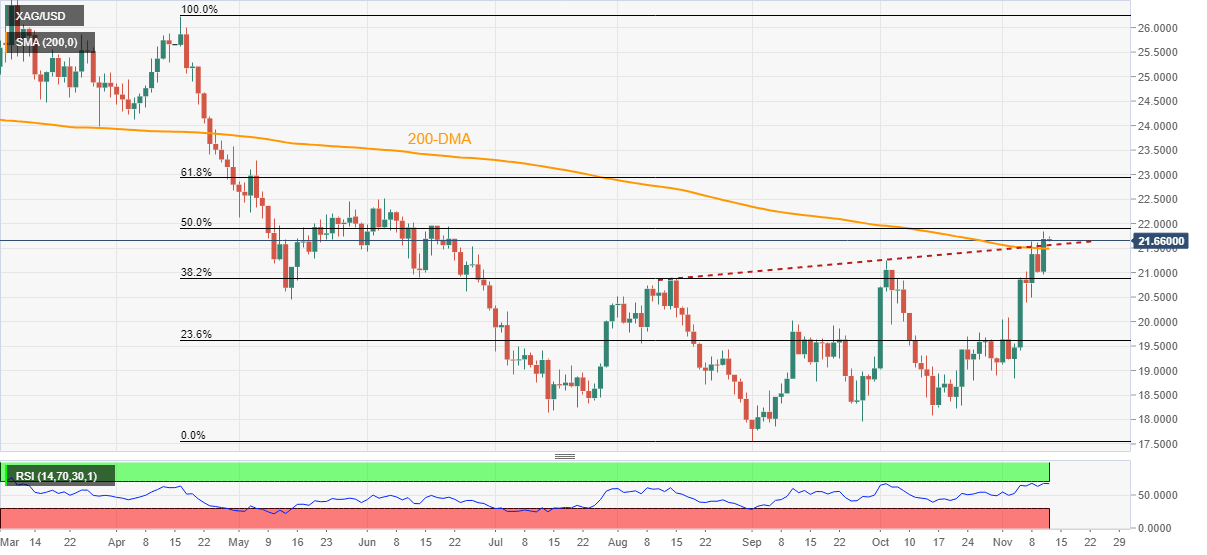

Silver Price Analysis: XAGUSD bulls keep $22.50 on radar despite latest inaction

- Silver price remains sidelined around 4.5-month high, pares the biggest daily jump in a week.

- Nearly overbought RSI suggests limited upside unless crossing June’s peak.

- Sellers need validation from $21.50 for fresh entry, $20.00 appears the key support.

Silver price (XAGUSD) struggles to defend buyers around the highest levels since late June, marked the previous day, while taking rounds to $21.70-65 during Friday’s Asian session.

In doing so, the bright metal dribbles above the key $21.50 resistance-turned-support confluence including the 200-DMA and an upward-sloping trend line from early August.

Even if the $21.50 breakout keeps the commodity buyers hopeful, nearly overbought RSI (44) conditions challenge the quote’s further advances, which in turn highlight the 50% Fibonacci retracement level of the metal’s April-September downside, near $21.90.

Also acting as the near-term upside hurdle for the XAGUSD is the June 2022 peak surrounding $22.50.

It’s worth noting that the 61.8% Fibonacci retracement level appears the last defense of the Silver bear before directing the price towards the late March swing low of around $24.00.

Alternatively, a downside break of the $21.50 resistance-turned-support will need validation from the tops marked during October and September, around $21.25 and $20.85 in that order, to convince silver bears. Following that, a downward trajectory toward $20.00 can’t be ruled out.

Silver: Daily chart

Trend: Limited upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.