- Silver bears catch a breather after refreshing multi-day low.

- Downside break of 100-day SMA directs sellers toward an ascending trend line from March 18.

- Bulls look for entries beyond previous support line.

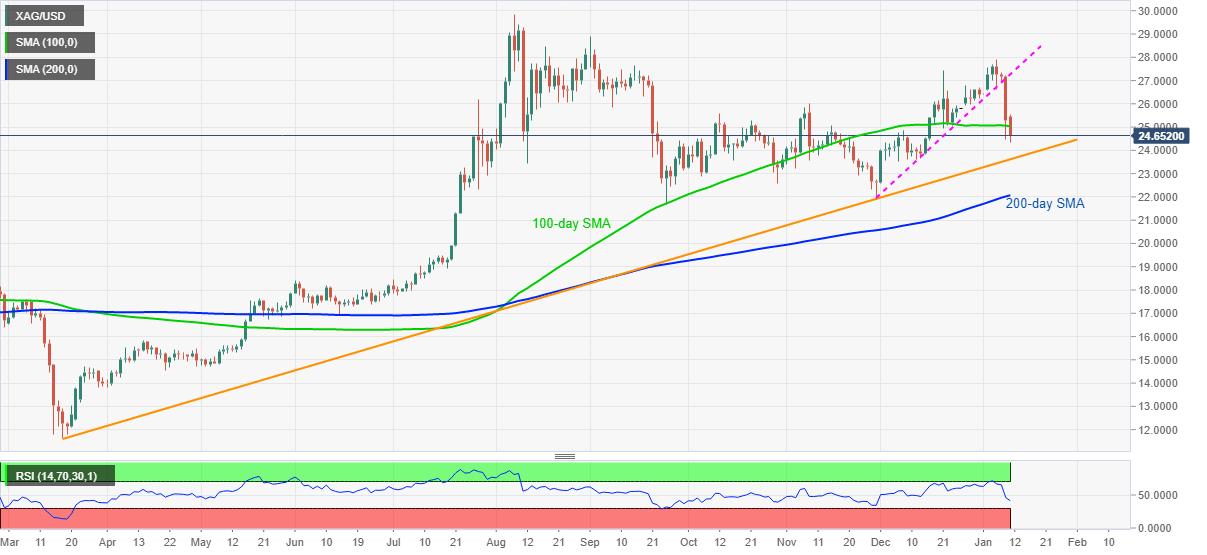

Having dropped to a fresh low since the mid-December, silver takes rounds to $24.60, down 2.70%, during early Monday. While a downside break of an ascending trend line from November 30 pleased the commodity sellers during last week, the latest south-run below 100-day SMA highlights a multi-month-old support line for sellers.

It should be noted that an absence of oversold RSI adds strength to the downside momentum.

That said, the $24.00 round-figure can offer an intermediate halt during the fall targeting an aforementioned support line, currently near $23.60.

Also acting as the key support is 200-day SMA, at $22.07 now, followed by November’s low of $21.89.

On the contrary, an upside break of 100-day SMA, currently around $25.03 can aim for November’s top near $26.00. However, any further rise needs to regain above the previous support line, at $27.25, to convince buyers. Additionally, the monthly high of $27.92 acts as an extra filter to the north.

Overall, silver prices have some more room to the downside before confronting the key technical supports.

Silver daily chart

Trend: Further weakness expected

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Gold price jumps to fresh record high above $3,200 on US-China tariff war

Gold price sits at all-time highs of $3,219 in the Asian session on Friday. The weakening of the US Dollar and escalating trade war between the US and China provide some support to traditional safe haven asset Gold price amid increased dovish Fed expectations.

USD/JPY recovers losses in sync with US Dollar, retakes 143.50

USD/JPY is trimming losses to retest 143.50 in Asian trading hours on Friday, having tested levels under 143.00. The pair is tracking the US Dollar price action amid persistent trade jitters and US recession fears. The Fed-BoJ divergent policy expectations support the Japanese Yen, keep the weight intact on the pair.

AUD/USD consolidates weekly gains near 0.6250 despite trade tensions

AUD/USD consolidates weekly gains near 0.6250 in Asian trading on Friday. The pair capitalizes on sustained US Dollar weakness even as risk aversion remains at full steam on deepening US-China trade war. The White House confirmed on Thursdayt that the cumulative US tariffs on Chinese goods have risen to 145%.

Can Trump's tariff pause and declining inflation keep Bitcoin afloat? Experts weigh in

Bitcoin dived below $80,000 on Thursday despite US Consumer Price Index data coming in lower than expected and President Donald Trump's 90-day reciprocal tariffs pause on 75 countries.

Trump’s tariff pause sparks rally – What comes next?

Markets staged a dramatic reversal Wednesday, led by a 12% surge in the Nasdaq and strong gains across major indices, following President Trump’s unexpected decision to pause tariff escalation for non-retaliating trade partners.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.