Silver Price Forecast: Correction deeper than expected, questions uptrend

- Silver corrects back more deeply than was expected.

- The market is balanced, the correction is questioning the dominant uptrend.

- RSI is diverging bearishly suggesting potential underlying weakness.

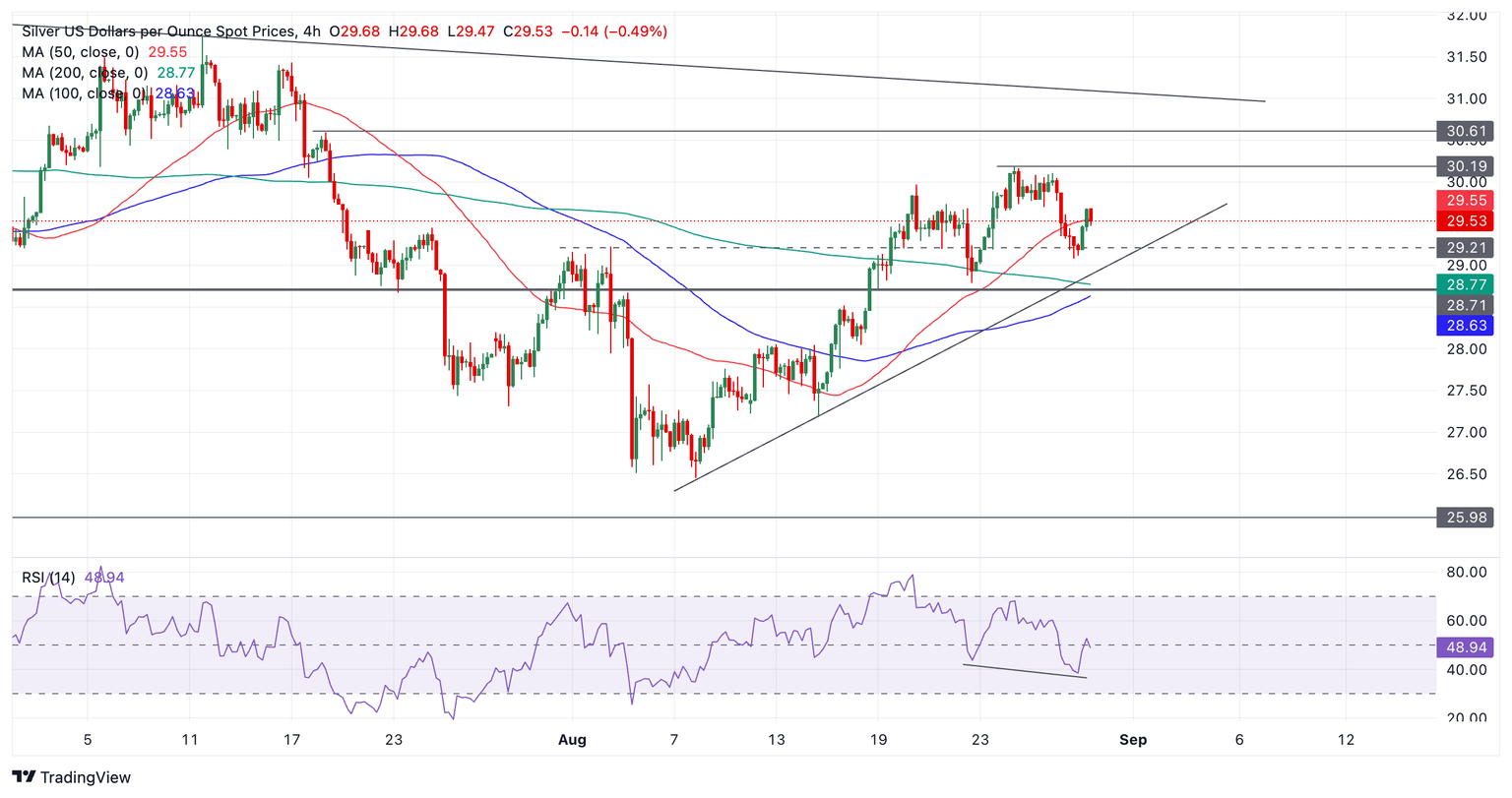

Silver (XAG/USD) has corrected back after posting higher highs of $30.19 on August 26. During the pull back, the pair broke below key support at $29.23 (August 2 high) and this brought the short-term uptrend into doubt.

That said, given the price overall continues posting higher highs and higher lows the trend is probably still, on balance, probably still bullish – if weaker than it was.

Silver 4-hour Chart

A break above the August high at $30.19 would confirm more upside and the continuation of the bull trend, with the next target coming into view at $30.61 the July 18 swing high.

A break below the August 22 swing low at $28.79, however, would indicate a break in the sequence of rising peaks and troughs. This could indicate a reversal in the short-term uptrend and more downside on the horizon.

The Relative Strength Index (RSI) momentum indicator is diverging bearishly with price when comparing the August 22 and August 28 lows. Although the price did not make a lower low on the 28th, the RSI did, suggesting underlying weakness in the price.

The trend on the medium and longer-term charts is unclear – possibly sideways – indicating little directional bias from higher time frames.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.