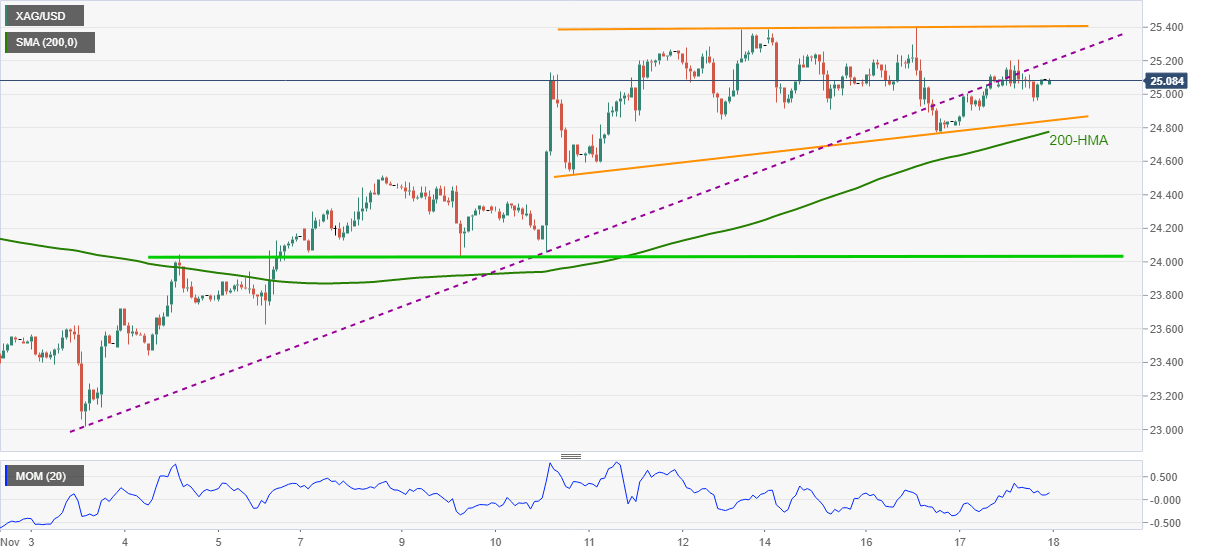

Silver Price Analysis: XAG/USD stays defensive near $25.00 inside ascending triangle

- Silver struggles to extend bounce off weekly low inside immediate bearish chart pattern.

- Sustained trading below previous support, sluggish Momentum keep sellers hopeful.

- Bulls need $25.40 breakout for fresh entries to target August month’s top.

Silver (XAG/USD) remains sidelined around $25.00, inside a one-week-old symmetrical triangle bearish formation during Thursday’s Asian session.

That said, the bright metal’s failure to jump back beyond the support-turned-resistance line from October 03, around $25.20, joins Momentum line’s retreat to tease silver sellers.

However, a clear downside break of the stated triangle’s support, around $24.85 at the latest, as well as a break of the 200-HMA level of $24.75, becomes necessary for the bear’s entry.

Following that, November 08 swing high near $24.50 and a two-week-long horizontal area near $24.00 will gain the market’s attention.

Meanwhile, the stated previous support line, around $25.20, guards the quote’s immediate upside ahead of the triangle’s resistance line near $25.40.

Should the silver buyers keep reins past $25.40, a run-up towards the August month’s high of $26.00 can’t be ruled out.

Silver: Hourly chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.