Silver Price Analysis: XAG/USD sticks to gains near $23.25 area, remains below 100-day SMA

- Silver regains positive traction on Wednesday and inches closer to the multi-week high.

- The technical setup favours bulls and supports prospects for a further appreciating move.

- A convincing break below the ascending channel support will negate the positive outlook.

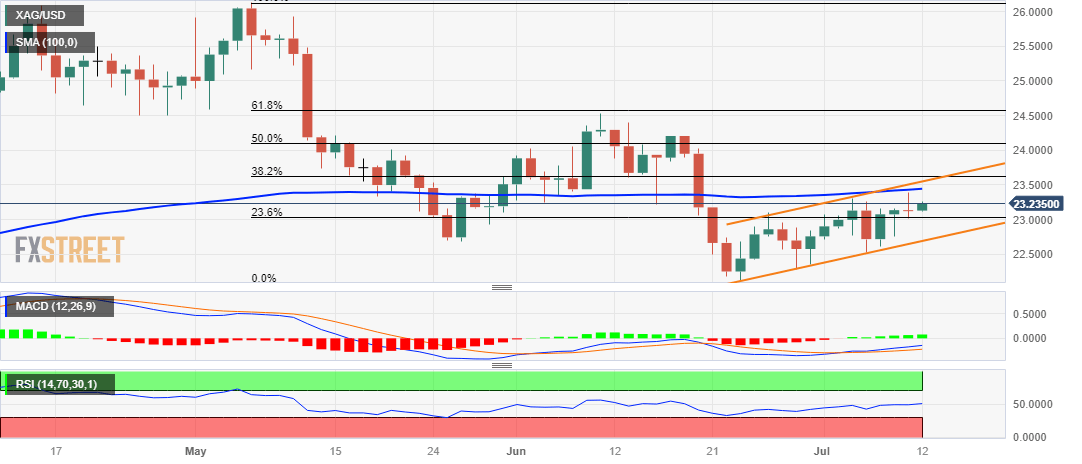

Silver attracts some dip-buying during the Asian session on Wednesday and stalls the overnight rejection slide from the vicinity of the 100-day Simple Moving Average (SMA). The white metal currently trades around the $23.25 region, up nearly 0.50% for the day, and remains well within the striking distance of a three-week high touched on Tuesday.

Looking at the broader picture, the recent recovery from the $22.00 neighbourhood, or the multi-month low set on June 23, has been along an upward-sloping channel. This points to a well-established short-term uptrend and favours bullish traders. Adding to this, technical indicators on the daily chart have just started gaining positive traction and support prospects for a further near-term appreciating move.

That said, any subsequent move up might continue to confront some resistance near the $23.45 region (100-day SMA), which is closely followed by the $23.55-$23.60 confluence. The latter comprises the top end of the aforementioned trend channel and the 38.2% Fibonacci retracement level of the downfall of May-June downfall from the YTD peak, which if cleared will confirm a fresh bullish breakout.

The XAG/USD might then accelerate the momentum towards reclaiming the $24.00 round figure, which coincides with the 50% Fibo. level. The positive momentum could get extended further towards the $24.20-$24.25 intermediate barrier en route to the June monthly swing high, around the $24.55 region, above which the commodity might eventually aim to reclaim the $25.00 psychological mark.

On the flip side, the 23.6% Fibo. level, around the $23.00 round figure, now seems to protect the immediate downside. Any further decline is more likely to attract buyers and remain cushioned near the ascending trend-channel support, currently pegged around the $22.75-$22.70 region. That said, a convincing break below could make the XAG/USD vulnerable to sliding back towards challenging the $22 mark.

Some follow-through selling should pave the way for a fall towards the $21.70-$21.65 zone, below which the XAG/USD could drop to the $21.25 support en route to the $21.00 round figure.

Silver daily chart

Key levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.