Silver Price Analysis: XAG/USD sets for strong weekly gains on escalating geopolitical tensions

- Silver price rallies to $29, boosted by safe-haven demand due to geopolitical tensions.

- A decline in US yields has reinforced demand for non-yielding assets.

- The US Dollar advances as speculation for Fed rate cuts wanes.

Silver price (XAG/USD) looks set for a positive weekly close for the third time in a row. The precious metal strengthens as geopolitical tensions and China’s weak economic outlook strengthen safe-haven demand.

Iran promised to retaliate against Israel’s air strike on their embassy near Damascus in which seven members of its Islamic Revolutionary Guard Corps (IRGC), including two generals, were killed. The war situation in Gaza between Israel and Palestine could further escalate after the direct intervention of Iran. Meanwhile, the Israeli administration vowed to invade Rafah where displaced Palestinians have been sheltered. Investors channel their funds into non-yielding assets, such as Silver, amid geopolitical uncertainty.

Meanwhile, a sharp decline in US Treasury yields has reduced the opportunity cost of investment in non-yielding assets. 10-year US Treasury yields retreat to 4.55% from a more than four-month high of 4.60%. The US Dollar Index (DXY) is an inch away from recapturing a five-month high at 106.00.

The US Dollar strengthens as stubbornly higher consumer price inflation and strong Nonfarm Payrolls (NFP) data for March have forced traders to unwind their bets leaned toward the Federal Reserve (Fed) to begin reducing interest rates in the June and July policy meetings. Now, investors see the Fed pivoting to rate cuts from September. Also, investors expect that the Fed will reduce interest rates only two times by the year-end instead of three projected by Fed policymakers in the latest dot plot.

Silver technical analysis

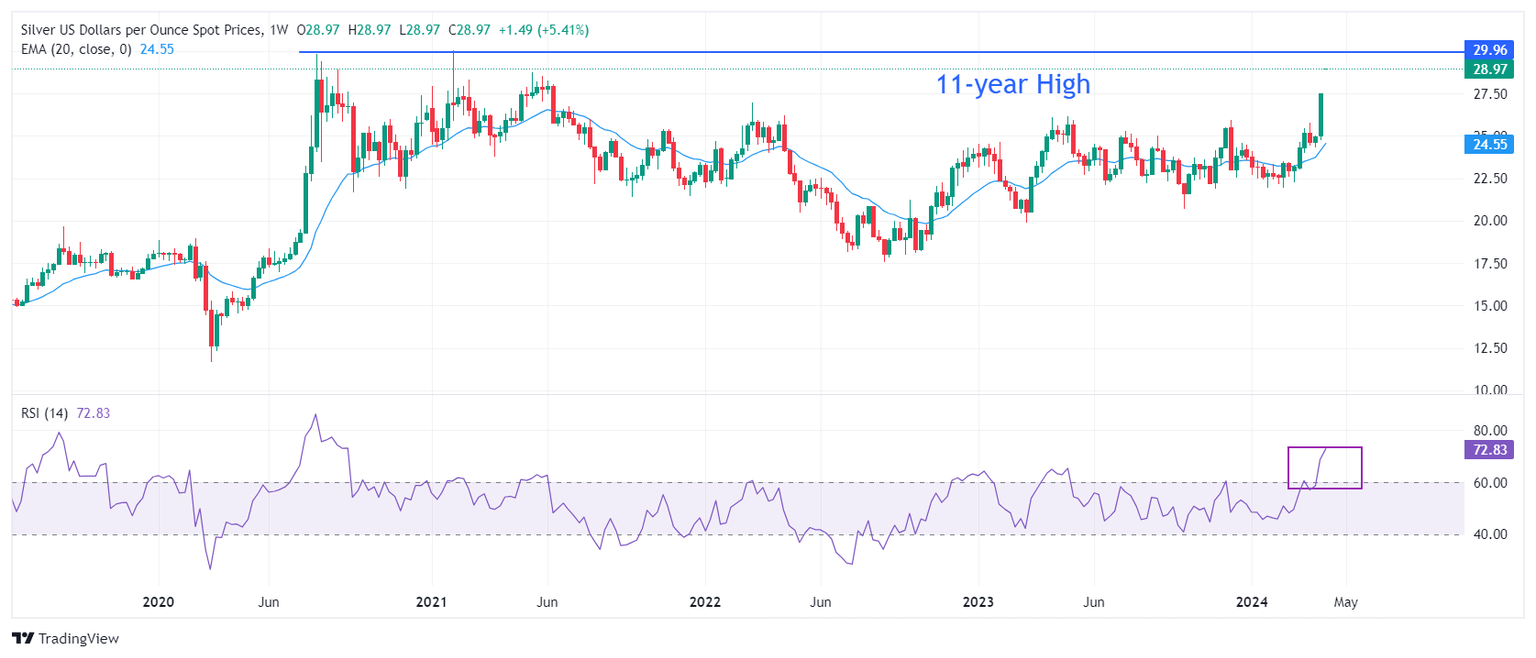

Silver price approaches an 11-month high near $30, plotted from 27 July 2020 high on a weekly timeframe. The long-term outlook is bullish as the 20-week Exponential Moving Average (EMA) at $24.56 is sloping higher. The 14-period Relative Strength Index (RSI) rises to 73.00, suggesting strong buying momentum. More upside remains favored amid the absence of divergence signals.

Silver weekly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.