Silver Price Analysis: XAGUSD reverses from $20.90 resistance confluence

- Silver price pares the biggest daily gains in a month, holds lower ground of late.

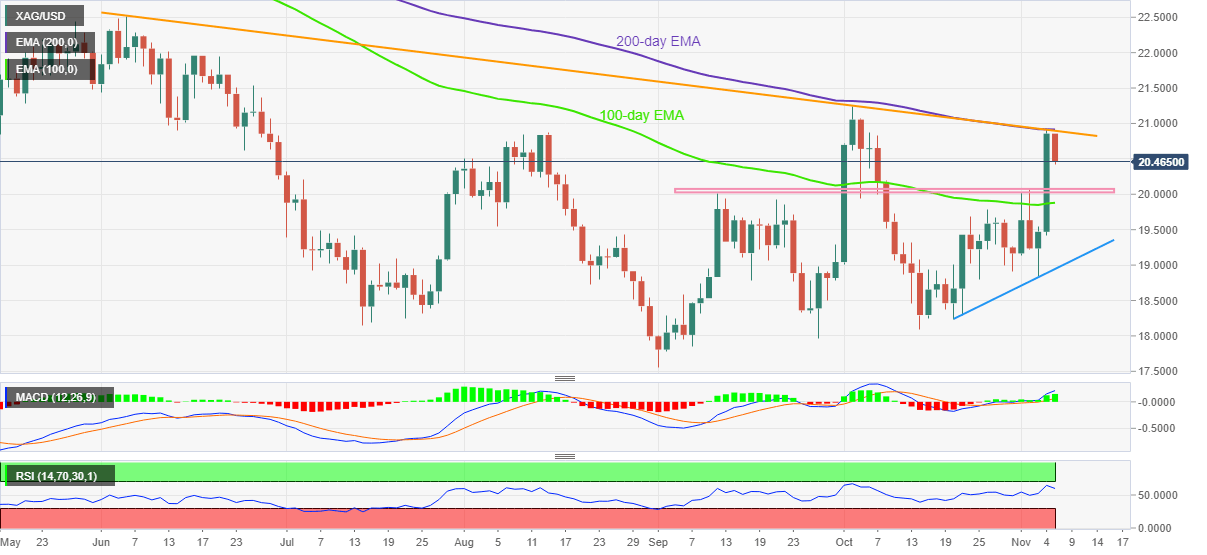

- Convergence of 200-day EMA, five-month-old descending trend line appears a tough nut to crack for the bulls.

- Two-month-old horizontal support, 100-day EMA restricts short-term downside.

- Oscillators remain favorable to bulls despite the latest retreat.

Silver price (XAGUSD) drops from the one-month high, flashed the previous day, during Monday’s Asian session. That said, the bright metal prints a 1.80% intraday loss as sellers attack the $20.50 level by the press time.

In doing so, the bullion traders pare the biggest daily gains in a month as the price reversed from a convergence of the 200-day EMA and a downward-sloping resistance line from early June, around $20.90.

It’s worth noting, however, that a one-month-old horizontal support region around the $20.00 threshold restricts the quote’s immediate downside ahead of the 100-day EMA level surrounding $19.90.

However, the quote’s further weakness appears elusive as the MACD signals are bullish and the RSI (14) remains firmer, despite the latest pullback.

Even if the XAGUSD drops below $19.90, a 12-day-long support line near $19.00 appears the latest defense of the metal buyers.

Alternatively, a daily closing beyond the $20.90 resistance confluence needs validation from the $21.00 threshold, as well as October’s peak of $21.24, before convincing buyers.

Silver price: Daily chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.