Silver Price Forecast: XAG/USD eyes breakout above $28 as Fed rate-cut bets in September max out

- Silver price gathers strength to break above $28.00 on firm Fed rate-cut prospects.

- US inflation grew moderately in July.

- Investors await the US monthly Retail Sales data for July.

Silver price (XAG/USD) jumps to near crucial resistance of $28.00 in Thursday’s European session. The white metal aims to deliver more upside as investors expect that the Federal Reserve (Fed) looks set to start reducing interest rates from the September meeting.

According to the CME FedWatch tool, 30-day Federal Finds Futures pricing data shows that the Fed is certain to cut its key borrowing rates in September but traders are split over the size of interest-rate cuts.

Firm speculation for Fed rate cuts has been further boosted by the moderate increase in the United States (US) Consumer Price Index (CPI) data in July, which confirmed that progress in the disinflation process towards bank’s target of 2% continues. Annual headline and core CPI, which excludes volatile food and energy prices, decelerated to 2.9% and 3.2%, respectively.

Growing expectations for Fed rate cuts have weighed on the US Dollar (USD) and bond yields. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, exhibits a subdued performance slightly above a more than seven-month low of 102.16. 10-year US Treasury yields jump to near 8.45% but are still close to weekly lows.

Meanwhile, investors await the US monthly Retail Sales data for July, which will be published at 12:30 GMT. The economic data is expected to show that Retail Sales rose by 0.3% after remaining flat in June.

Silver technical analysis

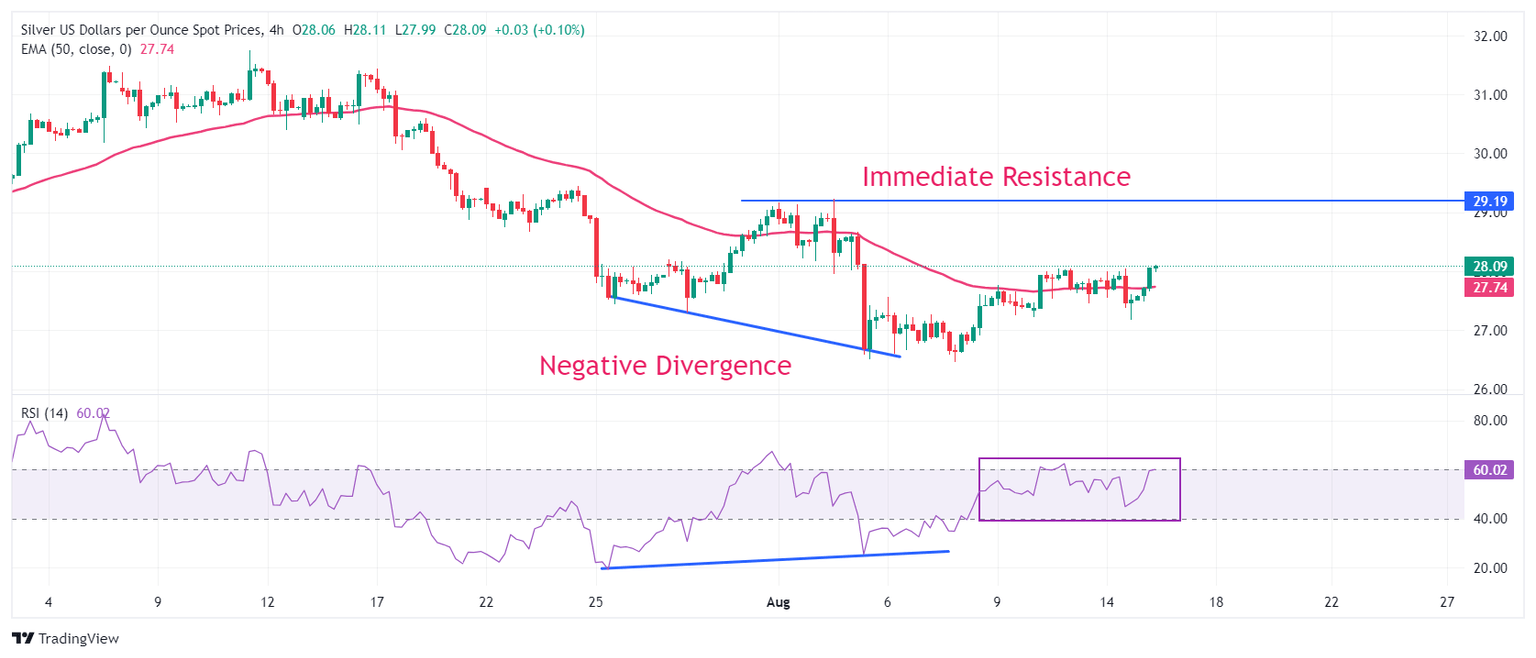

Silver price rebounds after a negative divergence formation on a four-hour timeframe, which shapes when the momentum oscillator refuses to make lower lows, while the asset continues. The 14-period Relative Strength Index (RSI) rebounded from 24.00 without hitting downside below previous low of 20.00.

However, the above-mentioned formation would trigger if the white metal breaks above the immediate swing high plotted from the August 2 high of $29.23.

The asset climbs above the 50-period Exponential Moving Average (EMA) near $27.70, suggesting that the near-term trend is upbeat.

The 14-period RSI has bounced back to near 60.00 and a decisive break above the same will trigger the upside momentum.

Silver four-hour chart

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold's. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold's moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.