Silver Price Analysis: XAG/USD sits near two-week high, 200-day SMA holds the key for bulls

- Silver attracts some dip-buying on Tuesday and climbs back to a nearly two-week top.

- The mixed technical setup warrants caution before placing aggressive directional bets.

- The 200-day SMA is likely to keep a lid on any further gains and act as a pivotal point.

Silver reverses modest intraday losses to the $23.15 area and climbs back closer to a nearly two-week high touched this Tuesday. The white metal now trades around the $23.25 region during the early European session, nearly unchanged for the day.

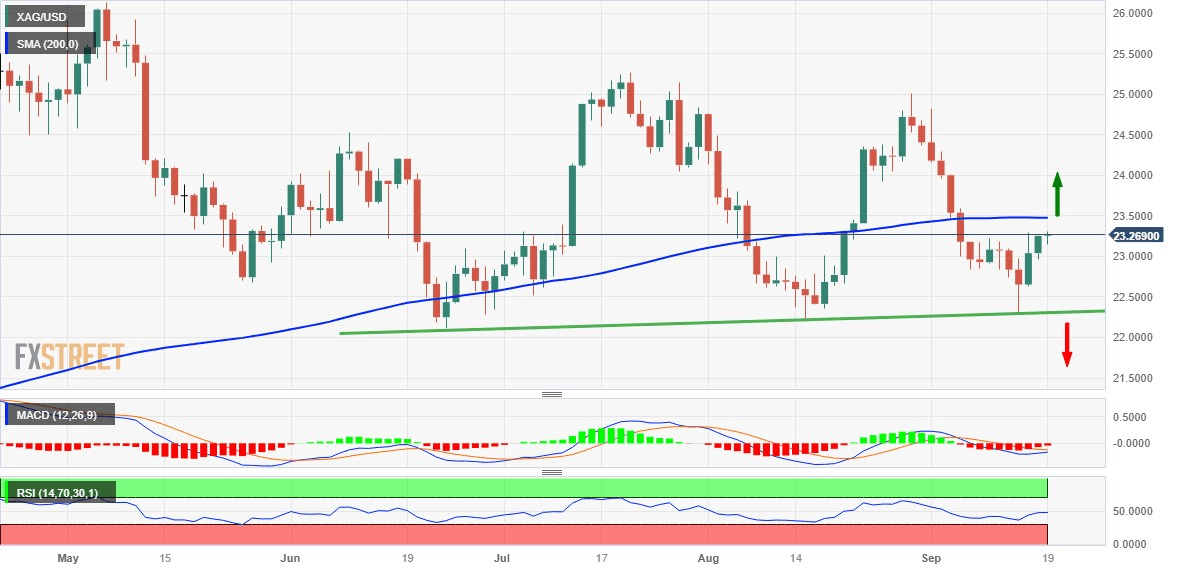

From a technical perspective, oscillators on the daily chart – though have been recovering from lower levels – are still holding in the negative territory and favour bearish traders. That said, last week's solid bounce from the $22.30 support area – representing an ascending trend line extending from the June monthly low – and the subsequent strength warrants caution before positioning for deeper losses ahead of the pivotal FOMC monetary policy decision on Wednesday.

In the meantime, any meaningful decline is likely to find some support near the $23.00 round figure ahead of the $22.80 area and the $23.30 region or a nearly one-month low touched last Thursday. A convincing break below the latter will be seen as a fresh trigger for bearish traders and make the XAG/USD vulnerable to accelerate the fall towards the next relevant support near the $21.25 zone. The downward trajectory could get extended further towards the $21.00 mark.

On the flip side, momentum beyond the $23.30 area, or the daily peak, could face stiff resistance and remain capped near a technically significant 200-day Simple Moving Average (SMA), currently pegged around the $23.45 region. A sustained breakout, however, could shift the bias in favour of bullish traders. This, in turn, should allow the XAG/USD to climb further beyond the 100-day SMA barrier near the $23.80 region and aim to reclaim the $24.00 round-figure mark.

The next relevant hurdle is pegged near the $24.30-$24.35 region, above which the XAG/USD is likely to conquer the $25.00 psychological mark. The latter coincides with the August monthly swing high and is closely followed by the July peak, around the $25.25 region.

Silver daily chart

Technical levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.