Silver Price Forecast: XAG/USD falls slightly from two-year high above $26.50 ahead of Fed Powell speech

- Silver price drops slightly from fresh two-year high of $26.55 ahead of key events.

- The near-term appeal is upbeat due to deepening geopolitical tensions.

- The US Dollar corrects ahead of Fed Powell speech.

Silver price (XAG/USD) faces nominal selling pressure after touching a fresh more than two-year high at $26.55 in the European session on Wednesday. The near-term demand for the white metal is upbeat due to deepening geopolitical tensions and a correction in the US Dollar.

Major agencies have accused Israel’s military for targeting charity staff who were advised to deliver necessities to civilians in Gaza. Non-yielding assets, such as Silver, expect higher investment in times of geopolitical uncertainty.

Meanwhile, a corrective move in the US Dollar has also boosted Silver prices. The US Dollar Index (DXY) drops to 104.73 despite the upbeat United States Manufacturing PMI data for March has improved the economic outlook.

In today’s session, investors will focus on the Federal Reserve (Fed) Chairman Jerome Powell’s speech, and the release of the ADP Employment Change and the Services PMI for March. Fed Powell’s speech could provide clues about when the central bank will start reducing interest rates. The ADP agency will report the number of jobseekers recruited by private employers.

Later this week, the publication of the US Nonfarm Payrolls (NFP) data for March will be the major event. The official labor market data could influence market expectations for Fed rate cuts at the June meeting.

Silver technical analysis

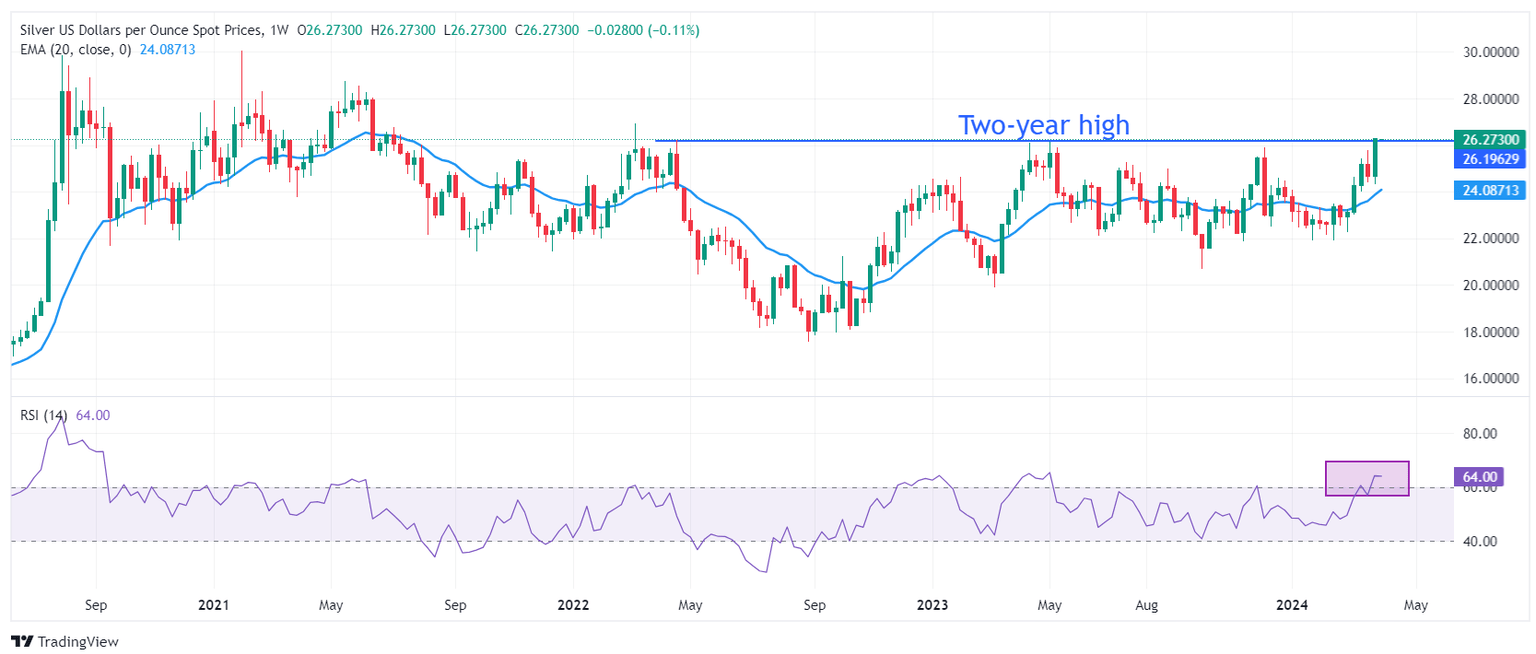

Silver price hits a fresh two-year high at $26.55 after breaking above the crucial resistance of $26.22 from 18 April 2022. The near-term demand is strong as the 20-week Exponential Moving Average (EMA) at $24.08 is sloping higher.

The 14-period Relative Strength Index (RSI) moves into the bullish range of 60.00-80.00, indicating that momentum towards the upside is strong.

(This story was corrected on April 3 at 12:00 GMT to say that Silver price has marked a new two-year high at $26.55 instead of $26.30. It was also corrected to say that resistance at $26.22 was from April 18 2022 instead of April 22)

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.