored by a technical signal, with the Relative Strength Index (RSI) exiting from oversold conditions, which triggered a buy signal. Failure to extend its gains above $21.00 could pave the way for further downside.

The XAG/USD first support would be the February 27 daily low of $20.56, which, once cleared, it could pave the way to the YTD low at $20.43. On the other hand, if Silver stays afloat above $21.00, the XAG/USD could test the February 24 high at $21.39.

What to watch?

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD drops below 1.0450 as USD gathers strength

EUR/USD stays on the back foot and trades below 1.0450 on Wednesday. The cautious market stance helps the US Dollar (USD) stay resilient against its rivals and weighs on the pair as markets wait for the Federal Reserve to publish the minutes of the January policy meeting.

Gold climbs to new all-time high near $2,950

Gold retreats slightly from the all-time high it touched at $2,947 but manages to stay above $2,930 on Wednesday. The benchmark 10-year US Treasury bond yield clings to modest gains above 4.55%, limiting XAU/USD's upside.

GBP/USD retreats below 1.2600 despite strong UK inflation data

GBP/USD struggles to hold its ground and trades in the red below 1.2600 on Wednesday. Earlier in the day, the data from the UK showed that the annual CPI inflation climbed to 3% in January from 2.5% in December. Market focus shifts to FOMC Minutes.

Maker Price Forecast: MKR generates highest daily revenue of $10 million

Maker (MKR) price extends its gains by 6%, trading around $1,189 on Wednesday after rallying more than 20% so far this week. Artemis data shows that MKR generated $10 million in revenue on February 10, the new yearly high in daily revenue.

Money market outlook 2025: Trends and dynamics in the Eurozone, US, and UK

We delve into the world of money market funds. Distinct dynamics are at play in the US, eurozone, and UK. In the US, repo rates are more attractive, and bills are expected to appreciate. It's also worth noting that the Fed might cut rates more than anticipated, similar to the UK. In the eurozone, unsecured rates remain elevated.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.